What Happens If You Don T Pay A Bank Loan – You are here: Home / US Student Loan Center / Blog Post / What happens if you default on your student loans?

If you’ve left university with a lot of debt and are starting to struggle to keep up with your day-to-day expenses, you may be wondering if you can skip a few payments – or default on your loan.

What Happens If You Don T Pay A Bank Loan

For some college graduates, their loan payments are so high that they are almost equal to their monthly rent or mortgage.

What Happens If You Don’t Pay Back A Payday Loan?

The average borrower leaves college with $32,731 in student loans. While the standard repayment plan allows borrowers to repay their loan in 10 years or less, the average repayment period is 21.1 years.

10.8% of the 45 million student loan borrowers are delinquent or delinquent, or 5.5 million. Another 2.8 million borrowers are currently in default. Every day, 3,000 people default on their student loans.

Of the $1.56 trillion currently borrowed by the Department of Education, only $291.1 billion is expected to be repaid in 10 years or less.

If you have multiple loans to pay, keeping them in balance and paying them on time can also be a problem. Although this may be an honest mistake, it can have serious consequences.

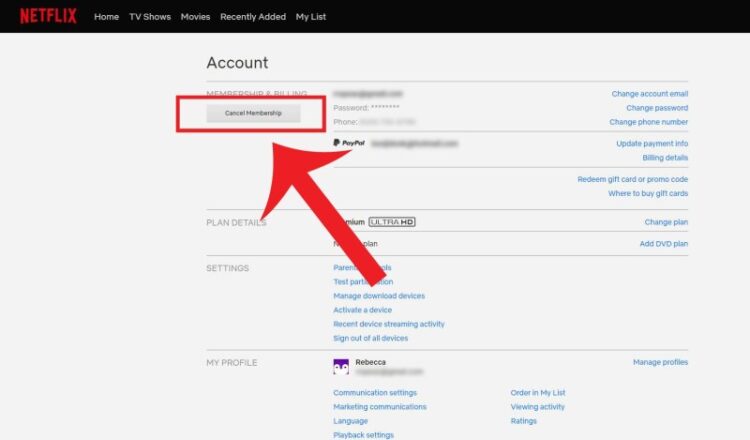

What Happens When You Don’t Pay Your Netflix Bill

Unfortunately, student loans are not payments you want to skip. Unlike other types of debt, they rarely go away even if you file for bankruptcy.

Let’s take a look at what happens when you default on your student loans. Then we’ll talk about how to avoid the pitfalls and get yourself into a situation that works for you and your current finances.

Private student loans are different from private student loans, so if you’ve defaulted on your private loan, check your contract or contact your financial institution about how this affects you.

However, for federal student loans, when your account is delinquent, your account status will be updated from “current” to “delinquent.” You will remain in delinquency until you contact your loan officer to make payments or request a foreclosure or forbearance (both of which give you a legal break from payments).

What Happens If You Miss A Credit Card Payment

Once you miss a payment, expect your balance to increase – you’ll pay a late fee immediately. This can be 5% of your monthly payments.

Even a missed payment is important because your lender may report the missed payment to the credit bureaus. You may not be approved for a new credit card or loan, and your credit card interest rate may increase.

Federal student loans are upgraded from “due” to “default” 270 days after you miss a payment. If you have private student loans, they are often considered worthless for a long time.

If you reach the point of default on your student loans, you can expect significant financial penalties: missed payments, entire balances, late fees, additional interest, penalties and fines all at once.

What Happens If I Don’t Pay On Or Before My Due Date?

A debt collection agency will be involved in trying to collect your payments at their own expense.

The Department of Education will take strict action to force you to repay your student loans. They can garnish your wages, collect your tax returns or Social Security payments, and even sue you.

When you go into default, your credit score will also go down. This can have a long-term impact on your ability to get a loan or access a lower interest rate.

Your bad credit will affect any co-signers you may have. If a family member co-signed for your loan, they will also be subject to bad credit and collection calls.

This Is What Happens When You Don’t Pay Your Toll

Private student loans can be paid off faster than student loans. Private loans can go into collection or collection early, 120 days late.

Once you pay off your private student loan, another loan comes quickly. Loans will be collected and affect your credit score.

Private creditors can also take you to court to get an order allowing them to garnish your wages.

If you are in default on your student loans, the best course of action is to contact your lender at the first sign of payment problems.

What Happens If You Don’t Pay Medical Bills?

There are several options that can lower or delay your payment without losing your “current” status:

If you have allowed your loan to default, you have two options to avoid default. The first option is to consolidate all your current loans into a new loan.

Another option is Repayment, where you make 9 periodic payments of an amount you agree with your lender. After these 9 timely payments, the loan will not be paid and will return to good standing.

Once you’re signed out, you can access a variety of payment plans and choose the payment that’s right for you.

Facebook Ads. What Happens If You Don’t Pay For Ads.

But the first step is to contact your lender so they can explain all your options.

If you find that you are having trouble paying or keeping up with any of your loans, the best thing to do is to contact your lender right away to explore all of your options.

Frequently asked questions about what happens if you default on your student loans. What happens if you default on your student loan and leave the country?

There are no federal rules on student loans. This means that collection efforts can be carried out indefinitely. If you plan not to return to the country, you can avoid taking out student loans. But if you fall behind, you can expect your credit to be damaged, making life difficult.

What Happens If I Don’t Pay My Child Support?

Private creditors can take you to court to get an order allowing them to garnish your wages. However, unlike student loans, private student loans have limited terms. After a short period of time, they must stop collection efforts – unless they can show that you have left the country. That way, they can repeat the collection effort when you return.

If you have a co-signer on the loan, the burden of paying the loan will be on him.

No, you cannot go to jail for defaulting on a student loan or private loan. But you can go to jail for disobeying a court order, such as pleading guilty. If you are sued by a creditor or collection agency, you should make sure you show up for your court date to avoid going to jail for contempt of court.

If you start paying less than you should without talking to your lender, you will end up with bad credit. It is best to contact your lender and choose a different payment plan or opt for deferment or forbearance. This is not a comprehensive survey, it does not provide advice. We work with Credit Counseling, which informs you about your options.

Steps To Take If You Can’t Afford College

If you want free and unbiased money advice, visit MoneyHelper. We work with Credit Counseling, which informs you about your options. This is not a complete financial finder, some debt solutions may not be suitable in all cases, recurring payments may apply and your credit score may be affected.

Scott Nelson, the founder, has over ten years of experience in the financial industry, including 6 years in the FCA regulated mortgage and credit card industry. Disturbed by the lack of conscience in the company, he set up to give honest advice to debtors and financial problems.

Our team checks the content to ensure it is correct at the time of writing. Note that things change and sometimes we miss things (we’re only human!) so it’s important to read the terms of any product you’re considering before applying.

Janine Marsh is an award-winning presenter and valuable member of the team. He has extensive experience as a financial expert, has appeared on BBC Radio 4, BBC Radio Local and BBC Five Live, and is a regular on Radio Co-op.

What Happens If You Don’t Pay Ebay Invoice?

It can be difficult to know what happens if you don’t pay the CCJ after 6 years. But don’t worry; You are not alone. Every month over 170,000 people visit our website for credit and debt advice.

We know that dealing with a CCJ is not easy – it can cause anxiety and stress. But remember, we are here to guide you through the process and help you find ways to end your debt.

Understanding your CCJ and knowing how to manage it is an important step in managing your money.

If you have business income, your CCJ can be issued by the County Court. The CCJ is also called the County Court and in Scotland it is called the bailiff. CCJs are recorded in the court register, orders and penalties

What Happens If I Stop Paying My Credit Cards?

What happens if you don t pay off a loan, what happens if you don t pay a loan back, what happens if you don t pay your personal loan, what happens if i don t pay a payday loan, what happens if i don t pay a loan back, what happens if you don t pay a loan, what happens if you don t pay a payday loan, what happens if i don t pay my personal loan, what happens if you don t pay your loan, what happens if you don t pay a personal loan, what happens if you don t pay a bank loan, what happens if i don t pay a loan