What Is The Difference Between Direct Subsidized And Unsubsidized Loan – Learn how the different types of student loans work, as well as tips on how much you can and should borrow.

Getting a college degree is expensive. Tuition, fees, room and board, and required course materials can add up to a large and daunting bill.

What Is The Difference Between Direct Subsidized And Unsubsidized Loan

If grants, scholarships and savings aren’t enough for you, you may need to consider taking out student loans to pay for your studies.

Explaining Federal Direct Unsubsidized Loans

Student loans can help cover the cost of education, but debt can also become a huge financial burden. There are 2 basic types of loans you can use: federal student loans and private student loans.

Student loans are money you borrow to cover your college expenses and eventually have to pay back (in cases, but we’ll get to that later).

When you take out a student loan, you sign and accept an agreement that contains the detailed terms of the loan.

This includes the interest rate, the period during which the interest starts to accumulate, the minimum monthly payment required and the total time you have to pay off the entire loan. Here’s what it all means:

How To Get A Student Loan & Student Loan Options

When comparing student loans and deciding which one to choose, you should familiarize yourself with these terms.

A student loan can be taken out by the student or his parents. In 2020, 34% of college students took out student loans, and 20% of students’ parents took out loans to help pay for college.

That same year, the average amount students borrowed was $11,836 a year, and parents borrowed an average of $12,535 a year.

Interest is the cost that a lender charges to borrow funds. Part of each monthly payment covers the interest applied for the period, and the remaining part pays the original amount of the loan.

The Difference Between Subsidized And Unsubsidized Student Loans

Let’s say you have a $5,000 loan with an annual interest rate of 5%. Although the interest rate is expressed on an annual basis, it is actually charged daily. Over 30 days, this loan would accrue $20.55 in interest: [(0.05/365) x 30 days x $5000 = $20.55].

In this example, if you’re making a $100 monthly loan payment, you’ll only pay $79.45 because the $20.55 in interest will be paid first.

With student loans, you have options, so don’t take out a loan until you’ve done your research. The two main student loan lenders are the federal government (federal student loans) and private financial institutions (private student loans).

In 2020, 30% of students used federal loans and 13% of students used private loans. The type of loan you choose is very important because it affects the cost of the loan and your ability to repay.

Federal Direct Student Loans: 2023 Review

When you take out a federal loan, you are borrowing from the U.S. Department of Education’s Federal Direct Loan Program. William D. Ford (what a mouth!). That’s why we call federal student loans direct loans, or federal loans for short.

To apply for federal student loans, you must file the Free Application for Federal Student Aid (FAFSA®), also known as the FAFSA. To be accepted for federal student loans, you must sign a promissory note (a legal promise to repay the entire loan with applicable interest) and complete credit counseling.

Because PLUS loans are also available to parents, a financial advisor or lender often uses the term grad PLUS loan to indicate that the loan is intended for graduate or professional students.

Unlike other federal loans, your credit history will be used to decide if you qualify for a loan.

What Is A Federal Direct Subsidized Loan?

Usually, the interest rate on federal loans is lower than on private loans, but private loans are worth considering if you don’t qualify for federal loans or can’t get a federal loan large enough to cover all of your education costs.

The application process for private student loans varies, so you’ll need to get detailed information from the lender offering your private loan.

Federal student loans and private student loans are not the same thing. The terms differ – especially in terms of whether it is subsidized, the start of the repayment period and the possibility of repayment.

The Parent PLUS Loan is the only federal student loan that requires a cosigner (someone who agrees to pay off the loan if you can’t). No other federal loan requires a cosigner.

Subsidies: Definition, How They Work, Pros And Cons

Otherwise, a private loan requires a co-signer. The exception is if you have a very strong credit history.

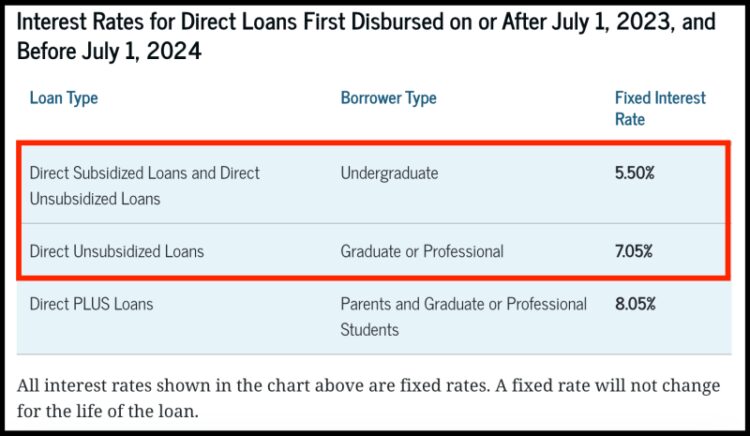

The interest rate on federal student loans is fixed – it is set at the time you take out the loan and does not change for the rest of the time you take out the loan. Private loans can have fixed or variable interest rates. If your loan is variable, the interest rate is usually linked to the market rate and may rise or fall over the life of the loan. If interest rates rise, you’ll see much higher student loan debt payments and could end up paying a lot more than you expected.

As we mentioned before, the interest rate on federal loans is generally lower than on private student loans.

Federal student loans have established origination fees and other fees. For loans approved before October 1, 2023, the loan fee is 1.057% of the balance.

Subsidized Vs. Unsubsidized Loans: Which Is Better For Students?

Private student loan lenders may charge different fees, depending on the lender you choose. You have to shop around to find the lender that offers the cheapest loan.

Private loans usually require you to start repaying the loan immediately. On the other hand, you don’t have to make any federal loan payments until you graduate. After you leave school, there is usually a 6-month grace period before your federal loan repayment begins.

One exception: If you drop out of college or decide to enroll less than half-time, you’ll have to pay off your federal loans before you graduate.

When a federal loan is a subsidized loan, it means the lender will cover your interest payments as long as you meet their requirements.

Subsidized Vs. Unsubsidized Loans

Typical requirements are that the loan is intended to cover the undergraduate student’s expenses, that he attends school at least half-time, and that he can demonstrate financial need.

Otherwise, private loans are always unsubsidized loans that accrue interest immediately and require you to start making payments while you’re still in school.

The Department of Education (DOE) offers a consolidation loan, which is a loan that allows you to combine several federal loans into one with a fixed interest rate at no cost.

Although some private lenders may offer consolidation loans, they often charge a fee. Loan consolidation is useful when you are paying off several student loans from different lenders. Instead of dealing with multiple payments with different deadlines, you deal with one payment.

Federal Student Loans Guide: Subsidized & Unsubsidized Loans Review

The standard repayment period for federal student loans is 10 years. Consolidation loans can be approved for a period of up to 30 years.

On the other hand, private student loans have a wider variety of repayment terms. Longer terms lead to lower student loan payments, but you’ll end up paying more over the life of the loan.

For example, a dependent student can borrow up to $5,500 in federal loans. However, that same student cannot borrow more than $3,500 of that $5,500 in subsidized loans.

In their fourth year, if all goes well, they can borrow an additional $7,500 in federal loans ($5,500 or less for subsidized loans), until they exceed the combined loan limit of $31,000 from all their student loans ($23,000 within the subsidized loan limit credit).

Subsidized Vs. Unsubsidized Student Loans: Know The Difference

It’s also important to remember that you can’t get more from federal student loans than the cost of attending college minus any other aid you receive. If your cost of attendance is $20,000 and you receive a $15,000 scholarship, you can only receive up to $5,000 in federal loans. If you get a lot of other help, it can affect your debt limits.

Although you can borrow up to $5,500 in federal loans in your first year as a dependent student, that doesn’t mean you have to.

Once your FAFSA application is processed, your school will provide a financial aid offer detailing your financial aid and available federal student loans.

Take the time you need to review your funds and remember that you don’t have to take the entire amount offered. You can always take less.

What Is A Direct Subsidized Loan Vs. A Direct Unsubsidized Loan?

In cases where you absolutely must take on debt to afford college, a subsidized loan is always better than an unsubsidized loan. And much better than alternative forms of debt like credit cards and personal loans.

With private student loans, repayment usually starts immediately. You must start making monthly payments while in school and on a repayment plan. Contact your private lender to see if they offer any repayment options.

For federal student loans, repayment usually begins after graduation. Exceptions are when you stop your studies or change your enrollment status to less than half-time.

With federal loans, there is no established repayment plan. DOE offers many repayment options

One Grant, One Loan: What Exactly Does It Mean?

What is the difference between a unsubsidized and subsidized loan, difference between direct loan subsidized and unsubsidized, what's the difference between subsidized and unsubsidized loan, what is the difference between subsidized student loan and unsubsidized, direct loan subsidized and unsubsidized, direct loan subsidized vs unsubsidized, what is the difference between direct loan subsidized and unsubsidized, difference between subsidized and unsubsidized student loan, the difference between direct subsidized loan and unsubsidized, the difference between subsidized and unsubsidized loan, what is the difference between subsidized and unsubsidized loan, what is the difference between direct subsidized and unsubsidized loans