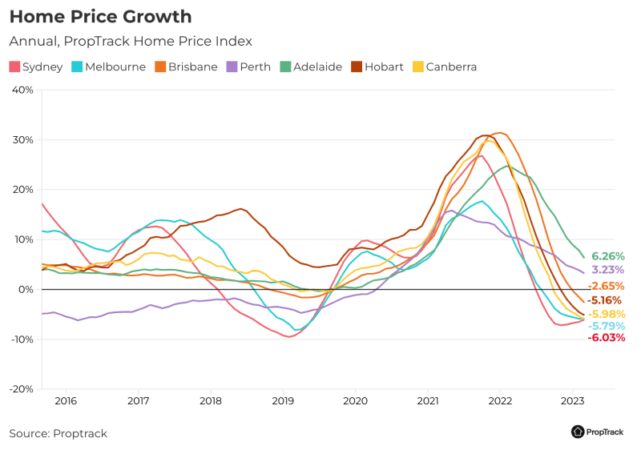

Sydney’s Mortgage Loan Interest Rate Trends: Impact On Profit – After a peak decline of just 4%, national house prices are rising again, with Sydney rebounding.

The housing market started the year strongly and after nine straight months of declines house prices rose for the third time this year in March.

Sydney’s Mortgage Loan Interest Rate Trends: Impact On Profit

Market conditions remain firm and although auction volumes are down, clearance rates are at their highest level of the year.

Overview Of Insurtech & Its Impact On The Insurance Industry

However, they remain elevated compared to the middle of the year, when rapidly rising interest rates have created a mismatch between buyers and sellers’ expectations.

Rising mortgage rates, inflation and economic uncertainty have dampened homebuyer demand, causing sales volumes to decline from the highs seen in 2021 and early 2022.

Domestic sales volumes were down 24% in the first 12 weeks of 2023, compared to the same period in 2022.

However, they are close to the levels observed during the same period in 2020 and are higher than the volumes of the first 12 weeks of 2019. This suggests that although the overall activity is down, that is to stabilize.

Westpac, Nab, Commonwealth, Anz: Banks Pass On Interest Rate Rise

While interest rates have been the main driver of falling asset prices, there are other factors in the market.

The amount of property sales, immigration rates, new housing construction, rental contract markets, and interstate and regional migration all influence housing quantity growth trends, as well as how they are spread across the country.

Currently, the slow flow of new listings and limited inventory on the market, combined with the tightening of the rental market and the strong impact on immigration, is putting downward pressure on rising interest rates.

Fewer properties came on the market at the same time last year, creating a more competitive buying environment and supporting home values.

Reserve Bank Holds Interest Rates At Record Low, Sticks To 2024 Forecast For First Rate Rises

The level of consumer demand supports that prices are resistant to declines implied by changes in the ability to borrow.

Sydney is leading the house price recovery so far, recording the biggest rise in value of any capital city in the last quarter, according to the latest PropTrac house price index.

Sydney house values increased by 1.01% in the March quarter, the fastest pace seen since the December 2021 quarter.

Sydney also led the slowdown and saw a major correction, with house prices falling 7.19% from the highest recorded in December 2022, another factor fueling buyer interest.

Reserve Bank Hikes Interest Rates To 3.85 Per Cent

Prices in Sydney are 6.25% below the peak, but the fall has somewhat dampened the pandemic boom, with house prices still 22.8% higher than pre-pandemic levels.

And while house prices have fallen from their peaks in most markets, they are significantly higher than pre-pandemic levels in every capital and regional region across Australia.

In the analysis of smaller geographies, the regions that caused the slowdown are the ones leading to an emerging recovery.

EXERCISE data per cent, although the lower end of the market is doing better in the economic downturn, the higher end is driving the recovery.

Australian Property Prices Are Falling But Housing Is Still Expensive

After falling sharply during the recession, prices in expensive areas of Sydney and Melbourne have rebounded heavily.

Previous cycles have seen a similar pattern, in which market peaks lead to both declines and subsequent recoveries.

A marked reduction in borrowing capacity and a reduction in affordability suggest a larger price fall than seen so far, with substantial price tightening pressure already imposed by large drivers offset.

A strong crackdown on immigration and contract rental markets, combined with limited stock in the market, are supporting property prices.

Trends To Watch In Real Assets

Now that the RBA has stopped its policy tightening, the process is expected to remain low, with house prices stabilizing further as uncertainty among buyers eases.

Get Your Real Estimate™ Track your property value and get views and data tailored to homeowners. Find your email now

With rate hikes in sight, buyers and sellers can better adapt to the high-interest environment and move forward with their real estate plans. If inflationary pressures are more persistent than expected, the situation will change.

Inventory levels will influence housing prices in the coming months. If the listing environment remains tight, fewer properties will come on the market, which could put the board under prices.

Rba Interest Rates: Australian Mortgage Holders World’s Most Abused

For this reason, the key test will be how the so-called “fixed rate” mortgage cliff holds up in the coming months and if it will find a drop in value in the second wind.

And in this tight cycle, many borrowers who used fixed-rate mortgages during Covid are still feeling the full impact of rate hikes.

I take a closer look at the CBA’s portfolio of loan benchmarks in the market, with more than one in four home loans cut off. He said one of two outstanding guaranteed home loans will expire at some point this year.

Many of these borrowers face increasingly steep mortgage payments as certain conditions expire in the coming months.

How Much Higher Will Interest Rates Go? Here Are Three Predictions

The RBA’s securitization dataset suggests that around 35% of outstanding mortgage debt is securitised. About 70% of this debt is expected to be converted into various loans this year. These families are moving in the face of a sharp increase in service costs such as significantly higher tariffs.

These increases are partly due to significant savings over the past few years. And for those who can refinance with another lender, the current level of competition — with less fair terms and many lenders offering discounts — also offers some respite.

In addition to financial support, the strong increase in home prices during the pandemic means many families have significant support for the equity in their homes.

Banks work with their customers to reduce this hangover or cliff, as some call it.

What Is The Fixed Rate Mortgage Cliff And How Bad Will It Be?

However, this will undoubtedly be a difficult period, as substantial economic adjustments will be required against the cost of living pressures experienced elsewhere.

For the most part, homeowners prefer to pay off their mortgages and pay off their home foreclosure, avoiding mortgage default or a significant number of distressed sales.

Accordingly, consumer spending is expected to accelerate sharply in the coming months as the impact of rising interest rates is already taking hold. Journalists at The Australian Monitor base their editorial research and opinions on objective, independent news gathering. .

When we cover investment and personal finance stories, our goal is to inform readers before recommending specific financial products or asset classes. While it is possible to highlight some positive aspects of a particular financial product or asset class, there is no guarantee that the reader will benefit from the product or investment method and indeed suffer losses if it does. They get a product or a method.

Will Australia Go Into A Recession?

To the extent that any recommendations, opinions or statements made in the article constitute financial advice, they constitute general information and are not personal advice in any form. Accordingly, no recommendations or statements should be made regarding financial matters, investment objectives, tax consequences or any particular requirements of the reader.

Readers of our articles should not act on any recommendation without taking appropriate steps to understand the information contained in the articles, consulting their independent financial advisors, in order to consider whether the recommendation (if) is appropriate, taking into account the objectives and investment of funds. position and job. Present access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product or to engage in or engage in any business from the Australian Monitor. With different financial products and services available, we cannot compare all providers in the market. Therefore, our ranking is not a comprehensive review of any sector. Although we make great efforts to ensure that our organizational criteria are relevant to consumer concerns, we cannot guarantee that everything that may be considered relevant to the economy is covered. We make every effort to provide accurate and up-to-date information. However, Australian Currency does not guarantee the accuracy, completeness or timeliness of this website. Australian Currency accepts no obligation to indemnify any person for inaccuracies, omissions or changes in the information contained in our stories or to make any information or information available to any person.

Editor’s Note: Australian currency income can be earned from this story revealed here. Read our rant here.

The housing market is changing. Everyone knows that prices fall as interest rates rise, but the composition of the market shocks and changes, if you own a property – or want it – it’s important to understand how the parts relate to each other.

Sydney Property: Why Banks Want Higher Interest Rates (and It’s Not What You Think)

A forensic analysis of the real estate market allows us to understand how it works and provides us with better information about what happens in the last quarter of 2022 – the time of the spring sale – and in 2023, when interest rates are expected to reach their final peak.

The prices are interesting.

Low interest rate mortgage loan, mortgage loan interest rate today, mortgage interest rate trends, home loan mortgage interest rate, bank mortgage loan interest rate, reverse mortgage loan interest rate, mortgage loan interest rate, mortgage loan rate of interest, hdfc mortgage loan interest rate, interest rate on mortgage loan, mortgage loan interest rate calculator, mortgage loan interest rate trends