Taking Out Personal Loan To Pay Off Credit Cards – Due to a minor update, online banking will be unavailable from 1:00 AM to 7:00 AM ET on Sunday, December 17th. We apologize for any inconvenience.

Are you considering taking out a personal loan to pay off your credit card? Consolidating your card balances into one loan is an effective way to manage potentially out-of-control debt, but it takes patience and discipline to make it work. Let’s take a look at personal loans and whether they are right for you.

Taking Out Personal Loan To Pay Off Credit Cards

Are you dealing with mounting balances on multiple credit cards and perhaps having trouble meeting payment deadlines or minimum balances? If your credit card debt is becoming a problem, it’s time to find more sustainable ways to pay off what you have and manage your spending.

Credit Card: What It Is, How It Works, And How To Get One

A personal loan is a popular and efficient way to pay off your credit cards in full, replacing them with more manageable and predictable monthly payments. At the same time, you work hard to control your expenses. How does it all work?

Personal loans are issued by credit unions, banks and online lenders to finance a variety of personal expenses, from the inevitable purchase to your dream wedding. They are also a popular choice for credit card debt consolidation because of fixed monthly payments that range from two to seven years and interest rates that are much lower than most credit cards.

The fixed annual percentage rate (APR) you pay on your loan will depend on your income, credit score and current debt level. Typically, your lender will allow you to lower your monthly payments by paying off the loan over a longer term or at a higher annual interest rate.

Taking out a personal loan can provide you with a one-time payment that you can use to pay off your credit cards, thereby shifting balances on multiple cards, each with their own interest rates and lower rates. There will be fewer return rules, with one pass. . Expected monthly payments.

Calculate Credit Card Payments And Costs: Examples

A personal loan allows you to cover your expenses within your means, allowing you to plan for the future while paying off your loan at a reasonable interest rate. However, this only works if you stop spending on your credit card. If you continue to accumulate a high interest balance, your loan will become another debt that you will have trouble paying off.

Consolidating high interest debt into a personal loan from one or more credit cards has a few distinct advantages.

With a fixed rate, you pay the same amount in one bill each month, even if prices go up.

While the APR you’ll pay will depend on your overall credit score, it will likely be lower than the interest rate you’d charge on a credit card.

Adulting 101: Interest Rates, Fees And Credit Reports — What To Look Out For When Taking A Personal Loan From A Bank

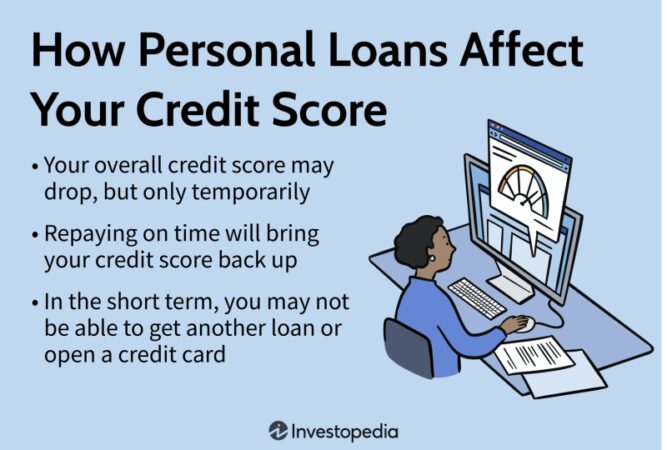

A personal loan can also improve your credit score by eliminating payments and slowly improving your debt-to-income ratio.

Applying for personal loans is relatively easy. Best of all, most personal loans don’t require you to provide collateral in the form of cash or assets like a house, car or boat.

At the same time, taking out a personal loan can affect many aspects of your financial life. It is important to consider some potential pitfalls.

A lower APR is never guaranteed. Depending on your credit score, loan and loan term, you may pay more each month to pay off the loan.

Should You Get A Personal Loan To Pay Off Credit Card Debt?

In addition to interest, personal loans come with fees such as loan repayment fees, late fees and sometimes even early loan repayment penalties.

When you cancel or stop using your card, you’ll also lose many potential rewards, including cash back, redeemable points, loyalty bonuses and benefits like access to health clubs or business class travel.

Unlike interest on some other types of debt, such as home mortgages or some student loans, interest on your personal loan is taxable.

A personal loan is not suitable for everyone. They require a long-term commitment on your part and significant changes in your budget and spending habits. A loan may not be a good option for you if:

Free Personal Loan Agreement Template

If loans aren’t right for you, there are several alternatives to better managing your credit card debt:

On the other hand, if you want to get your credit card debt under control before it becomes a big problem, and you’re willing to make some sacrifices for it, a personal loan makes sense. In this case, consolidating your credit card debt and being more disciplined about your budget and how you spend your money are great ways to set yourself up for long-term success.

Talking to a reputable local lender like Atlantic Financial Union Credit Union is an important first step in your journey. We are ready to work with you to give you the tools you need to take control of your financial future.

Click below to learn more about how our personal loans can help you on your path to success.

How One Woman Paid Off $68,000 In Student Loans In 2 Years

The link you are clicking on has been provided as a thank you. You will leave the Atlantic Financial FCU website. We do not endorse or control the content of the website you visit. “Expert Verification” means that our Financial Review Committee has reviewed the article for complete accuracy and clarity. The review board is made up of a panel of financial experts whose aim is to ensure that our content is always objective and balanced.

Nicole Dicker By Nicole DickerArrow Personal Finance Get It Right Contributor Nicole Dicker has been a full-time freelance writer since 2012 and a personal finance enthusiast since 2004, when she graduated college and was looking for financial guidance. Your money or your life to get a public library copy. In addition to writing for, his work has appeared on CreditCards.com, Vox, Lifehacker, Popular Science, The Penny Hoarder, The Simple Dollar, and NBC News. Dick spent five years as a writer and editor for Bullfold, a personal finance blog where people can talk honestly about money. Dick also teaches writing, freelancing and publishing courses and works with writers as a development editor and editor. Connect with Nicole Dicker on Twitter Connect with Nicole Dicker on LinkedIn Linkedin Nicole Dicker

By Liliana Hall Editor Liliana Hall Editor Arrow Right Associate Editor Liliana is an editor and reporter with feature writing experience for the Credit Cards team. Connect with Liliana Hall on LinkedIn Linkedin Liliana Hall

Reviewer: Poonkulali Thangavelu Reviewer: Poonkulali ThangaveluArrow Law Senior Writer, Credit Cards Poonkulali Thangavelu is a senior writer and columnist at CreditCards.com, where he covers legal and regulatory issues related to credit and credit cards. Connect with Poonkulali Thangavelu on Twitter Connect with Poonkulali Thangavelu on LinkedIn Connect with Poonkulali Thangavelu on Linkedin Connect with Poonkulali Thangavelu on Email Poonkulali Thangavelu About Our Moderation Board Poonkulali Thangavelu

Should You Use A Personal Loan To Pay Off Credit Card?

. The content of this page is correct as of the date of publication; However, some of the mentioned offers have expired. Terms apply to the offers on this page. Any opinions, analyses, comments or recommendations expressed herein are solely those of the author and have not been reviewed, endorsed or otherwise endorsed by any card issuer.

At, we’re on a mission to demystify the credit card industry—no matter where you’re traveling—and make it one you can navigate with confidence. Our team is made up of many experts, from credit card specialists to data analysts and, most importantly, people like you who make credit card purchases. With a combination of expertise and perspective, we closely monitor the credit card industry throughout the year:

At, we focus on what consumers care about the most: rewards, offers and welcome bonuses, APR and the overall customer experience. Each publisher discussed on our site is evaluated based on the value they provide to users at all levels. We check every step of the way, making accuracy a priority so we can continue to serve you.

We follow a strict institutional policy so you can trust us to put your interests first. Our award-winning editors and reporters create honest, accurate content to help you make the right financial decisions.

What Is Revolving Credit? What It Is, How It Works, And Examples

We appreciate your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards to ensure this. Our editors and reporters thoroughly fact-check editorial content to ensure that the information you read is accurate. We maintain a firewall between our advertisers and editorial teams. Our editorial team does not receive direct compensation from advertisers.

The editorial team writes articles on behalf of you, the reader. Our goal is to provide you with the best advice to help you make informed personal financial decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team does not receive direct compensation from advertisers and our content is thoroughly checked for factual accuracy. So are you reading an article or

Taking out loan to pay off debt, is it a good idea to take out a personal loan to pay off credit cards, best personal loan to pay off credit cards, personal loan to pay off credit cards, getting a personal loan to pay off credit cards, personal loan to pay off credit debt, taking a personal loan to pay off credit cards, pay credit cards off with personal loan, taking out a personal loan to pay off credit cards, taking out personal loan, taking personal loan to pay off credit cards, taking personal loan to pay credit cards