What Is The Difference Between Home Equity Loan And Cash Out Refinance – Home equity loans and real estate loans are two major types of loans that use the home as collateral, or collateral, for the loan. This means that the lender can evict you if you don’t keep up with your payments. However, home equity loans and loans are used for many purposes and at different stages of home buying and home ownership.

A traditional loan is when a financial institution, such as a bank or credit union, lends you money to buy a home.

What Is The Difference Between Home Equity Loan And Cash Out Refinance

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg?strip=all)

In most traditional mortgages, the bank lends up to 80% of the home’s value or purchase price, whichever is less. For example, if the home is worth $200,000, the borrower will qualify for a loan payment of $160,000. The borrower must pay 20%, or $40,000, respectively.

The Pros And Cons Of A Home Equity Loan

In other cases, such as federal loan programs that offer down payment assistance, you can get a loan for more than 80% of the value.

Bad credit mortgage options include the Federal Home Owner (FHA) home loan, which allows you to put down as little as 3.5% as long as you pay for home insurance. Loans from the US Department of Veterans Affairs (VA) and the US Department of Agriculture (USDA), require 0% down.

The mortgage interest rate can be fixed (it remains the same throughout the term of the loan) or variable (changes annually, for example). You repay the loan with interest over a fixed period of time. Most loan terms are 15, 20, or 30 years, although other terms are available.

Before getting a loan, it’s important to shop around for the best mortgage lenders to determine which one will give you the best rate and loan terms. The loan calculator is also great at showing how different interest rates and loan terms affect your monthly payments.

What Is Home Equity?

If you fall behind on payments, the lender can foreclose on your home. The lender then sells the property, usually at auction, to recover its money. In this case, this loan (called the “primary” loan) must be related to the next lender to hit the house, such as a home loan (sometimes called a “secondary loan”) or a home equity line of credit (HELOC). ). The original lender must be paid in full before subsequent lenders receive the proceeds of the sale.

A home loan is also a type of loan. However, you get a home loan when you already own a property and have equity. Most lenders limit your home loan amount to more than 80% of your total equity value.

As the name suggests, a home loan is secured – that is, guaranteed by the homeowner’s equity, which is the difference between the value of the property and the amount of the existing loan. For example, if you owe $150,000 on a home worth $250,000, you have $100,000 in equity. We think your credit is good, and if you don’t qualify, you can get an additional loan using a portion of the $100,000 in business equity.

Like traditional loans, home loans are loans that are repaid over time. Different loan companies have different requirements based on the percentage of home equity they are willing to lend. Your credit score will help you with this decision.

Dbs Home Equity Income Loan

Lenders use your loan-to-value (LTV) ratio to determine how much you can borrow. The LTV ratio is calculated by dividing the loan amount by the appraised value of the home. If you pay a good amount on the loan – or if the value of the house has increased, the loan-to-value ratio will be higher and you can get a bigger home loan.

Home equity loans often come with a fixed rate, while traditional loans can have a fixed or variable interest rate.

Generally, a home equity loan is considered a second mortgage. If you already have a home loan. If your home goes into foreclosure, the lender who holds the loan will not pay until you make the first payment.

Therefore, home loans are more risky, which is why these loans often have higher interest rates than traditional loans.

Best Guide To Home Equity Loan Singapore

However, not all home loans are subprime loans. If you own all of your property, you can consider getting a home equity loan. In this case, the lender of the house is considered the first owner. An inspection may only be required to complete the transaction if you own the property outright.

Home loans and mortgages have the same tax deductions along with their interest as a result of the Tax Cuts and Jobs Act of 2017. Before the Tax Cuts and Jobs Act, you could only deduct $100,000 of your home loan. honest debt

Currently, mortgage interest is tax deductible on loans up to $1 million (if you take out the loan before December 15, 2017) or $750,000 (if you cancel after that date). This new measure applies to some home loans as well if they are used to buy, build, or improve a home.

Homeowners can use a home equity loan for any purpose. But if you use the loan for purposes other than buying, building or improving a home (such as paying off a loan or paying for your child’s college), you can’t deduct the interest.

Home Equity Loan For Debt Consolidation?

A home equity loan is another type of loan that allows you to borrow money against the equity you have in your home. You take that money for granted. It is also called a second mortgage because you have another loan to pay off your first loan.

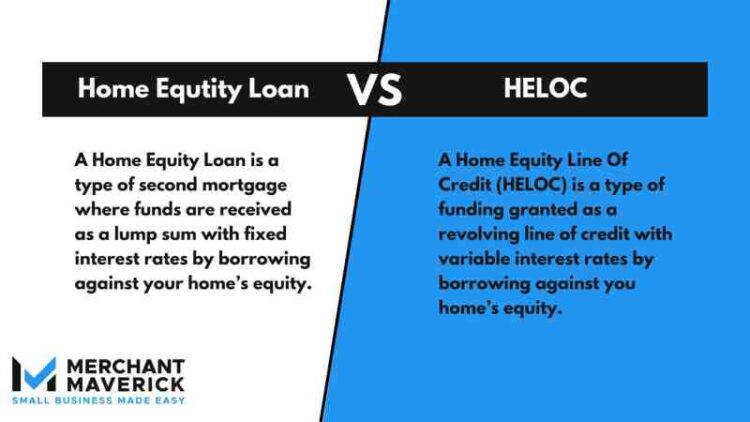

There are several important differences between a home equity loan and a HELOC. A home loan is a fixed, one-time payment that is repaid over time. A HELOC is a type of line of credit that uses the home as collateral that can be used and paid off, similar to a credit card.

A home equity loan will usually have a lower interest rate than a home equity loan or HELOC. First time loans have priority over repayment in the event of default and carry less risk than a home equity loan or HELOC. However, home loans may seem to have lower closing costs.

If you have a very low interest rate on your current mortgage, you may need to use a home equity loan to borrow the extra money you need. But there are limits to your tax deduction, including using the money for the purpose of improving your property.

Is Cash Out Refinancing Your Property A Good Move For Your Home Equity Loan?

If the value of your loan has dropped significantly since you paid off your existing loan – or if you need the money for a reason unrelated to your home – you may be able to take advantage of the loan again. If you refinance, you can save the extra money you borrowed, because traditional loans often have lower interest rates than home loans, and you can get a lower rate on your existing balance.

Ask writers to use relevant information to support their work. These include white papers, articles, original publications, and interviews with industry experts. We also use original research from other reputable publishers where appropriate. You can learn more about the standards we follow to create fair, unbiased content in our policies. The COVID-19 pandemic has changed everyone’s lives. If you have experienced unemployment and need help fixing your home, a home equity loan can be an affordable financing option. Also, prices are at historical rates and home values are rising in response to increased demand. In this article, we will explain the difference between Home Loans and lines of credit and help you choose the best option that fits your needs and goals.

Also known as a second mortgage, a home equity loan is secured by the equity in your home. Your equity is the difference between your current balance and the market value of your home. Generally, you can borrow up to 80% of your home’s value, so you must have the right amount to qualify. At Palisades Credit Union, members can qualify for a loan of up to 100% of their home equity.

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg?strip=all)

Home loans usually come with a fixed interest rate and are fixed-rate loans, meaning you get a lump sum after you close the loan and pay it back, plus interest, in monthly payments.

Home Equity Loan, Heloc Or Cash Out Refinance. What’s Best?

Applying for a home equity loan is similar to the process you go through to get your first mortgage. Here are the steps:

Abbreviated, HELOC, a Home Equity Line of Credit is a revolving, revolving line of credit.

Difference between refinance and cash out refinance, what is the difference between refinance and home equity loan, difference between refinance and home equity loan, difference between heloc and cash out refinance, difference between cash out refinance and home equity loan, cash out refinance vs home equity loan, cash out refinance home equity loan, home equity loan versus cash out refinance, what is the difference between a cash out refinance and home equity loan, what is better cash out refinance or home equity loan, is a cash out refinance a home equity loan, cash out refinance or home equity loan