What Is The Average Interest Rate For Student Loans – According to a report released by the Federal Reserve Board of Governors, 43 percent of college-educated Americans have student debt, 93 percent of which is in the form of student loans. From 2006 to 2018 outstanding student loan debt tripled, and the average annual cost of college tuition increased nearly $10,000 over the same period (

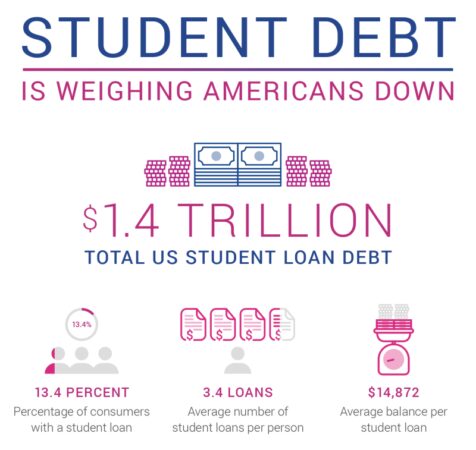

In 2020 As of the first quarter, the outstanding balance of student loans was about $1.67 trillion, with private student loans accounting for about 8 percent of the market, or $131.81 billion. While private student loans make up a relatively small portion of all outstanding student debt, they have been growing rapidly for a decade. Although the granting of federal loans in 2010-2011 and 2018-2019 decreased by more than 25 percent, annual private student loans increased by nearly 78 percent during the same period. In fact, from 2008 to 2019 growth in personal loan debt outpaced all other consumer financial products, including car loans, credit card balances and mortgages. At the end of 2019, outstanding private student loan debt was 71 percent. higher than a decade ago.

What Is The Average Interest Rate For Student Loans

Students can get student loans through the federal student loan program or private lenders. Often, federal loan recipients also use private loans as a way to cover expenses that exceed the federal loan limit. Unlike federal student loans, private student loans require a credit check at the time of application. Private student loan lenders generally have more flexibility and discretion than federal agencies and can offer borrowers terms and rates based on their credit history.

Are Interest Rates Going Up?

Using consumer finance research, we forecast private and federal student loan interest rates for 2019.

). While federal and private student loans in this example have similar interest rates, it’s important to note that federal student loans have a fixed interest rate for the life of the loan, while private student loans can have variable interest rates.

The private student loan market is represented by a few large lenders, such as Sallie Mae and Navient, which focus on student loans (

). Other active players in this market include banks such as Wells Fargo and Discover, whose combined portfolio of consumer financial products includes private student loans. However, a large share of the market is made up of smaller companies such as fintech companies and private non-bank education lenders. Together, these small institutions account for about one-third of the private student loan market as measured by outstanding loan balances.

Tackling Student Loans: Utilizing Average Balance For Success

Private student loans are also packaged into student loan asset-backed securities (SLABs). SLAB helps diversify credit risk by tying loans to securities and provides a variety of investment opportunities for investors with different risk appetites. Figure 4

The leading issuers in the private student loan market have been shown to have issued nearly $15 billion. USD of new private SLABs.

There are significant differences between private and federal student loans when it comes to delinquency and default mechanisms. For one thing, private student loans are generally less likely to miss payments. Federal student loan programs offer a nine-month grace period if you miss a payment, while private student loans can become foreclosure when you miss a payment.

In addition, federal student loan borrowers may have additional options to help them get out of default, such as loan rehabilitation and loan consolidation. Such options are generally very limited for borrowers with private student loans. Many private lenders will cancel a foreclosure after 120 days of late payments, closing the door on borrowers willing to negotiate a repayment agreement. In addition to additional loan options, federal loans also come with forbearance, income-based repayment and loan forgiveness programs that private lenders typically don’t offer.

Compute Loan Interest With Calculators Or Templates

Finally, when a borrower defaults, the government typically has more enforcement options, including wage garnishment and tax refund forfeiture. Private creditors often rely on lawsuits as their primary means of collection.

Delinquencies and defaults on private student loans have been low in recent years. During the COVID-19 pandemic, low default rates may be due to proactive efforts by lenders to offer borrowers forbearance agreements. Figure 5

Here’s a quick look at the state of student loans in 2020. first quarter overview. About five percent of private student loans were forgiven, more than double the rate at the end of 2019. quarter, when the loan utilization during that period was about two percent.

As part of the government’s relief efforts in response to the COVID-19 pandemic, federal student loans have been repaid interest-free starting in 2020. March. until at least 2021 month of January. Pay for causes related to COVID-19. For example, some private student loan servicers waive late fees for a period of time, extend financial aid in the event of hardship, or automatically grant a grace period of one to two months at the borrower’s request. More efficient. This article will look at the average interest rate on car loans, credit cards, and mortgages.

Current Student Loan Interest Rates

We are a nation of debt because we want more and because of the capacity of our financial system to provide more. When used properly, debt can help us live better and become wealthier. But when debt is used indiscriminately, it can destroy our financial dreams.

Below is a list of the most indebted countries by trading economy. America’s debt to GDP is currently ~106%, ranging from an all-time low of 31.7% to a high of 122%.

When your country’s debt exceeds its GDP, it would be a good idea to encourage politicians to exercise fiscal restraint so that the next financial crisis doesn’t send your country to hell.

Note how the most indebted countries, such as Greece, Italy and Portugal, continue to struggle after the 2008-2009 crisis. financial crises.

Student Loan Pause Could Cost $275 Billion

Let’s take a look at these types of consumer debt and rank them from worst to best. We will also check the latest interest rates by loan type.

Average annual credit card interest rate in 2020 in the middle is 17%. Some go as high as 29.99% if you have terrible credit. That’s a ridiculously high interest rate that can’t even match the annual returns of great investor Warren Buffett.

If you carry a balance, the credit card companies are scamming you. They secretly expect you to spend more than you earn or forget to pay the balance each month. No financial samurai should ever have revolving credit card debt. Use a credit card for rewards points, insurance, free 30-day credit, and concierge services, but that’s it.

I highly recommend spending less time playing the 0% APR balance transfer game. Instead, focus on making more money. Don’t use your credit card as a crutch to support irresponsible spending habits.

Average Business Loan Interest Rates

Borrowing money to buy a depreciating asset is a very bad move. Some people justify a car loan by saying it’s 1.9% or something. But 1.9% is still too much if you’re losing money on your car every month.

If you can afford to spend 1/5 to 1/10 of your gross income on a car, you shouldn’t be taking out a car loan. If you buy a car for 1/5-1/10 of your gross income and get a 0% loan, you can invest the difference, then great. Or say no to car loans.

The older I get, the more I realize how important education is to achieving financial independence and happiness. If you have the knowledge and skills to do something, life becomes much easier. He said that nothing you learn in college can be learned for free online. So skyrocketing college tuition seems like a hoax, especially since high tuition doesn’t guarantee a high-paying job after graduation.

If your family doesn’t have a lot of money, choose a college that offers enough free grant money to pay you back within four years of graduation. I have a strong bias towards public schools, having attended the College of William and Mary for undergrad and UC Berkeley for business school. You can deduct up to $2,500 of student loan interest paid in any year if your modified adjusted gross income is less. $80,000 or $160,000 for couples filing jointly.

High Student Loan Debt Threatens Upward Mobility

I offer reliable student loan debt refinancing. Fill in your information and get real quotes from 10 qualified lenders competing for your business. The trusted solution is an easy way to compare the best rates and lenders.

The average 30-year fixed-rate mortgage fell to around 2.78%. The average 15-year fixed rate mortgage is 2.32%, which is currently the best deal. The average 5/1 ARM is 2.89%.

Mortgage debt is considered the lowest form of debt because it is tied to property that has historically appreciated in value. In addition, the US government allows all mortgage interest to be written off

Average interest rate for student loans, current average interest rate for student loans, average interest rate on student loans calculator, what is the average interest rate of student loans, refinance student loans interest rate, what is the average interest rate on student loans, average interest rate for unsubsidized student loans, what is the average interest rate on federal student loans, average interest rate for graduate student loans, average interest rate for student loans 2016, lowest interest rate student loans, average interest rate student loans