Will Student Loans With Navient Be Forgiven – If you’ve been following the latest student loan headlines, you know that Navient — one of the nation’s largest student loan servicers — has agreed to a comprehensive student loan settlement. As a new student borrower, you can receive $1.7 billion in student loan cancellations. This is good news. (That’s how you get $1.7 billion in student loan forgiveness).

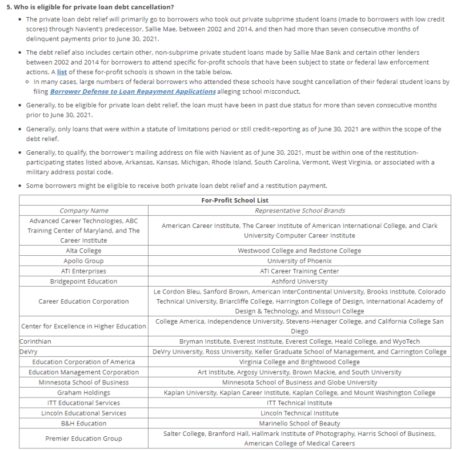

The bad news, however, is that there’s a good chance you won’t qualify. For example, about 66,000 of the 45 million borrowers in student loans are eligible for $1.7 billion in student loan forgiveness. Another 350,000 student borrowers could qualify for an additional $95 million in student loan relief. That means millions of student loan borrowers are ineligible for student loan forgiveness. (Here’s who doesn’t get student loan relief).

Will Student Loans With Navient Be Forgiven

However, there is a silver lining. If you are not able to cancel this student loan, there are many other viable options, and here is one step to consider.

Class Action Settlement: Navient Student Loan Servicer Users Have One Day To File Claim For $16 Million Settlement

If you have federal student loans, the good news is that your student loans are on hold until May 1, 2022. This means that mandatory federal student loan payments, interest will not accrue, and student loans will not be collected in principal. Beginning in March 2020, when Congress passed the CARES Act, student borrowers received this historic student loan relief. (Biden should end student loan relief). The US Department of Education estimates that student loan borrowers save $5 billion per month in loan interest. Progressives in Congress want President Joe Biden to extend student loan relief beyond May. (Stopping student loan payments until 2023?) However, the White House and the Department of Education have so far announced that student loan payments will resume as planned in May. (Student Loans Begin Soon. How to Prepare for Repayment).

If the thought of going back to monthly student loan payments makes you cringe, you’re not alone. Student loan repayment can be a lot to manage, especially if you have multiple student loans with different student loan interest rates, student loan balances, and student loan servicing. (Biden stops challenging student loan forgiveness after public outcry). Student loan consolidation is a strategy for organizing and streamlining federal student loans. You can consolidate your existing federal student loans into one direct consolidation loan. This new federal student loan has student loan balance, student loan interest rate, student loan servicer, and monthly payment. It will simplify your life every month. The downside is that you won’t get a lower interest rate. Instead, your interest rate will be equal to an average of 1/8% of current interest rates.

There are many options for student loan forgiveness, including income-based repayment plans such as IBR, PAYE, REPAYE, and ICR. Ask for more information on student loan servicing. (If Biden cancels student loans, it will be next). Alternatively, there are student loan forgiveness options, such as Public Service Loan Forgiveness. Through this program, you work for an eligible public service or nonprofit employer, make 120 monthly student loan payments, and meet other requirements. The good news is that you can completely cancel your federal student loans. The downside is that it takes 10 years. If you have past student loan payments that don’t qualify for Public Service Loan Forgiveness, you can meet a limited discount to count past student loan payments. (Student loans are on hold, but here are 6 things for now).

Student loan refinancing is the best way to get a lower interest rate on your student loans. Student loan refinancing rates are now the lowest in history, starting at 1.74 percent for variable rates and 1.99 percent for fixed rates.

Navient Student Loans: Resources, Repayments

For example, suppose you have $100,000 in student loans, an 8 percent interest rate, and a 10-year repayment term. By refinancing your student loan with a 3 percent interest rate and a 10-year repayment period, you’ll save $248 per month for a total of $29,720. You can choose a fixed or variable interest rate and a repayment period of 5 to 20 years. There are no application fees, origination fees or prepayments if you pay off your student loans early. Also, you can refinance to find a lower interest rate in the future. To qualify, you need a credit score of at least 650, current employment or a signed job offer, stable income, and a low debt-to-income ratio.

With student loan refinancing, you can refinance private or federal student loans, or both. Refinancing personal loans is a smart move if you can get a lower interest rate. It depends on whether you think you need federal benefits such as federal loan refinancing, income-based repayment, or public service loan forgiveness. If so, do not refinance federal student loans. If not, you may decide to refinance federal student loans to get a lower interest rate and save money.

Student Loans: Related Reading Can’t Get Student Loan Forgiveness and Will Student Loan Payments Be Until 2023? If Biden cancels student loans, Biden must end student loan relief, and that’s what’s happening. Signed up. A long period between 2009 and 2017. For more information and the latest information on the latest case, please visit www.NavientAGSettlement.com.

SEATTLE – Attorney General Bob Ferguson announced that as a result of his lawsuit, student loan servicer Navient will pay nearly $45 million in debt relief, restitution and costs to settle a lawsuit in Washington. Ferguson alleged that Sallie Mae’s successor, Navient, then the nation’s largest student loan broker, engaged in numerous unfair and fraudulent practices that harmed student borrowers in Washington.

Will Navient Student Loans Be Forgiven?

Washington, along with Illinois, was the first state to file suit against Navient, and the first to receive a ruling that the law had been violated.

Washingtonians don’t have to do anything to receive these benefits. Navient will notify borrowers who receive personal loan cancellations and refunds for all payments made on those loans after June 30, 2021. Washington citizens eligible for a refund will receive a postcard in the mail from the Attorney General. Statement Administrator in the following months. Federal student loan borrowers who may be eligible for a refund are encouraged to update their studentaid.gov account contact information or create one if they do not already have one.

Borrowers seeking credit or debt relief span all generations: from high school students attending colleges and universities, to mid-careers who dropped out in the early 2000s after Navient’s harmful practices attended for-profit schools. Affected everyone from the students.

“Higher education should not be a lifetime of debt relief — and student loan companies have no right to cheat Washingtonians to increase their profits,” Ferguson said. “We will hold the nation’s largest student loan broker accountable, push for tough corporate reforms, and help repair the damage done to Washington borrowers. We will fight to stop financial abuse of debt-ridden Washington students. Will continue.”

Some Mississippians Will Benefit From Navient Settlement

Instead of fully explaining the benefits of income-based repayment plans, innovative payments put Washington students into forbearance. Naveen wrongfully pushed borrowers into forbearance, which was good for the company because it was simpler and cheaper, but hurt most borrowers in the long run. Forbearance allowed borrowers to temporarily suspend payments, but their interest continued to accrue. As repayment continues, interest on the principal of the loan is compounded, in which case the borrower must pay interest on the principal. Unlike forbearance, income-driven plans offer the option of loan forgiveness after 20 or 25 years of qualifying payments and offer valuable interest rate assistance. Income-based plans can have payments as low as $0 per month.

Ferguson filed the proposed consent decree today in King County Superior Court. A consent decree still requires court approval.

Today’s consent decree also includes broad injunctive relief to prevent Navient from engaging in similar misconduct in the future.

Millions of eligible public employees in the United States have access to the Public Service Loan Forgiveness (PSLF) program, which offers a discount that allows them to count past payments or repayment periods. Navient requires borrowers to be notified of important changes recently made by the Department of Education.

Navient Settlement To Provide More Than $31 Million In Relief To Hoosier Borrowers

Ferguson encourages all Washington residents who work in the government or nonprofit sectors to visit the PSLF website or the Washington Student Loan Advocate website.

Student loan borrowers can contact the Washington Office of the Washington Student Ombudsman with questions or complaints about their student loans using the Washington Student Complaints Portal at studentcomplaints.wa.gov.

On October 20, 2021, the US Navant handed over 5.6 million loans owned by the Department of Education to a company called Maximus.

Will navient student loans be forgiven, will nelnet student loans be forgiven, will student loans in collections be forgiven, how to get navient student loans forgiven, will my student loans be forgiven, when will student loans be forgiven, will student loans ever be forgiven, will private student loans be forgiven, will sallie mae student loans be forgiven, will my navient student loans be forgiven, can navient loans be forgiven, will student loans be forgiven