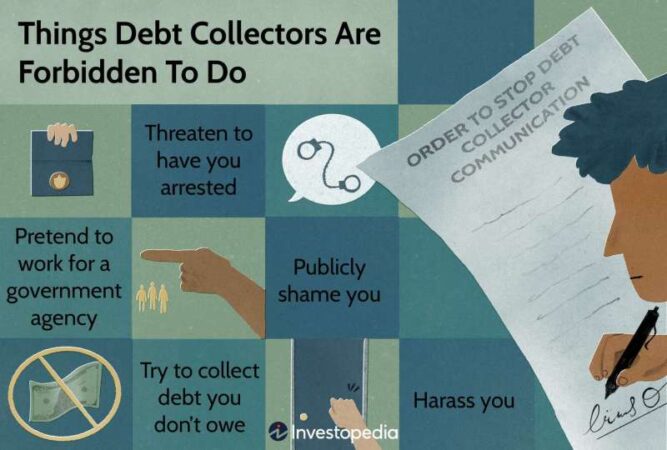

When Can A Debt Collector Sue You – Lenders have a reputation – some deserved – for being rude, rude and even dangerous when trying to get borrowers to pay. The Federal Fair Debt Collection Practices Act (FDCPA) was created to prevent this bad and abusive behavior. However, some debt collection agencies ignore the law. Here are five strategies that debt collectors specifically prohibit from using.

The FDCPA prohibits debt collectors from pretending to work for the government, including law enforcement agencies. They can’t apply to work for a consumer advertising agency.

When Can A Debt Collector Sue You

A 2014 case in Georgia clearly shows what debt collectors are not allowed to do. The owner and six employees of Williams, Scott & Associates have been arrested for alleged fraud and said they will be arrested and charged for not paying their debts.

What Debt Collectors Can And Can’t Do Under The Law?

Debt collectors have also accused themselves of not working as promised to federal and state governments, including the Department of Justice and the United States. Marshals.

Debt collectors can’t say you’ve committed a crime, or that you’ll be arrested if you don’t pay back the money they say you owe.

First, the authorities cannot issue a warrant for your arrest or put you in jail. Plus, you won’t be foreclosed on if you don’t pay your credit card debt, mortgage, car loan or medical bills on time.

That said, if you receive a legal order to appear in court in a debt-related matter and you don’t appear, the judge can issue a summons. notice you are under arrest. And if you don’t pay court related debts, or refuse to pay taxes or child support, you could end up in jail.

What To Do If A Debt Collector Sues You A Guide To A Great Defense

Debt collectors are not allowed to publicly embarrass you from paying money that you may or may not owe.

In fact, they are not even allowed to contact you by mail. They cannot publish the names of those who owe money. They cannot discuss the matter with anyone other than you, your partner or your lawyer.

Debt collectors may contact third parties to try to track you down, but they can only ask these people for your address, home and work phone numbers. Generally, they will not contact these people more than once.

Some debt collection agencies knowingly or unknowingly rely on false information to get money out of you.

Intent To Sue

The creditor to whom you originally owed the money may have sold your debt to a collection agency, which in turn sold it to another collection agency. An error somewhere along the route could mean that the person calling you has incorrect information.

Or the agency may try to collect debts from you that have already been destroyed or are still owed by someone else with a similar name.

Within five days of first contacting you, the debt collector must send you a written letter telling you how much you owe, to whom and how to pay. You may have to ask them to do this.

If you are not sure what you owe, send a letter to the debt collector by certified mail with a return receipt asking for more information. Make sure you are not responsible for the debt.

Debt Collection Series: How To Respond To A Collections Letter

The Consumer Financial Protection Bureau provides sample forms for bill collectors that you can use to make sure you’re not misrepresenting or providing more information than necessary.

The law sets out specific ways that debt collectors are not allowed to harass you. They are not allowed to:

Even if you take the last step, there are still some situations that will cause the collectors to contact you again: They may contact you to tell you that they do not want to contact you or to tell you that have sued you. .

If you receive a subpoena for a lawsuit regarding your debt, don’t ignore it. An illegal accountant may create this information, but it may also be legal.

How Do I Make A Payment To A Debt Collection Agency?

If you received a subpoena, find the court’s contact information online (not in the notice you received) and call the court directly to confirm the subpoena. warning is correct. Do not use the address or phone number listed on the form you received.

There is one important exception to the FDCPA: Internal debt collection agencies are not subject to it. For example, if you are behind on your Macy’s credit card account and Macy’s calls you directly, Macy’s is not required to follow the rules described above.

Most internal debt collection agencies go after debts that are only a few weeks or months old. Then the former creditor often hires a collection agency to collect for him, or sell your debt to a buyer who gets to keep the collection.

The Federal Trade Commission suggests that you contact the Federal Trade Commission, the Consumer Financial Protection Bureau (CFPB), and the Office of the Attorney General. “Many states have their own tax laws that differ from federal laws,” he notes. “Your state attorney general’s office can help you determine your rights under state law.”

Sued By A Debt Collector In Missouri

No, according to the CFPB, “it only applies to the collection of debts incurred by the consumer primarily for personal, family or household purposes. .”

It depends on the type of debt and the law of your country. Where statutes of limitations do apply, they generally last between three and six years, the CFPB said. But even after the deadline expires, the CFPB added, debt collectors can still “try to get you to pay the debt by sending you letters or calling you, as long as they’re not breaking the law.” of doing so.”

The Federal Criminal Code Act (FDCPA) sets specific rules that debt collectors must follow and prohibits certain types of abuse. However, not all debt collection agencies follow the rules. If a collection agency comes after you, know that you have rights. And if the debt collector violates this law, you can report it to the authorities and even file a lawsuit.

Require writers to use the key to support their work. These include white papers, keynotes, keynotes and interviews with industry experts. If necessary, we also refer to original research from other reputable publishers. Learn more about the standards we follow to create authentic, unbiased content in our Editing Guidelines.

How To Handle Debt That Has ‘expired’

The offers listed in this table are from the partnership they are funded by. This payment will affect how and where the names are displayed. does not include all available stores. Details: Yes, you can pay after the service. The best way to solve a debt problem is to send the answer first and then call the other person and make the request. You can answer within 15 minutes. This gives you the strength you need to solve.

People are often sued by debt collection agencies out of the blue. If you do not respond to the lawsuit, you will automatically lose the case and collection agencies can collect the debt directly from your bank account or checking account. For those who owe some debt, it is usually best to file a lawsuit and then deal with a debt collector.

If you’ve received a foreclosure, it’s probably because you haven’t paid off the debt. However, according to research from the Consumer Financial Protection Bureau, there’s a good chance you’re not in debt at all. If you owe a debt, the lawsuit is usually the debtor’s last payment and means you won’t have to pay the amount for a while.

In many states, if you are sued for debt, you will receive a summons and complaint. These are legal documents that begin to accumulate value. The newspaper tells you that you are being taken to court, and the complaint tells you why you are being taken to court.

Oh Sh*t My Charge Off Got Sent To Some Law Firm. What Do I Do?

You can give this information privately, which means that someone will give it to you. You can receive this information by mail. You may not get service at all, but through a process called “plumbing service,” the lawsuit is still being filed against you.

We hear it all the time from our customers: “I still haven’t received the invoice!” Collectors do this because they think you won’t respond to the lawsuit. If you don’t respond, debt collectors can take a wrongful action against you. If the court allows it, the default judgment gives debt collectors the legal right to pay your wages, seize your property, etc.

You can avoid a default judgment by submitting an answer to the court and contacting the debt collector to reach a settlement.

Technically, you can contact your attorney at any time to discuss payment arrangements. However, there are some tips and tricks that will help you achieve the perfect plan for you.

Examples Of Affirmative Defenses In Answer To A Debt Collection Lawsuit

So yes, you can settle the debt after the deadline, but make sure you do it

When will a debt collector sue, can a third party debt collector sue you, can debt collector sue me, can you sue debt collectors, can a debt collector sue you, when can a debt collector sue you, can you counter sue a debt collector, can a debt collector sue you after 7 years, will a debt collector sue me, can a debt collector sue, sue a debt collector, can i sue a debt collector