- What Is The Difference Between Income Statement And Balance Sheet

- What Is An Income Statement? A Complete Guide

- Gross Profit Vs. Operating Profit Vs. Net Income: What’s The Difference?

- Profit Center Accounting Basics In Sap S/4hana Finance

- Income Statement: How To Read And Use It

- Greg Pierce On Linkedin: The Difference Between The P&l And The Statement Of Cash Flows

What Is The Difference Between Income Statement And Balance Sheet – The balance sheet shows the financial position of the company on a particular date. It lists all the assets and liabilities of the organization at that time Assets are things that can be easily converted into cash or used to make cash, such as cash, receivables, inventory, equipment and investments. Liabilities are amounts owed to others, such as accounts payable, notes payable, and long-term debt. The difference between total assets and liabilities is the owner’s equity in the company.

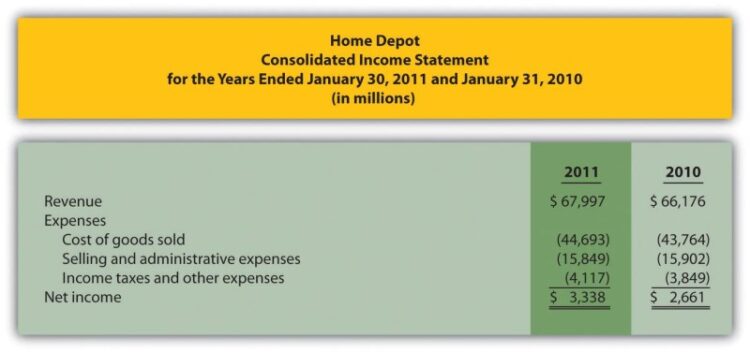

An income statement shows the profit or loss of a business over a period of time. It combines income and expenses for the period and calculates net income or loss as the difference between these two amounts.

What Is The Difference Between Income Statement And Balance Sheet

A cash flow statement shows how money has flowed in and out of an organization over a period of time. A balance sheet shows the financial position of an organization at a particular point in time.

What Is An Income Statement? A Complete Guide

A cash flow statement shows how money has flowed in and out of an organization over a period of time. An income statement shows the profit or loss of a business over a period of time.

The cash flow statement is prepared for the convenience of senior management and cannot be prepared without a working capital turnover schedule. They show where the money comes from and how it is spent.

True is a Certified Educator in Personal Finance (CEPF®), author of the Handy Financial Ratios Guide, member of the Society for the Advancement of Business Planning and Writing, contributor to his financial education website, Financial Strategists, and various financial communities. He spoke to students from universities such as the CFA Institute, as well as his alma mater, Biola University, where he earned a bachelor of science degree in business and data analytics.

To learn more about Truth, visit his personal website, his author profile on Amazon, or his speaker profile on the CFA Institute website.

Gross Profit Vs. Operating Profit Vs. Net Income: What’s The Difference?

We use cookies to ensure that we provide you with the best possible experience on our website. If you continue to use this website, we will assume that you are happy with it.

Our team of auditors are established professionals with decades of personal finance experience and multiple advanced degrees and certifications.

They regularly contribute to top financial publications, such as the Wall Street Journal, US News & World Report, Reuters, Morning Star, Yahoo Finance, Bloomberg, MarketWatch, Investopedia, TheStreet.com, Motley Fool, CNBC and many more.

Finance Strategist is a leading financial education organization that connects people with financial experts, which prides itself on providing accurate and reliable financial information to millions of students each year.

Profit Center Accounting Basics In Sap S/4hana Finance

We aim to provide an understandable and comprehensive explanation of financial topics using simple text supported by helpful images and animated videos.

Our writing and editing staff is a group of professionals who hold senior financial positions and have written for many publications of major financial sources. Our work has been directly cited by Entrepreneur, Business Insider, Investopedia, Forbes, CNBC and many others.

Our goal is to empower students with the most truthful and reliable financial information possible to help them make informed decisions about their personal needs.

Ask a question about your financial situation and give as much detail as possible. Your information is kept secure and will not be shared unless you specify.

Income Statement Analysis: How To Read An Income Statement

Someone on our team will connect you with a financial professional in our network who has the right qualifications and expertise.

A financial professional will provide guidance based on the information provided and a no-obligation call to better understand your situation.

Tip: Experts are more likely to answer questions if they are given background and context. The more details you provide, the faster and more thorough the response will be.

Tip: A portfolio is often more complex when it contains investable assets. Answer these questions to help us connect you with the right job.

Balance Sheet Vs Income Statement: All You Need To Know

A financial expert should be arriving soon. In the meantime, here are a few articles that may be relevant to your question:

A financial expert should be arriving soon. In the meantime, here are a few articles you may be interested in: A Complete Guide to the Difference Between a Balance Sheet and an Income Statement and An Explainer for Understanding Financial Statements.

The balance sheet and income statement are important records for business owners. A company usually has a healthy balance sheet if the income statement is strong, while one may be poor while another is strong. You wonder now why this is happening or what is separating them. Who wins the conflict between the income statement and the balance sheet?

We can say that each report is different in terms of details. A balance sheet gives you an overview of a company’s assets and liabilities at a particular point in time, while an income statement gives a picture of a company’s performance over a period of time. Let’s look at some of the differences between these basic reports.

Solved The Main Difference Between A Contribution Income

A balance sheet is a summary of a company’s assets and liabilities at a particular point in time. To make a financial analysis, it is used in conjunction with other important financial documents such as income statements or cash flow statements. A balance sheet is used to represent the total value of your company at a given point in time and to provide information to interested parties about the company’s financial position.

Assets, liabilities and equity at the end of the accounting period are listed in the balance sheet, which is a financial statement.

The math is simple: a business must finance whatever it has (assets) by borrowing money (debt), raising money from investors (issuing shares of stock) or using retained earnings.

For a balance sheet to be considered “balanced,” a company’s total assets must equal the total of its liabilities and equity.

Difference Between Capital And Revenue Expenditure(with Table)

A balance sheet shows how a company uses its assets and how those assets are financed using the liability side of the statement. Make sure you review them every month because banks and investors look at a company’s balance sheet to see how it is using its resources.

An income statement, often called a profit and loss statement, shows the financial health of a business over a specific period of time. In addition, it provides the business with useful data related to profits, sales and costs. Important financial decisions are based on the income statement.

Since they are important for cost control and revenue growth, revenue and expenses are reviewed regularly. For example, even though a company’s sales may increase, if expenses increase faster than revenues, the company may lose money.

In order to determine whether a company is making a profit or a loss during that period, investors and creditors often pay close attention to the operating area of the income statement. Apart from providing useful information, it also shows the performance of the company’s management and its performance compared to its competitors in the same sector.

Income Statement: How To Read And Use It

Revenue, cost of goods sold, operating expenses, and net profit or loss for the period are all included in the income statement.

Salaries, rent, and non-cash equipment are examples of expenses that a company often faces and are classified as operating expenses. Depreciation or interest payments are examples of operating expenses that are not related to core business activities. Just as operating income is defined as income unrelated to core business activities, operating income is defined as income earned from core business activities.

In order for a company to know what to look for in each, it is important to understand the difference between an income statement and a balance sheet.

Although the income statement and the balance sheet are very different in many ways, there are some notable similarities. Although they serve different purposes, lenders and investors use both to choose whether to support the company or not.

Deferred Tax And Temporary Differences

The income statement and the balance sheet perform important functions for banks and investors because they provide a clear picture of the company’s current and future financial health, although they are used to evaluate different types of data.

, we are committed to providing the highest quality professional accounting, tax, MIS, and CFO services to start and grow businesses.

When you work with him, you get a team of financial experts who take money off your plate – “so you can focus on your business.” Start your free trial, then enjoy 3 months for $1/month when you sign up. Basic monthly or introductory plan.

Start a free trial and enjoy 3 months for $1/month on select plans Sign up now

Greg Pierce On Linkedin: The Difference Between The P&l And The Statement Of Cash Flows

Try it for free, and check out all the tools and services you need to start, run and grow your business

Running a small business comes with a lot of paperwork. As a small business owner, you may be asked to prepare financial documents such as balance sheets and profit and loss statements to show to existing or potential investors. These reports – detailing everything from a company’s profits to its operating costs and debt – show financial performance and help investors make forecasts.

Income statement and balance sheet, what is the difference between balance sheet and income statement, difference between balance sheet and income statement, link between balance sheet and income statement, the difference between balance sheet and income statement, difference between balance sheet and profit and loss statement, understanding the balance sheet and income statement, difference between balance sheet and financial statement, what's the difference between balance sheet and income statement, what is income statement and balance sheet, what is the difference between p&l and income statement, difference between income statement and balance sheet and cash flow