When Should You Refinance Your Student Loans – Editor’s Note: Lamp by SoFi strives to provide objective, independent and accurate content. Publishers are separate from our business operations and do not receive direct compensation from advertisers or partners. Read more about our editorial guidelines and how we make money.

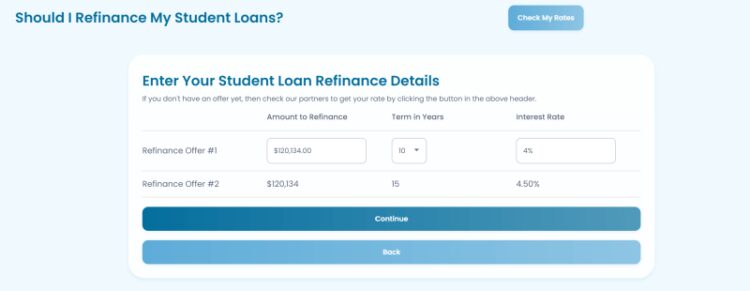

You may be wondering how to refinance student loans to save interest or extend your repayment term. Whatever the reason, generally speaking, you can refinance student loans in five easy steps. Note: Only private lenders offer student loan refinancing. If you refinance your federal student loans, you may no longer have access to certain incentives and repayment options offered by the federal government. Is it a good idea to refinance your student loans? Refinancing your student loans may be a good idea. Qualify for lower interest rates and terms that reduce your overall loan costs. Borrowers with better credit and lower debt-to-income ratios may qualify for a better rate from a lender. If you need to lower your monthly payments, you can refinance your student loans for a longer repayment period. However, you will pay more in total interest over the life of the loan. Weighing the pros and cons of student loan refinancing can help you decide if refinancing is right for you. Refinancing to a lower rate and shorter payments may reduce your total finance payments. If you qualify for $0 monthly payments under the Public Service Loan Forgiveness (PSLF) or Income Responsive Repayment (IDR) programs, refinancing federal student loans may not be right for you. Private student loans are not eligible for federal government grants, including PSLF, teacher loan forgiveness, or the Value Education (Savings) Program. What is a savings plan? One of the federal ITR schemes is the Savings Plan which replaces your income (refund) plan. Calculating your monthly payment amount based on your income and family size. Individuals earning less than 225% of the poverty line ($32,800 for a single borrower in 2023) qualify for a $0 monthly payment under the program. This period can be waived after 20 or 25 years under any IT ITR scheme, but Rs. Enrollment in the SA Savings Plan with an original balance of Rs 12,000 or less can be forgiven after 10 years. Recommended: Should I Refinance My Student Loans? Step 1: Determine if you qualify The first step in refinancing student loans is to determine if you qualify. Eligibility criteria vary by lender, but here are some general requirements: be a U.S. citizen or legal permanent resident, have at least $5,000 in outstanding federal or private student loans, or proof of income in your state. You may need a minimum credit score of 680 to qualify for a hard credit check of your credit score before applying. Keep in mind that student loan refinancing can affect your credit score if a lender runs a hard check on your credit report. A hard inquiry can remain on your credit report for two years, and the initial impact can lower your credit score by several points. Some lenders require a degree, but you can refinance student loans without a college degree. Step 2: Compare prices between different lenders The next step is to compare prices between student loan refinancing offers. Lenders may offer fixed or variable interest rates. A fixed interest rate remains the same for the life of your loan, but a variable rate can increase or decrease. Lenders may also offer repayment terms ranging from five to 20 years. A longer payment period may reduce your monthly payment. payments, but you will pay longer. Refinancing will increase your total interest costs. If your goal is to reduce your finance charges, a shorter repayment period may be best. Comparing the rates and terms of different student loan refinancing companies can help you find the right refinance for you. Step 3: Get Prequalified You can check your eligibility for prequalified loan offers. Refinancing Loans Online by Submitting an Online Inquiry These inquiries usually involve a soft credit check. A soft inquiry allows lenders to access your credit information without affecting your credit score. If you meet the lender’s eligibility criteria, you can get a pre-qualified refinance offer. This allows you to find and compare student loan refinancing options before choosing the right one for you. Tip: Will refinancing student loans hurt your credit? Step 4: Apply In this step, you can submit a student loan refinancing application to the lender of your choice. Getting a prequalified loan offer doesn’t guarantee you’ll be approved, but it can help you understand what a lender is willing to offer. Please be prepared to provide the following documents when applying: A driver’s license or other government-issued photo ID may be reinforced. A cosigner is someone who shares the financial responsibility of repaying the loan with the primary lender, reducing the borrower’s risk. If you have good credit, a cosigner with excellent credit can help you qualify for a better interest rate than you would get on your own. Step 5: Start making payments on your refinanced student loan. Once approved, the next step is to make the required payments. Refinance your student loan with your new lender Typically, you are responsible for making monthly payments within a certain period of time. Read the terms and conditions of the refinancing agreement carefully to understand them. You can refinance federal and private student loans, and there is no prepayment. . Student loan refinancing companies typically pay off your current student loan and then you pay the refinancing lender as specified in your new loan agreement. If you have federal student loans, you can explore income-based federal repayment plans. In addition to the new savings scheme that replaced the REPAYE scheme, there are other IDR schemes: Pay What You Earn (PAYE) and Income Contingent Payment (ICR). ) Income-Based Repayment (IBR) Depending on your income and family size, all four IDR plans may offer lower monthly payments than standard payment plans. The IDR plan does not require any monthly payment if your annual income is sufficient. At least one year of private student loans, including refinanced student loans, are not eligible for any federal repayment options. If you qualify for $0 monthly payments under the IDR program, refinancing federal student loans may not be right for you. Conclusion If you are considering refinancing student loans, it depends on your goals. There are different ways to refinance student loan debt. You can refinance for a longer term and lower your monthly payments, or you can refinance at a lower interest rate. Shopping around can help you find the right refinancing solution for you. If you’re looking to refinance student loans, Sophie’s Lamp helps you fill out a form and compare your student loan refinancing options. If you can lock in a low interest rate, refinancing may be right for you (long-term refinancing may increase your total interest costs). The lender can help you compare student loan refinancing rates and find the best one for you.

When Should You Refinance Your Student Loans

Sulman Abdur-Rahman writes for The Lantern about personal loans, car loans, student loans, and other personal finance topics. He has received more than 10 journalism awards and served as a board member of the New Jersey Society of Professional Journalists. Abdur-Rahman, an alumnus of Philadelphia-based Temple University, is a strong supporter of the First Amendment and free speech. If he has student loans hanging over his head, he knows how difficult it can be to pay them off and his progress slows, especially if his interest rate is higher than his Empire State Building.

Refinance Student Loans

But one way to speed up your loan payments and save you a lot of money on interest is to refinance. (Yes, we wish that were the only type of “finances.”) And chances are you’ve thought about it at least once.

We’re here to answer all your questions about student loan refinancing and help you decide if it’s right for you, so you can get rid of your student loans once and for all!

Student loan refinancing involves taking your personal loans (or a combination of federal and private loans) and converting them into a new loan. But remember, refinancing can only be done through a private lender.

Here’s how it works: The personal lender pays off your current loan balance and becomes your new lender. At that time you will receive

Refinance Medical School Student Loans [complete Guide]

Should i refinance student loans, should i refinance my private student loans, should i refinance my student loans now, when should you refinance student loans, how often should you refinance student loans, should you refinance student loans, when to refinance student loans, can you refinance student loans, should you refinance your student loans, refinance your student loans, should i refinance my student loans, when should i refinance my student loans