What Is The Average Interest Rate On A Home Loan – The average interest rate on a two-year new mortgage could break 6% in the coming days as lenders grapple with industry turmoil.

The prime rate rose to 5.98% on Friday as mortgage lenders raised the cost of home loans, according to Financial Information Service Manifacts.

What Is The Average Interest Rate On A Home Loan

Brokers described a difficult environment in which lenders set rates for short periods, then borrowers default and raise or raise interest rates.

Best Home Loan Deals Singapore (2023) ᐈ Compare Rates %

Andrew Montlake of Corco mortgage brokers said: “These conditions are difficult for anyone, especially for customers who need to make quick decisions and brokers are working around the clock.”

The standard two-year mortgage rate was 5.92% on Thursday, but rose on Friday. This is up from 6.65% in October last year following a slim budget under Liz Truss as prime minister.

According to Moneyfact, the typical five-year fixed rate is 5.62%, compared with 6.51% last year.

According to analysts, rates have risen steadily and sometimes suddenly in the past few weeks. Much will depend on official inflation data due next Wednesday.

Wsj: Interest Rate Peaks And Your Portfolio

Earlier figures on wage and price rises mean markets expect inflation and interest rates to remain higher than expected in the UK, which will be reflected in mortgage funding costs.

Other lenders to make changes in the past 24 hours include Clydesdale Bank, which has made several deals. Coventry Building Society has announced it will re-evaluate contracts on Tuesday next week.

On Friday, Skipton’s no-deposit mortgage rate for new customers rose from 5.49% to 5.89% for first-time buyers.

Charlotte Harrison, head of home finance at Skipton Building Society, said: “The rate increase reflects recent changes in the mortgage market.

Lending Interest Rates In Latin America 2022

As responsible lenders, we must be prudent in our approach to this product and market to ensure that tenants are not asking more than they can realistically pay. Join our 35,000+ subscribers to our MoneyZone newsletter for the latest prices, deals, exclusive deals, money-saving hacks and expert insights.

After three consecutive increases, the average home loan has surpassed pre-pandemic levels, reaching 4.05% last seen in July 2019. With another interest rate hike next week, borrowers should brace for mortgage payments. Repeat again.

Personal finance expert Claire Frawley said: “Despite many households trading their budgets for a couple of hundred dollar boosts, rate rises are continuing. Households are now expecting a four per cent increase.”

Owners paying principal and interest on a $400,000 loan currently pay $2,122 per month with an average variable interest rate of 4.05%. Their annual mortgage payments increased by another $1,356.

Interest Rates Explained By Raisin

“The last time interest rates averaged 4% was in June 2019, when they returned to pre-pandemic levels, after the RBA kept the cash rate at 1.50% for 30 months.”

According to the latest analysis, if lenders raise their cash rates by another 50 basis points in August, the average home loan variable rate will be 4.55% and the average bank variable rate will be 5.18%.

For homeowners with an average new loan amount of $615,310, a 50 percent increase would increase mortgage payments by $2,076 per year.

The median house price in Sydney, Melbourne and Canberra is over $800,000. For borrowers with more than $800,000 in debt, a 50 percent increase would add an extra $224 to their monthly mortgage payment, to $4,469. .

Best Savings Accounts In Singapore With Highest Interest Rates (nov 2023)

“Economists expect the RBA to raise the cash rate by 75 basis points in August, the biggest increase to date. However, their estimates were based on CPI, which rose to 6.3% year-on-year in June and then slowed to just 6.1%.

If the RBA raises the cash rate by 50 basis points and the big banks raise the full rate, customers with a mortgage at one of the big four banks will see an annual increase of $1,392.

The database with Homeloan360 is 2.54 per cent, 214 below the Big Four average variable rate (4.68%) and 151 below the average variable rate (4.05%). For prime mortgage holders, a 50-point increase could add $1,224 to annual mortgage costs.

“Many small lenders are still trying to attract new customers with competitive interest rates. So even if interest rates are going up, there’s still time to compare and switch home loans,” Frawley said.

Average Car Loan Interest Rates By Credit Score (december 2023)

Compare over 1800 products from over 200 banks, insurance and energy providers, helping thousands of Australians find the best deal every month with our award-winning comparison tools and calculators. As one of Australia’s most viewed comparison sites, our team of experts provide financial commentary and advice for Australia’s top news.

Our goal is to help you make smart financial decisions, and our award-winning comparison tools and services are free. As a marketplace, we make money from advertisements and products on this site, including other paid links that the provider pays us if you visit or remove a product from our site. They do not pay you anything extra to use our Service.

We pride ourselves on the tools and information we provide, and unlike other comparison sites, we have the ability to search all products in our database, whether or not we have a trading relationship with the suppliers of those products.

“Sponsorship”, “Hot Sale” and “Preferred Product” entries refer to products for which the supplier has paid for more prominent advertising.

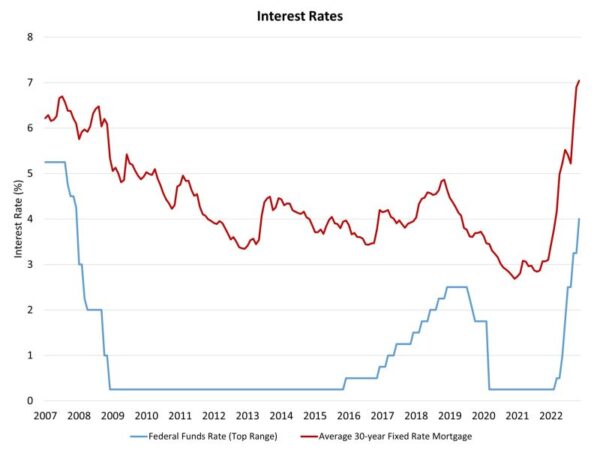

Years Of Us Interest Rates In One Chart

“Sort order” refers to the actual sort order and does not imply that any product is superior to others. You can easily change the order of the products displayed on the site.

Terms, conditions, exclusions, limitations and restrictions apply to any insurance products listed on the Site. These terms, conditions, exclusions, restrictions and limitations may affect the extent of benefits and coverage available under any insurance products listed on the website. Before deciding on any insurance product, please refer to the product disclosure statement and target market definition on the provider’s website for more information. Recently, the Reserve Bank announced a steady increase in cash rates. While there is no way to predict the future or timing of these changes, further developments are likely in the next 12 months.

We’ve heard that mortgage rates are historically low, so it’s important to take a long-term view of the real estate market and mortgage rates. Interest rates will never be this low. Most home loans start with a 30-year loan term – here’s how the Australian market has performed over the past 30 years.

If you ask any Australian who owned a home in the 80s, they’ll remember that interest rates were in the teens and double digits in the first half of that decade. It’s a tough time for homeowners with sky-high mortgage payments. In January 1990, the Reserve Bank’s cash rate reached 17.5% to slow the economy. This rate has a direct impact on home loan rates.

Happy Mortgage Interest Rate News As Average Rate Falls Below 5% Again

If you look at the average variable mortgage rates over the last 30 years, there are some highs. Current interest rates are at long-term lows.

Reserve Bank of Australia data may go back further. You can see the average interest rate on traditional variable rate home loans since 1959!

Amortization interest is part of the total cost of the home loan, and a variable interest rate means that it changes over time. It can go up, it can go down. Home loans have variable interest rates. You can see the rates of our home loan products here.

When making your choices or planning your home loan, it’s important to look at long-term interest rates to allow for any moves. However, it’s hard to predict how rates will change over time, but it’s good to be aware of them

A Closer Look At Interest Rates

What is the average interest rate on a personal loan, what is the average va loan interest rate, what is the average interest rate on a business loan, what's the average interest rate on a home equity loan, what is the average private student loan interest rate, what is the average interest rate on a home equity loan, what is the average interest rate on a student loan, what is the average interest rate on a home loan, average home loan interest rate, what is the average interest rate for a business loan, average interest rate on va home loan, what is the average interest rate on a car loan