What To Do To Get Prequalified For A Home Loan – Most real estate buyers have heard that if they want to buy a property, they must be pre-qualified for a mortgage or pre-approved. These are two important steps in the mortgage application process.

Some people use these terms interchangeably, but there are important differences that every home buyer should understand. Prequalification is just the first step. This can give you an idea of the loan amount you can qualify for. Pre-approval is the second step and the conditional commitment that actually gets you the mortgage.

What To Do To Get Prequalified For A Home Loan

“The pre-qualification process is based on data provided by the consumer,” said Todd Kaderabek, a partner at Beverly Hanks Real Estate Brokerage in downtown Asheville, North Carolina. “Pre-approval is verified consumer data, such as a credit check.”

Applying For A Home Loan (what Do I Need?)

Getting pre-qualified involves providing the bank or lender with your complete financial picture, including debts, income, and assets. The lender will look at everything and estimate how much the borrower can expect to receive. Pre-qualification can be done over the phone or online and is usually free.

Prequalification is quick, and it usually takes one to three days to receive your prequalification letter. Keep in mind that loan pre-qualification does not include a credit report analysis or an in-depth understanding of the borrower’s ability to purchase a home.

The initial pre-qualification stage allows you to discuss any goals or needs related to your mortgage. The lender will explain the different mortgage options and recommend the type that is best for you.

Mortgage discrimination is illegal. If you believe you have been discriminated against because of your race, religion, gender, marital status, use of public assistance, national origin, disability, or age, you can take action. One step is to file a report with the Consumer Financial Protection Bureau or the U.S. Department of Housing and Urban Development (HUD).

Complete Guide To Pre Construction Mortgage Approval Process

Likewise, the prequalification amount is not accurate because it is based solely on the information provided. This is exactly the amount the borrower can expect. A pre-qualified buyer does not carry the same weight as a pre-approved buyer who has undergone a more thorough investigation.

However, pre-qualification can be helpful when creating the proposal. “Almost all offers in our market require pre-qualification,” Kaderbey said. “Sellers are smart and don’t want to sign a contract with a buyer who can’t honor the contract. This is one of the first questions we ask potential buyers: Have you met with the lender and confirmed the down payment? Qualifying Status” If not, we advise the lender on the options. If so, we will request and retain a copy of the pre-qualification letter.”

The next step is to get pre-approved and this is more difficult. “Prequalification is a good indicator of creditworthiness and borrowing ability, but prequalification is the final decision,” Kaderbek said.

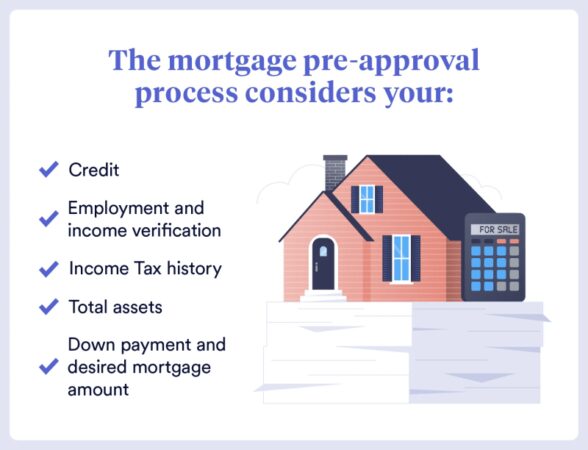

Borrowers must complete a formal mortgage application to get pre-approved and provide the lender with all necessary documents to conduct a comprehensive credit and financial check. The lender will then pre-approve the exact amount.

How Long Is A Mortgage Pre Approval Good For?

Going through the pre-approval process also gives you a better idea of the interest rate you will be charged. Some lenders allow borrowers to lock in the rate or charge pre-approval fees that can reach hundreds of dollars.

The lender will provide a conditional written commitment for the specified loan amount, which will allow the borrower to find homes at or below that price level. This gives borrowers an advantage when dealing with salespeople because they are one step closer to getting an actual mortgage.

The benefit of completing the pre-qualification and pre-approval steps before searching for a home is that it gives the borrower an idea of how much the borrower will have to spend. This allows you not to waste time searching for expensive real estate. Getting pre-approved for a mortgage can also speed up the actual buying process and communicate to sellers that an offer is important in a competitive market.

The borrower provides the lender with a copy of the sales contract and any other necessary documents as part of the complete underwriting process after selecting the home and submitting an offer. The lender hires a certified or licensed third-party contractor to perform a home appraisal to determine the value of the home.

Should You Get Pre Approved Before Looking For A Home?

We’ll double-check your income and credit to make sure nothing has changed since your initial approval, so now is not the time to buy big furniture.

The final step in the process is the loan commitment, which is issued by the bank only after the bank has approved the borrower and the home in question, meaning that the appraised value of the property is equal to or greater than the sales price. The bank may also want additional information if the appraiser raises any issues that need to be investigated, such as structural issues or malfunctions of the HVAC systems.

Getting pre-qualified and pre-approved for a mortgage gives potential homebuyers an early idea of how much housing they can afford. But most sellers prefer to negotiate with those who are pre-approved. Pre-approval also allows borrowers to close on a home faster, giving them an edge in a competitive market.

Not necessary. Remember that you should not buy at the highest price. Depending on market conditions, you may be able to purchase a home you like for less than the approved price, giving you extra money each month to put toward retirement, funding your children’s college, or crossing a few things off your bucket list.

Being Pre Approved Or Pre Qualified: Which Is Better?

Pre-qualification is different from pre-qualification. Prequalification means that the mortgage lender has reviewed the financial information you provided and believes you qualify for the loan. Pre-approval is the second step in the lending process and is a conditional commitment to give you a mortgage.

This isn’t always the case, but it can help convince the seller and their agent that you are a serious buyer and will likely be able to get a mortgage without any problems.

Although they sound the same, prequalification and preapproval have different meanings. Both are initial steps in the mortgage loan process, where pre-qualification is an indicator of the size of mortgage you may be approved for, and pre-approval is a conditional promise from a lender that you will be approved for a mortgage. Understanding the differences will help you navigate the mortgage process more smoothly.

Writers are required to use primary sources to support their work. This includes technical documents, government data, original reports, and interviews with industry experts. We also cite original research from other reputable publishers when appropriate. You can learn more about the standards we follow to create accurate and unbiased content in our editorial policy. If you’re thinking about buying or selling a home on Cape Cod, you’ve probably heard the following two terms many times:

Cant Afford To Pay Your Business Loans Get Pre Approved For Cash

Home buyers searching for a home often hear that they must be pre-qualified or pre-approved when applying for a mortgage. They look similar, but each serves a different purpose in this important process. Pre-qualification is just an estimate of the loan amount you can qualify for. Pre-approval goes a long way and shows buyers that you are more serious. Conditional approval is even stronger, as it singles out the most serious candidates and tests their ability to close the loan.

Getting pre-qualified for a mortgage usually means giving the lender basic verbal information about your financial situation, such as your debts, income, and other key factors that determine your loan eligibility. Your lender will analyze everything before deciding how much they are willing to lend you to buy a home on Cape Cod. Pre-qualification is usually done over the phone or online, and there is usually no fee. Remember, this is just a preliminary estimate; It does not include an analysis of your credit report or a detailed examination of your ability to afford a home that you may be interested in purchasing.

The first step in getting a mortgage is to discuss your goals and needs with your lender. They can then review all the mortgage types available and decide which one is best for you.

Loan pre-approval takes the loan process a step further than pre-qualification. To get pre-approved for a mortgage, applicants must complete a formal application and submit all necessary documents (both paper and digital) so the lender can conduct a comprehensive credit check. Once this step is completed, the lender can approve you up to a certain limit, allowing you to purchase the property.

Mortgage Pre Approval Calculator

Getting pre-approved by a lender before you start looking for a home has many benefits. For example, many lenders provide applicants with an approximate interest rate that they will charge if approved and/or allow the rate to lock in until everything is finalized. Also, some mortgage providers will give you a conditional commitment in writing after getting pre-approved, allowing you to search for a home within your budget. When it’s time to propose

What do you need to get prequalified for a home loan, what to do to get prequalified for a home loan, how to get prequalified for home loan, how do you get prequalified for a home loan, what you need to get prequalified for a home loan, get prequalified for home loan, how do i get prequalified for a home loan, what to do before getting prequalified for a home loan, what is needed to get prequalified for a home loan, prequalified for home loan, how do i get prequalified for a va home loan, when to get prequalified for home loan