Today's Interest Rates 30 Year Fixed Refinance – For mortgages in general and their legal structure, see the Law on Mortgages. For mortgage loans secured on ships, see Ship mortgages. For other uses, see Mortgage (disambiguation).

This article needs additional sources for verification. Help improve this article by adding links to reliable sources. Unauthorized materials may be tested and removed. Find source: “Mortgage” – news · newspaper · book · scholar · JSTOR (April 2020) (Find out how and who removed this message template)

Today's Interest Rates 30 Year Fixed Refinance

A mortgage loan or simply a mortgage (/ˈmɔːrɡɪdʒ /), also known in civil law as a mortgage loan, is a loan used by buyers of real estate to finance the purchase of real estate. , or used from an existing property. Landlords raise money for any purpose while placing a lien on the property they own. The loan is “secured” against the borrower’s property through a process known as mortgage origination. This means that a legal mechanism is in place that allows the principal to seize (“seize” or “repo”) and sell collateral to pay off the debt in the event that the borrower defaults or otherwise becomes bankrupt. on your terms. The word mortgage comes from a French legal term used in medieval England, meaning “promise to mortgage” and refers to a promise of ding (death) being enforced or property being guaranteed.

Fintech Stocks Have Tumbled. What Next?

KPR can also be described as “an interest paying (loan) creditor in the form of a guarantee”.

A mortgage lender can be an individual who owns their own home, or it can be a business that owns commercial property (for example, their place of business, a leased residential property or an investment portfolio). The lender will usually be a financial institution, such as a bank, credit union or building society, depending on the country in question, and loan agreements can be made directly or indirectly through an intermediary. The characteristics of a mortgage loan such as the size of the loan, the maturity of the loan, the interest rate, the method of repayment of the loan and other characteristics can be very different. Senior liens on the secured property have priority over the borrower’s other creditors, meaning that if the borrower goes bankrupt or insolvent, the other creditors will recover the debt owed to them from the sale of the secured property only if the senior debtor. full refund first.

In many jurisdictions, it is common to finance the purchase of a home with a mortgage loan. Some people have savings or liquid assets so they can buy a house right away. Countries with the highest demand for home ownership have developed strong domestic mortgage markets. Mortgages can be financed by the banking sector (ie with short-term deposits) or through the capital market through a process called “securitization”, which turns pools of mortgages into convertible bonds that can be issued to investors in smaller shares. sold to

Mortgage loan. Total payments (3 fixed interest rates and 2 loan periods) = Loan base + fees (taxes and fees) + total interest paid.

What Is Stagflation, What Causes It, And Why Is It Bad?

The final cost will be exactly the same: * 2.5% interest rate and 30-year term than 5% interest rate and 15-year term * 5% interest rate and 30-year term. years from when the interest rate is 10% and the term is 15 years

In Anglo-American property law, a mortgage occurs when the owner (usually in fee) gives his interest (right to the property) as security or collateral for a loan. Therefore, a mortgage is simply an encumbrance (restriction) on the property, but since most mortgages are placed as a condition for the payment of a new loan, the word CPR has become the key term for loans secured in this way. . real estate Like other types of loans, mortgages have an interest rate and are scheduled to be amortized over a period of time, usually 30 years. All types of real estate can be, and usually are, secured by mortgages and carry interest rates that are considered to reflect maturity risk.

Mortgage loans are the primary mechanism used in many countries to finance private ownership of residential and commercial property (see commercial mortgages). Although the exact terminology and form will vary from country to country, the basic components are the same:

Many special features are common to many markets, but above are the main features. Governments often regulate many aspects of mortgage payments, either directly (through legal requirements, for example) or indirectly (through stakeholder or financial market regulation, such as the banking industry), and often through state mediation (direct government regulation). . , directly from the state bank or sponsored by various institutions). Other aspects that determine a particular mortgage market may be regional, historical, or determined by the particular characteristics of the legal or financial system.

Va Loan Rates Today

Mortgage loans are typically structured as long-term loans, with periodic payments similar to annuities and calculated based on the time value of money formula. The most basic arrangement would require fixed monthly payments for thirty years, depending on local conditions. During this period, the principal part of the loan (the original loan) will be gradually paid off through amortization. In practice, many variations are possible and common around the world and in each country.

Lenders secure funds against property to earn interest income, and usually lend these funds themselves (for example, by taking deposits or issuing bonds). So the price that large borrowers borrow money affects the price of the loan. Lenders can also, in many countries, sell mortgage loans to other parties interested in receiving cash flow from borrowers, often in the form of collateral (through securities).

KPR Ldinga will also take into account the (perceived) risk of the mortgage loan, which is the possibility that the funds will be returned (usually considered as a function of the borrower’s creditworthiness); that if they do not return, the elders will be able to take out the wrong property; and financial risk, interest rate and time lag that may occur in some cases.

During the mortgage loan approval process, the mortgage lender verifies the financial information provided by the applicant regarding income, employment, credit history and the value of the home being purchased.

Nominal Interest Rate: Formula, What It Is Vs. Real Interest Rate

An evaluation can be ordered. The referral process can take anywhere from a few days to a few weeks. Sometimes the download process takes a long time until the provided financial statements need to be sent back to be shortened.

It is recommended that you continue with the same business and do not use a new loan during the underwriting process. Any changes made to an applicant’s credit, employment or financial information may result in loan default.

Many types of mortgages are used around the world, but several factors broadly determine the characteristics of mortgages. All of this may be subject to local regulations and legal requirements.

The two basic types of amortized mortgages are fixed-rate mortgages (FRMs) and adjustable-rate mortgages (ARMs) (also known as adjustable-rate or variable-rate mortgages). In some countries, such as the United States, fixed-rate mortgages are the norm, but variable-rate mortgages are relatively common. Combinations of fixed and floating rate mortgages are also common, where the mortgage loan will have a fixed rate for a specified period, for example the first five years, and will change after d of that period.

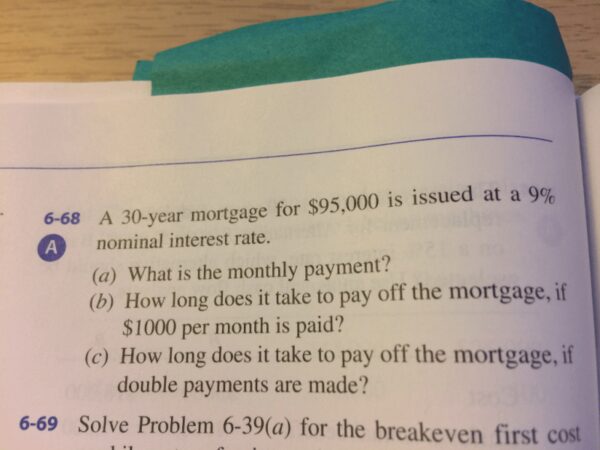

Info To Solve Question The Effective Interest Rate Is

Borrower compensation depends on credit risk in addition to interest rate risk. The mortgage origination and underwriting process includes checking credit scores, debt-to-income, payments, assets and home appraisals. Jumbo mortgages and subprime loans are not backed by government guarantees and face high interest rates. Other updates described below may also affect pricing.

When taking out a mortgage to buy a house, seniors usually require the borrower to make a down payment; that is, he contributed part of the costs of the property. This down payment can be expressed as a fraction of the value of the property (see below for a definition of this term). The loan-to-value ratio (or LTV) is a measure of the loan relative to the home’s value. Therefore, a mortgage loan where the tenant has paid 20% has a loan-to-value ratio of 80%. For loans made on property that the borrower already owns, the loan-to-value ratio will be calculated against the appraised value of the property.

The loan-to-value ratio is considered an important indicator of mortgage loan risk: the higher the LTV, the greater the risk that the value of the property (in the event of foreclosure) will not be sufficient to cover the remaining principal. on the loan. .

Because of the value

What Is Expectations Theory? Predicting Short Term Interest Rates

Today's interest rates 30 year fixed refinance, 30 year fixed jumbo refinance rates, va refinance rates 30 year fixed, refinance interest rates 30 year fixed, refinance interest rates today 30 year fixed, refinance rates 30 year fixed, mortgage interest rates refinance 30 year fixed, current va refinance rates 30 year fixed, cash out refinance rates 30 year fixed, current interest rates refinance 30 year fixed, best refinance rates 30 year fixed, mortgage interest rates today 30 year fixed refinance