What Happens If You Don T Pay Loans – You are here: Home / US Student Loans USA / Blog Posts / What happens if you default on your student loans?

If you came out of college with a lot of student loan debt and are starting to have trouble keeping up with your payments and day-to-day expenses, you may be wondering if you can skip minimum wage or stop paying off your loans.

What Happens If You Don T Pay Loans

For some college graduates, their loan payments are so high that they equal their monthly rent or mortgage payments.

What Happens If You Don’t Pay Back A Payday Loan?

The average borrower now leaves college with $32,731 in federal student loans. Although the repayment schedule allows borrowers to pay off their loans in 10 years or less, the repayment period is 21.1 years.

10.8% of the 45 million borrowers are delinquent or in arrears, or 5.5 million borrowers. Another 2.8 million borrowers are currently in default. Every day, 3,000 people pay off their student loans.

Of the $1.56 trillion currently borrowed by the Department of Education, only $291.1 billion is expected to be paid back in 10 years or less.

If you have a lot of debt to pay, keeping it organized and paying it off on time can be a challenge. Although this can be a serious mistake, it can have very serious consequences.

How To Run Away From Loan Shark In Singapore

Unfortunately, federal student loans are not payments you want to miss. Unlike other types of loans, they are usually not discharged, even if you make a payment.

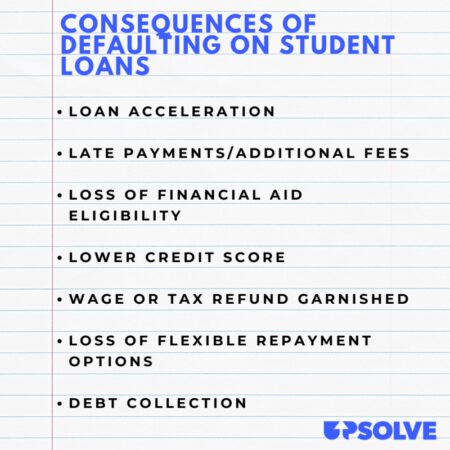

Let’s look at what happens if you default on your student loans. Then we’ll talk about how to avoid volatility and put you in a more stable position for yourself and your current finances.

Private student loans are different from federal student loans, so if you miss a payment on your student loan, check your contract or contact your financial institution to find out how it affects you.

But for federal student loans, if you miss a due date, your account will change from “current” to “past.” You will remain in debt until you contact your creditor for payment or file for foreclosure or foreclosure (both of which give you time off).

White House Pursuing Alternate Paths To Student Loan Forgiveness

If you don’t pay, expect your bill to increase; you will receive a late payment immediately. This can be 5% of your monthly payments.

Even a missed payment is a big deal, because your lender can report the missed payment to the credit bureaus. You may not be approved for new credit cards or loans, and your interest rate may increase.

Federal student loans go from “delinquent” to “default” 270 days after you miss a payment. If you have personal student loans, you are usually considered delinquent soon.

When you reach the point where your student loans go into default, expect a huge financial penalty: missed payments, all fees, late fees, additional interest, fines and penalties must be paid at once.

What Happens If You Never Pay Your Student Loans?

Collection agencies will be involved in trying to recover your payments, and the cost is your responsibility.

The Department of Education will take drastic measures to force you to repay your student loans. They can garnish your wages, withhold your taxes or Social Security payments, and sue you.

Once you default, your interest rate will continue to drop. This can have a lasting effect on borrowing money or getting a lower interest rate.

The level of your unsecured debt will also affect the number of co-signers you can have. If a family member co-signed on your loan, they will also receive bad credit and phone calls.

What Happens When You Default On A Loan?

Private student loan defaults can happen faster than student loan defaults. Private loans can be paid off or charged early, up to 120 days late.

As soon as you default on a private student loan, the loan defaults immediately. Your loan is foreclosed and your credit score is affected.

Private creditors can also sue you for allowing them to garnish your wages.

Instead of defaulting on federal student loans, your best bet is to contact a loan servicer as soon as you see payment problems.

Reasons Why Smes In Singapore Can Consider Taking A Business Loan

You can choose from several options that will reduce or delay your payments without losing “now”:

If you have already allowed your debts to go into default, you will have two options to get out. The first option would be to consolidate all your debts into a new loan.

The second option is rehabilitation, where you pay 9 at the time you agree with the lender. If you make 9 payments during this period, your loan will no longer be in arrears and you will have a good credit history.

:max_bytes(150000):strip_icc()/buy-now-pay-later-5182291-final-4dcaa9bea32a4aa398eb99e5ca5406bb.png?strip=all)

When you are debt free, you will be able to find different repayment plans and choose one based on your income, the amount you cannot afford to pay.

How To Build Credit History If You Don’t Have Any Existing Loans? (infographic)

But the first step is to contact a loan officer to explain all your options.

If you think you’re struggling to pay off or keep up with all of your debts, the best way to do this is to contact your lender right away to explore all of your options.

Frequently asked questions about What happens if you default on your student loans Q: What happens if you default on your student loans and leave the country?

There is no law against federal student loans. This means that the collection process will continue indefinitely. If you plan on never coming home, you can avoid your student loan debt. But if you go back, you can expect your credit to be ruined, which makes life very difficult.

What Happens When You Take Out A Loan And Don’t Use It?

Private creditors can sue you for allowing them to garnish your wages. But unlike federal student loans, private student loans have limits. After a while, they must stop their collection activities, unless they confirm that you have left the country. In this case, they can resume collection operations upon their return.

If you had a co-signer on your loan, the burden of repaying the loan would fall on them.

No, you cannot go to jail for defaulting on federal student loans or private student loans. But you can go to jail if you don’t follow a court order, such as subpoenaing someone to hear your case. If you are being sued by a debt service or collection agency, you should make sure you show up for all court dates to avoid going to jail for contempt of court.

If you start paying less than you owe, without consulting a loan officer, you will default on your loan. It is best to contact your lender and choose an alternative repayment option, or choose repayment or forbearance. Credit played an important role in the lives of middle-class Indians. Most of us have taken out a mortgage or personal loan at some point, whether it’s for the wedding of our dreams or something as small as a smartphone.

What You Need To Know About Late Mortgage Payments

However, due to the current situation, everyone is struggling to maintain their health and finances. In times like these, credit can save the day. However, if not planned and executed wisely, it can be dangerous.

If you’re thinking about paying off your debt and are worried about the consequences, don’t worry, we’ve got you covered.

A credit score refers to a sign of your creditworthiness, showing how well you’ve done with the loan or loans you’ve taken out so far. The interest rate is calculated based on the reports that borrowers share with credit rating agencies like CIBIL, Experian, CRIF and Equifax.

A delay of a few days in repayment will affect the loan amount. However, interest on the loan amount will be considered overdue for more than 30 days.

Default: What It Means, What Happens When You Default, Examples

You may have difficulty getting a new loan, financing requirements, and in some cases even a rental property. Also, insurance companies look at your credit score when deciding on premiums.

If you default on a secured loan, the lender will have the power to sell your loan to recover principal and interest, as well as fines and penalties. For example, a home will be sold at auction to pay off the loan, as well as damages, if you default on the mortgage.

If it is an unsecured loan, which is a personal loan, the borrower will have to pay a late fee while filing for bankruptcy. The creditor may also take criminal action if it is found that the breach was willful.

Any consequences you may face as a result of defaulting on the loan may also be followed by the co-signer and guarantor:

Reasons Smes Should Consider A Temporary Bridging Loan In 2022, Even If You Don’t Need The Money

After making a mistake, you

What happens if you don t pay payday loans, what happens if you don t pay your loan, what happens if you don t pay student loans, what happens if i don t pay my student loans, what happens if i don t pay student loans, what happens if i don t pay payday loans, what happens if you don t pay back student loans, what happens if you don t pay your student loans, what happens if you don t pay rent a center, what happens if you don t pay loans, what happens if you don t pay private student loans, what happens if you don t pay a medical bill