What Happens If You Stop Paying Health Insurance – People often feel ashamed of their medical debt and view it as a personal failure. In fact, it is a mass disease.

It is estimated that Americans are saddled with at least $140 billion in medical debt. Lack of insurance and rising medical costs are two major reasons why medical debt is a growing problem.

What Happens If You Stop Paying Health Insurance

What if I can’t afford sick leave? What if you accumulate medical debt and can’t pay it off on time? In both cases, the consequences can be severe.

Employee Benefits: Types, Importance, And Examples

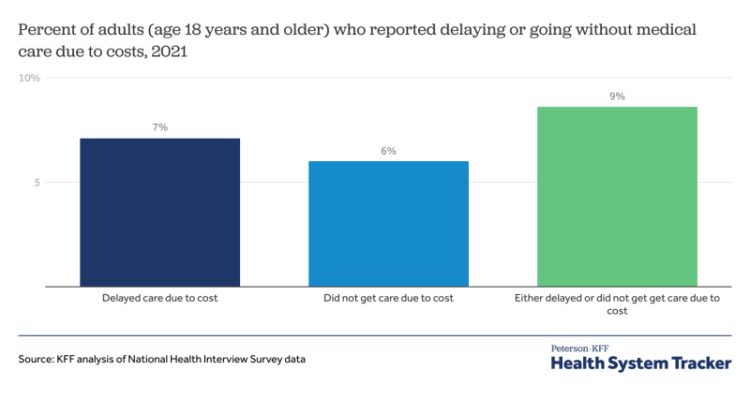

People can forego needed care, including doctor’s appointments, tests, treatments and prescription drugs, according to the Kaiser Family Foundation, a nonprofit health policy analysis group. They may have difficulty paying other bills, drain their savings, damage their credit, or even file for bankruptcy.

In the United States, many people do not pay for medical care because they cannot afford it. According to the U.S. Census Bureau, 19% of U.S. households cannot afford immediate medical care. Families with children are more likely to be behind on medical bills than families without children.

Lack of insurance is one of the leading causes of unpaid medical debt. An estimated 27.3 million U.S. residents under the age of 65 are uninsured. They may not be able to obtain insurance through their workplace, or they may be self-employed and unable to afford the high premiums. Whatever the reason, not having health insurance can quickly become a huge financial burden for those in need of health care.

People often cope with medical debt by postponing vacations, major household purchases, cutting household expenses, working more, borrowing from friends and family, and tapping retirement or savings accounts to pay these bills. Of course, much medical debt remains unpaid.

Reasons You Aren’t Getting Paid

If you are uninsured, you can check your insurance options on the federal health marketplace or contact your local health department to determine if you qualify for Medicaid.

When medical bills start to pile up, it’s important to be proactive rather than ignoring the situation. If you’re facing unpayable medical debt, try these debt relief tips to minimize the impact of your bills on your finances, health, and future.

Various sources will tell you that 7.1 to 80 percent of medical bills contain errors. The true percentage can only be guessed at, but the risk of error is obvious.

So how do you spot errors in medical billing? Sean Fox, co-president of Freedom Debt Relief in San Mateo, California, recommends checking your insurance company’s payment instructions first, preferably as soon as you receive them.

Side Effects Of Stopping Thyroid Medication

Look for duplicate products, services you didn’t receive, services you don’t recognize, and charges your insurance should cover. Review your health care provider’s bill to make sure your insurance is paying accurately. Call your insurance company or provider’s billing department to clarify anything you don’t understand or investigate possible errors, she says.

A more advanced approach is to obtain a copy of your medical records and try to compare them to what you were charged. You may need expert help to protect these records and make sense of it all.

If your healthcare provider does not provide you with an itemized bill, feel free to ask so you know exactly what services have been charged and how much each service costs.

If you want to discuss your bill, talk to your healthcare provider’s medical billing manager, who actually has the authority to lower your bill. Don’t wait until your account is past due or in collections, or your credit score may take a hit. When you receive your bill, talk to someone to make sure it’s correct.

Medi Cal Member Services

If you have a low income or are experiencing financial hardship, you may be able to apply for assistance, even if the hardship is solely related to your medical expenses. Depending on your income and savings, the hospital may provide charitable assistance. In fact, Fox said state law requires some hospitals to provide free or discounted services to low-income patients. When you receive a bill, let your healthcare provider know if a health problem is affecting your income and ability to pay.

One strategy for justifying a lower fee is to compare your quote to the prices charged by other providers in your area. Use sites like NewChoiceHealth.com or HealthcareBluebook.com to find out what you should pay. If you have health insurance, your insurance company’s website may also have a tool that allows you to get estimated costs of care for various procedures.

One tactic is to ask for a steep discount in exchange for prompt payment. For example, you can ask your supplier if they will write off the remaining balance if you pay 30% of your bill now. This strategy works because your ISP doesn’t have to bill you for months or years, saving time and money.

:max_bytes(150000):strip_icc()/life-insurance-policies-how-payouts-work.asp-final-8b7370a242df451d9caea293bc6eb300.png?strip=all)

If you can’t pay one percent of your entire bill immediately, try asking for a 25% discount if you’re making a large down payment now. A less aggressive strategy is to ask the provider if they will charge you the discounted rate Medicare or Medicaid pays.

What Do You Union Guys Pals Think Of This Letter The Company Handed Out This Morning?

If you can’t arrange reduced payments, ask about interest-free payment plans. Whatever terms your provider accepts, be sure to get them in writing.

Very few healthcare users are medical billing professionals. Enlisting the help of a medical professional, debt negotiator, or medical bill advocate would be a wise choice. These professionals can reduce your debt when you are unable or too embarrassed to try.

Medical billing advocates are insurance agents, nurses, attorneys, and healthcare administrators who can help break down and lower your bills. They will find errors, review bills and dispute overcharges. Some hourly rates can be as much as $100 or more. Others will charge 25% to 35% of the reduction in your bill.

You can also ask to speak with a health care provider at your hospital or insurance company if you need help understanding your bill and resolving payment issues, Fox said. A social worker can recommend charities, churches, community organizations and government agencies that can provide financial assistance.

Life Vs. Health Insurance: Choosing What To Buy

In March 2022, the major consumer credit reporting agencies announced measures aimed at reducing the impact of medical debt collections on consumer credit ratings. These include:

The first two measures will take effect on July 1, 2022, and the third measure will take effect in the first half of 2023.

In April 2022, the Biden administration launched a series of measures to minimize medical debt burdens and abusive collection practices. They include a ban on considering medical debt when evaluating applications for federal loan programs.

Disparities in the U.S. health care system affect millions of people, even though few can be sure they won’t face medical problems beyond their insurance coverage and ability to pay. Stay in control as much as possible by making sure your medical bills are accurate, negotiating lower costs, and understanding your rights when it comes to medical debt collection. If you are unable to resolve these issues yourself, seek help from a professional.

What Happens If You Don’t Pay A Hospital Bill?

If medical debt remains unpaid, the medical provider can turn it over to a debt collection agency. Worst case scenario, you could be sued for unpaid medical bills. If you lose your case, the creditor or debt collector may take steps to garnish your bank account or garnish your paycheck as payment.

After sufficient time has passed, unpaid medical debt may not be recovered depending on your state’s debt statute of limitations. This means you can no longer sue over these medical bills. However, this does not eliminate the debt or the credit report associated with it.

If you fall behind on medical bills, your creditors may agree to pay off the debt. This will allow you to pay less than what you owe to pay off the debt and forgive the rest. You can negotiate debt settlement on your own or hire a debt settlement company to do it on your behalf.

Unpaid medical bills can have a negative impact on your credit score if the debt is reported to the credit bureaus. Please note that, as noted above, consumer credit agencies have taken steps to minimize the impact of such reports.

Reasons To Leave Earwax Alone

Writers are required to use primary sources to support their work. It includes official documents, government data, original reports and interviews with experts in the field. Where appropriate, we also cite original research from other reputable publishers. You can learn more about the standards we follow when creating accurate, unbiased content in our editorial policy. Understanding health insurance policies can be a daunting task. Consumers generally do not have the power to decide which services are provided, which services are covered, and how much they should ultimately pay. It is not uncommon for a doctor to request a service, a patient to follow the doctor’s orders, and insurance to pay only part of the cost or not at all.

What happens if i stop paying my health insurance, what happens if you stop paying your car insurance, what happens if you stop paying car insurance, what happens if i stop paying my health insurance premium, what happens if you stop paying life insurance, what happens if you stop paying term life insurance, what happens if i stop paying my credit cards, what happens if i stop paying my timeshare, what happens if you stop paying your life insurance, what happens if you stop paying timeshare, what happens if you stop paying insurance, what happens to life insurance if you stop paying