What Is The Average Interest Rate For A Business Loan – If you’re using the Galaxy Fold, consider expanding the phone or viewing it in full screen mode to optimize your experience.

Advertiser Disclosures Most of the listings that appear on this site are owned by companies from which The Motley Fool receives compensation. This fee may affect how and where products appear on this site (including, for example, the order in which they appear), but our reviews and ratings are not affected by the fee. We do not include all companies or offers available in the market.

What Is The Average Interest Rate For A Business Loan

Most or all products come from our partners who pay us. This is how we earn. But our editorial integrity ensures that compensation does not influence the opinions of our experts. Terms and conditions may apply to offers listed on this page.

What’s The Average Student Loan Interest Rate?

The Federal Reserve interest rate, known as the federal funds rate, federal funds rate, or FOMC rate, is the interest rate at which banks and credit unions borrow and lend to each other, and is the benchmark for almost all interest rates. It is determined by the Federal Reserve and can be changed at any time.

The Federal Reserve decided to keep interest rates at a steady level for the third meeting in a row. The target range for the federal funds rate will remain at 5.25% to 5.5%.

Economists expect a pause in interest rate hikes due to several factors, including a slowdown in inflation. However, the Fed said in its notes after the meeting, “The Committee stands ready to adjust the stance of monetary policy as needed.”

The Federal Reserve decided to leave the benchmark interest rate unchanged at its December 12-13 policy meeting. The central bank raised interest rates 11 times between March 2022 and July 2023.

The Power Of Interest Rates: Growing Your Average Collected Balance

At its meeting at the end of September, the Fed decided to suspend interest rate hikes. The Oct. 31-Nov. 1 session marked the second straight stop, and the most recent session was the third straight in which interest rates remained unchanged.

The Fed has long been committed to maintaining an annual inflation rate of 2% over the long term. According to the Central Bank, this rate is the most conducive to economic stability.

The consumer price index, which measures changes in the cost of consumer goods and services, rose 3.1% year-on-year in November.

In its statement, the Fed noted that inflation eased but remained high. He also announced his intention to reduce annual inflation to 2% over time.

Average Interest Rate By Debt Type: Auto, Credit Card, Mortgage

However, the Fed felt that holding off on raising rates was the most prudent course of action given the inflationary situation. The central bank said it will continue to assess economic data and its impact on monetary policy.

The Fed also made clear that it is open to raising interest rates if inflation rises or remains above target. The Fed must strike a balance between returning inflation to 2% and potentially stretching the economy by increasing the cost of consumer debt to an unreasonable level. Although overall economic activity picked up in the third quarter of the year, recent indicators suggest that growth has begun to slow, allowing the Fed to keep rates steady.

Changes in the federal funds rate affect consumers because they can affect interest rates on credit cards, loans and savings accounts to varying degrees.

The central bank has one more chance to raise rates until the end of 2023. However, some experts believe that the Fed may be done raising interest rates — period.

The Mortgage Crunch • Resolution Foundation

“The fact that they left rates unchanged for the second time in a row suggests that the Fed may leave rates unchanged in December,” said Peter Cardillo, chief economist at Spartan Capital Securities. “And if they do, that means the Fed is done.”

According to the Fed’s September economic forecast, interest rates should reach 5.6% by the end of the year. However, that may not happen if the Fed keeps rates at their current levels.

The next Federal Reserve meeting in 2023 is scheduled for December 12-13, 2023. The FOMC meeting lasts two days to allow Federal Reserve Committee members to discuss the economic implications of the adjustments of the interest rate at the federal level. See tentative schedules for the remaining FOMC meetings in 2023-2024.”

Fed Chairman Jerome Powell suggested the possibility of another interest rate hike if the economy shows signs of improvement and continues to push prices higher.

How Is Credit Card Interest Actually Calculated?

The Committee will be prepared to adjust the stance of monetary policy accordingly if risks arise that may impede the achievement of its objectives. Federal Reserve Chairman Jerome Powell, November 1, 2023

For next year, Fed officials expect the economy to remain resilient and inflation to gradually decline, meaning rate cuts could be larger than expected. Based on the Fed’s previous economic projections, it expects the federal funds rate to reach 5.6% by the end of this year, 5.1% by the end of 2024 and 3.9% by the end of 2025.

While higher rates could slow the economy, Powell said inflation is the top priority and the Fed is “firmly committed to returning inflation to the 2% target.”

The Federal Reserve sets the target rate as a range, which provides flexibility to meet its targets. The chart below shows how the upper bound of the federal funds rate target has changed over time.

Interest Rates: Different Types And What They Mean To Borrowers

The target federal funds rate, set by the Federal Reserve, is the interest rate at which banks and other financial institutions borrow from each other.

When the Federal Reserve raises or lowers interest rates, it changes the target federal funds rate. By adjusting this rate, the Fed can influence borrowing and lending practices throughout the economy.

The Federal Reserve’s current interest rate was raised by a quarter point from 5.25% to 5.50% in July, the highest level in 22 years. After a brief pause in June, the Federal Reserve raised interest rates again by a quarter of a percentage point in July, returning the federal funds rate to a target range of 5.25% to 5.50%. , which marks the highest level of benchmark borrowing costs. in July. older than 22 years.

Interest rates can have a huge impact on the economy. Ultimately, the Federal Reserve’s interest rate is an important tool for maintaining a stable economy.

Federal Funds Rate

The federal funds rate is what banks charge each other for overnight loans, but it also affects many business and consumer loan products.

Low interest rates can stimulate the economy by making it easier for individuals and businesses to borrow money for large purchases and investments, leading to increased economic activity. At the same time, high interest rates inhibit consumer and business spending, which increases the cost of borrowing, which reduces economic activity.

One of the primary responsibilities of the Federal Reserve System is to ensure price stability. This means keeping inflation consistently low and stable over the long term.

When inflation is low and stable, people can hold onto their money without worrying that it will lose purchasing power due to high inflation. In other words, the dollar goes better in a low inflation environment.

Interest Rate Radar: Benelux Countries Offer The Lowest Corporate Interest Rates

Since the Fed began raising rates in March, it has raised rates by 5.50%, making the hikes the fastest cycle on record.

After falling for 12 consecutive months in consumer prices, inflation hit 3% year-on-year in June before rising to 3.7% in August. That’s the lowest annual inflation rate in more than two and a half years, but still above the Fed’s 2% target.

The federal funds rate is the interest rate that banks charge when they lend money to each other from their reserve balances.

The federal government requires all “storage institutions,” such as banks and credit unions, to maintain a certain amount of funds (reserves) each night to avoid the risk of being depleted. Those who do not have enough reserves borrow from other financial institutions that have more than enough. The interest rate they pay to borrow money is known as the federal funds rate.

Side Effects Of Monetary Easing In A Low Interest Rate Environment: Reversal And Risk Taking

When the Federal Reserve’s interest rate is high, banks are reluctant to lend to each other, and the supply of liquidity in the economy decreases. This means that consumers and banks borrow and spend less, which can cause the economy to slow down. The Federal Reserve typically raises interest rates when the economy is strong.

It’s easy to understand why the Federal Reserve wants to stimulate the economy, but it may be harder to understand why it wants to slow it down: Isn’t economic growth a good thing? In other words, what goes up must come down, and the higher an economy goes, the more it can fall.

When rates are low and people feel good about the economy, consumers tend to take on too much debt, and lenders may lend too much money to unqualified borrowers. This puts individuals, businesses and banks in a precarious position as the economy inevitably slows down.

When the Federal Reserve’s interest rate is low, there is more cash in circulation and banks can borrow from each bank.

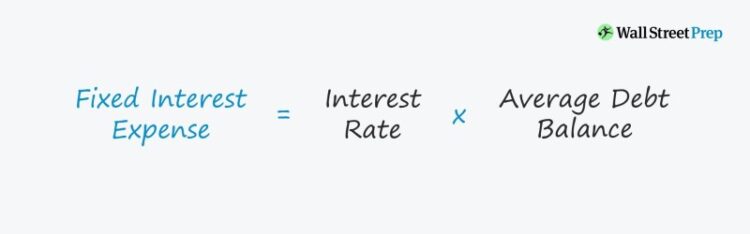

Fixed Interest Rate

What is the average interest rate for a business loan, what is the average student loan interest rate, average interest rate for small business loan, what is the average private student loan interest rate, what is the average business loan interest rate, what is the average personal loan interest rate, average business loan interest rate, what is the average va loan interest rate, average loan interest rate, what is the average interest rate for a home loan, what is the average interest rate on a personal loan, what is the average interest rate on a construction loan