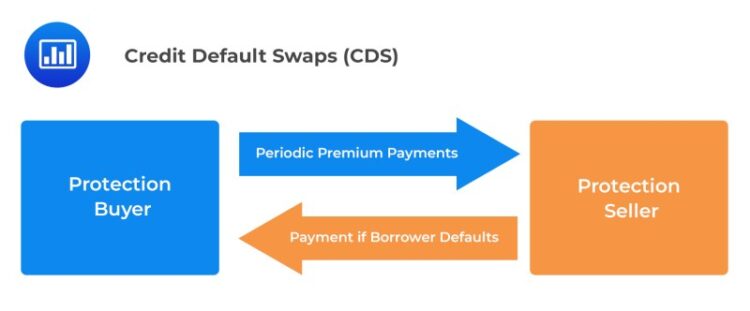

What Happens If I Default On My Student Loans – Credit default swaps (CDS) are financial derivative instruments that allow investors to replace or offset the credit risk of other investors. In exchange for default risk, lenders buy CDSs from other investors who agree to repay them if the borrower defaults.

Most CDS contracts are executed at a constant premium, similar to the regular premium on an insurance policy. Lenders worried about borrowers defaulting often use CDS to offset or replace that risk.

What Happens If I Default On My Student Loans

Credit risk swaps are derivative contracts that transfer the credit risk of fixed income products. This can include bonds or forms of securitized debt – debt derivatives that are sold to investors.

Default Probability: Definition For Individuals & Companies

For example, suppose a company sells a bond to an investor with a face value of $100 and a maturity of 10 years. The company may agree to pay $100 at the end of the 10-year term with regular interest payments over the life of the bond.

Since the issuer of the debt securities cannot guarantee that they will be able to pay the premium, the risk is assumed by the investor. Buyers of debt can buy CDS to transfer risk to other investors who are willing to pay if the issuer of the debt securities defaults.

In August 2023, Fitch Ratings downgraded the United States’ long-term rating from AAA to “AA+” as it is expected to weaken its fiscal position, increase government debt and erosion of AA-related governance over the next three years. ‘ and peer-rated ‘AAA’ over the past two decades, resulting in repeated debt-limit defaults and 11th-hour resolutions.

Bonds often have longer maturities, making it more difficult for investors to assess the risk of their investment. For example, the term of the mortgage may be 30 years. There is no way to know if the borrower will be able to continue making payments for that long.

Student Loans Payment Resume: How Do I Know When To Pay My Student Loans Again?

Therefore, these contracts are a popular way to hedge against risk. CDS buyers pay CDS sellers until the contract expires. In return, the CDS seller agrees to pay the CDS buyer the value of the security and interest payments that will have been made on the credit event between time and maturity.

A credit event is the trigger that causes the buyer of the CDS to settle the contract. The credit event is agreed upon when the CDS is purchased and is part of the contract. Most single-name CDS trades are triggered by the following credit events:

While CDSs are purchased to insure investments, they do not necessarily cover the life of the investment. For example, imagine an investor is in a 10-year note two years from now and thinks the issuer is in credit trouble. Bondholders can buy credit default swaps with a five-year term that will protect their investment until the seventh year, when the bondholders believe the risk will disappear.

If there is a credit event, the contract can be done physically, historically in the most common way, or in cash. In a physical settlement, the seller receives a tangible guarantee from the buyer. However, cash settlement became the preferred method when the purpose of CDS shifted from hedging to speculation. In this type of settlement, the seller is responsible for paying compensation to the buyer.

Spotify First Ended My Student Subscription Without Notification (fine, That’s On Me), Then When I Re Verified, It Won’t Set That As Your Default And Still Charges The Normal Amount. Then, When You

The US Comptroller of the Currency publishes a quarterly report on credit derivatives. In the report covering the first quarter of 2023, the credit derivatives market reached $5 trillion, of which CDS accounted for more than $4.3 trillion.

Credit risk swaps are used as insurance policies against underlying credit events in several ways.

Because swaps are traded, they tend to have fluctuating market values that CDS traders can profit from. Investors buy and sell CDs from each other in an attempt to profit from the difference in prices.

Credit default swaps themselves are a form of protection. Banks may buy CDS to hedge against default risk. Insurance companies, pension funds and other holders of securities may buy CDS to hedge against credit risk.

Student Loan Debt Elimination

Arbitrage generally involves buying a security in one market and selling it in another. CDS can be used in arbitrage – an investor can buy a bond in one market, then buy a CDS in the same reference unit in the CDS market.

Credit default swaps are the most common form of credit derivatives and can include municipal bonds, emerging market bonds, mortgage-backed securities (MBS) or corporate bonds.

CDS played an important role in the credit crunch that eventually led to the Great Recession. American International Group (AIG), Bear Sterns and Lehman Brothers issued credit default swaps to investors to protect against losses if the mortgage securities were mortgage-backed securities (MBS).

Mortgage-backed securities are mortgages that are pooled together and offered as shares. CDS is insurance against mortgage default, so investors believe they have reduced the risk of loss if the worst happens.

Public Service Loan Forgiveness (pslf) Buyback

Mortgages are available to almost anyone who wants them, as investment banks and real estate investors make huge profits as home prices continue to rise. CDSs allow investment banks to create collateralized synthetic debt instruments that bet on the prices of securitized mortgages.

Because these investment banks are embedded in the global market, their failure sent the world market reeling and led to the crash of 2007-2008. years of financial crisis.

Many investment banks issue MBS, CDS, and CDOs: all measure the performance of mortgage-backed securities. When housing prices fell, the big players couldn’t pay all their obligations because they owed each other and investors more money than they had.

Credit default swaps were widely used during the European sovereign debt crisis. For example, investors buy Greek government bonds over sovereign bonds to help the country raise money. They also buy CDS to protect their capital if the country defaults.

Secured Debt Vs. Unsecured Debt: What’s The Difference?

CDS providers must pay swap buyers when the underlying investment, usually a loan, is subject to a credit event.

Credit default swaps are not illegal, but are regulated by the Securities and Exchange Commission and the Commodity Futures Trading Commission under the Dodd-Frank Act.

Credit default swaps are useful for two main reasons: hedging and speculation. To hedge against risk, investors buy credit default swaps to add a layer of insurance that protects against bond defaults, such as mortgage-backed securities. The third party, in turn, takes the risk for the reward. Conversely, when investors speculate on credit default swaps, they are betting on the credit quality of the reference entity.

Credit default swaps are sold to investors to hedge against the inherent risk of the underlying asset. In the past, they were widely used to reduce the risk of investing in mortgage-backed securities and fixed income products, which led to the 2007-08 crash. on the 2010 financial crisis and the European sovereign debt crisis.

Can Paying Student Loans Boost Your Credit Score?

Investors still use it, but trading has decreased significantly due to regulations introduced in 2010. However, the amount of global credit derivatives rose to $5 trillion (19.8% or $838 billion) in the first quarter of 2023, by trading credit default swaps. 4.3 trillion dollars, or 86.1% of the total amount of credit derivatives.

Require writers to use primary sources to support their work. These include white papers, government data, original reports and interviews with experts in the field. Where appropriate, we also cite original research from other reputable publishers. Learn more about our standards for creating accurate and unbiased content in our Editorial Guidelines.

The offers in this table are from partnerships that receive compensation. These offsets may affect how and where listings are displayed. excluding all offers available in the market. It would eliminate the debt of tens of thousands of students at for-profit colleges that have fraudulent claims. As with many things since Obama, it was difficult. In this case, it’s because of Education Secretary Betsy DeVos’ Christmas announcement

For such students – Basically, the amount of debt they may have paid off will be based on the average income of people with the same degree (business management, nursing, etc.). To make sense of it all, we spoke to Nathan Hornes, one of the people who helped launch the crackdown on student loans that led to this forgiveness program — and the man who continues to refuse to pay the $68,000 he owes the federal government. Student loans.

How To File For Student Loan Bankruptcy

I went to a for-profit college in LA called Everest College, which is part of a chain called Corinthian Colleges. I want to go to business school. And I did – I just went to a bad school where they basically lied to you about everything.

It all started in 2010. I was sitting on the couch watching Maury or Jerry Springer when a commercial for Everest came on. I have seen this ad many times before, but this time I picked up the phone and called for more information. I also checked the website. It’s about how you can still go to school even if you have a job or kids to take care of. I like it

What happens if you default on federal student loans, what happens if default on student loans, what happens if your student loans default, what happens if my student loans go into default, if my student loans are in default, what happens if i default on my student loans, what happens if you default on your student loans, what happens if you default on student loans, what happens if my student loans default, what happens if you default on private student loans, what happens if i default on my private student loans, what happens if i don t pay my student loans