What To Do When Your Identity Has Been Stolen – Seeing missed payments on your credit card statement can be stressful. Identity theft is more common than you might think. In 2018, nearly 60 million Americans had their personal information stolen. If you believe you’ve been the victim of identity theft, follow these steps to clean up your name and credit.

Has the bank approached you about an unusual payment? If so, take a look at your financial accounts. The first red flag of identity theft is an unauthorized payment. If your account is hacked, ask your bank to lock or close your account to prevent additional charges.

What To Do When Your Identity Has Been Stolen

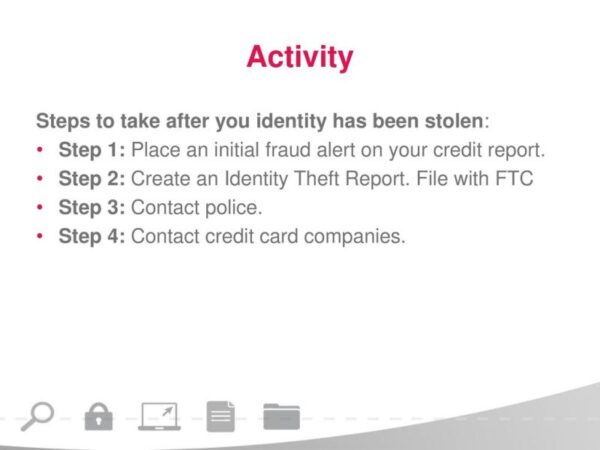

Contact one of the credit reporting agencies (Experian, Equifax, TransUnion) and request a fraud alert. The warning will last for 90 days and will make it difficult for a thief to open more accounts in your name.

Ricky Maye Quote: “your Identity Is Not In Who You Can Be. It Is In Who

Request a credit report from all three reporting agencies and look for any accounts you don’t recognize. Also, check your payment history and unknown personal information that can’t be accessed from your account.

Go to the FTC’s website and fill out the Fraud Complaint and Notice form and print it for your records. Both forms serve as an ID theft report along with a police report. This report will help you dispute fake accounts.

Report the theft to local law enforcement. Then get a copy of the police report. Check the police report for all fake accounts. Also, give the police a copy of the FTC’s Plagiarism Report form.

You may be offered free credit monitoring in the event of a data breach. These services monitor suspicious activity on your credit report and send you alerts when new accounts are opened in your name.

Anyone Else Having This Issue? I’ve Provided All The Correct Information And Yet My Identity Cannot Be Verified. Has Happened Multiple Times And Support Has Been Everything But Helpful. I’ve Called At

As a precaution, you may want to close all your accounts and open new ones to avoid future damage. The thief may come back to control your money in the future, so talk to your financial institution and decide if closing your account is the best decision.

The best way to keep all personal information safe is to regularly update your online account. If you have a strong password with a mix of letters, numbers, and symbols, your account is less likely to be hacked. Do not use the same password for multiple accounts, and do not remove your address or phone number from public profiles or social media.

Bank of the Lowcountry takes identity theft seriously, so if you are a victim of identity theft, please follow these steps and contact us at (843) 549-2265. If you notice any suspicious activity on your bank statement, call your bank immediately to protect your account.

Call a customer service representative at your local branch to sign up for online banking at this time: By Libby Wells. By Libby WellsArrow. Former Right Writer, Credit Cards Libby Wells covers banking and savings products. He has more than 30 years of experience as a writer and editor in newspapers, magazines and online publications. Libby Wells

How To Know (and Check) If Your Identity Has Been Stolen

Edited by Lance Davis Lance Davis VP of Rights at Arrow Lance Davis is a VP overseeing content for mortgages, savings, investments, consumer loans, insurance, credit cards and small business. Lance leads a team of over 70 editors, reporters and publishers who are passionate about creating content that helps readers make smart financial decisions. Connect with Lance Davis on Twitter Connect with Lance Davis on Twitter Linkedin Connect with Lance Davis by Email

Founded in 1976, the organization has a long history of helping people make smart financial choices. We’ve maintained that reputation for more than four decades by clarifying the financial decision-making process and giving people confidence in their next steps.

We adhere to strict editorial policies, so you can be sure we put your best interests first. All of our content is produced by highly qualified professionals and edited by industry experts to ensure that everything we publish is factual, accurate and reliable.

Our banking reporters and editors focus on what consumers care about most – the best banks, the latest interest rates, alternative account types, money-saving tips and more.

Alert! If This Has Happened To You, Your Identity Has Been Stolen On The Internet

We adhere to strict editorial policies, so you can be sure we put your best interests first. Our award-winning editors and reporters create honest, accurate content to help you make smart financial decisions.

We appreciate your trust. Our mission is to provide our readers with accurate and unbiased information, and we have editorial standards to ensure this. Our editors and reporters check the accuracy of the information you read to make sure it’s accurate. We operate a firewall between advertisers and the editorial team. Our editorial team does not receive direct compensation from advertisers.

The editorial team is writing on behalf of you – the reader. Our goal is to provide you with the best advice to help you make smart decisions about your personal finances. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team does not receive direct compensation from advertisers and carefully reviews our content to ensure accuracy. So whether you’re reading an article or an opinion piece, you can be sure you’re getting reliable and trustworthy information.

You have a question about money. there are answers. Our experts have been helping you manage your money for over 40 years. We always strive to provide customers with the expert advice and tools they need to succeed throughout their lifelong financial journey.

Bolster Identity Security With Threat Detection & Response

We adhere to strict editorial policies, so you can be confident that our content is honest and accurate. Our award-winning editors and reporters create honest, accurate content to help you make smart financial decisions. The content created by our editors is factual and factual and not influenced by our advertisers.

By explaining how we make money, we’re transparent about providing quality content, competitive pricing, and useful tools.

Is an independent publisher and ad-supported comparison service. We receive compensation for advertising sponsored products or services or for clicking on certain links on our site. Therefore, unless prohibited by law for mortgage, home equity or other home equity products, this fee may affect how, where, and in what order those products appear in the listed categories. Other factors, such as our website rules, whether we offer products in your region or within your chosen credit rating, may affect how and where products appear on this website. Although we strive to offer a wide range of offers, this does not include information on financial or credit products and services.

If your driver’s license number, social security number, or other personal information is stolen, it’s important to know what to do and respond as quickly as possible.

Digital Identity Verification For Financial Institutions

According to the nonprofit Identity Theft Center, identity theft is often the result of cyber attacks such as phishing emails, sweet messages, and malware.

Financial and/or reputational damage can be minimized if you detect a breach early and act promptly. If your personal information is stolen, you should take the following steps.

“Report your stolen ID to the issuing authority immediately,” said John Buzzard, senior fraud and security analyst at Javelin Strategy & Research.

If your account has been hacked, contact your bank. If your credit card number has been stolen, notify your credit card issuer. If your Social Security number has been stolen, contact the Social Security Administration.

What Are The Steps Should Be Do If You Are The Victim Of Identity Theft? By Emmapacino

“Don’t delay this process,” Buzzard said. “If a criminal commits a crime by identifying you, especially if your identity card is discarded or confiscated during the act, the relevant authorities can visit you.”

Contact the major credit reporting bureaus like Equifax, Experian, and TransUnion to request a freeze or fraud alert on your credit file. These powerful tools are free and won’t affect your credit score.

A credit freeze prevents third parties from accessing your credit. So, if you’re applying for a mortgage and your credit file is frozen, the lender can’t check your credit until the lien is cleared.

However, there are exceptions. Employers and landlords who perform background checks, collection agencies that work for the company you owe money to, and federal, state, and local government agencies can still collect your credit. Read the details of each news agency’s freeze.

Ways To Determine If Your Identity Has Been Stolen

A credit freeze does not prevent your chosen credit monitoring service from checking your credit.

The fraud alert initially lasts for a year and requires potential lenders to contact you to verify your identity before granting a loan.

The FTC’s IdentityTheft.gov guides you step-by-step through the identity theft process. Reports are generated for specific credential breaches, such as stolen Social Security numbers or other personal information.

The FTC does not investigate identity theft. Rather, it supports and facilitates investigations and prosecutions

Required Documentation For Sign Up

I think my identity has been stolen, how do you know when your identity has been stolen, what to do when identity has been stolen, if you think your identity has been stolen, how to see if my identity has been stolen, has your identity been stolen, what to do if your identity has been stolen, what do you do when your identity has been stolen, what should you do if your identity has been stolen, identity has been stolen, check if my identity has been stolen, check if your identity has been stolen