Student Loans In Default What To Do – Late payments and non-payments are loan agreements that represent different levels of the same problem: missed payments. The loan expires if you pay late (even by one day) or miss the regular installments or payments.

Credit defaults – due to late payments – when the borrower fails to increase current credit obligations or does not repay the loan as agreed (e.g. insufficient payments). Payday loans are ideal for changing the nature of your credit relationship with lenders and other potential lenders.

Student Loans In Default What To Do

Late payments are used to describe situations in which borrowers miss a certain amount of time to make a single payment on a loan, such as a student loan, home loan, credit card, or car loan. Except unsecured loans. There are risks of delays, depending on the type of loan, the term and the reason for the delay.

Strategic Default For Student Loans: Why It’s A Bad Idea

For example, let’s say a recent graduate doesn’t pay off his student loan in two days. Their loans remain in default until they pay off or defer their loans.

On the other hand, the loan is reduced if the borrower refuses to repay his loan as stipulated in his agreement. Usually it involves losing a lot of money over time. There is a period of time between the lender and the federal government before the loan is officially disbursed. For example, most federal loans are not considered in default until the borrower has not made a payment on the loan for 270 days, as required by law.

Lateness affects the borrower’s credit score, but default negatively affects both the consumer’s credit score and the consumer’s credit rating, making it difficult to borrow money in the future.

In most cases, late payment can only be resolved by paying the past due amount, plus any fees or charges incurred as a result of the non-payment. Afterwards, regular payments can take effect immediately. Instead, defaults usually cause the balance of your loan to mature after the normal payment specified in the original loan agreement. Repairing and renewing credit agreements is often difficult.

Federal Loans Vs. Private Loans

Delays have a significant impact on a borrower’s credit score, but failure to report them can also have a negative effect on the customer’s credit rating, making it difficult to borrow money in the future. They may have difficulty obtaining a loan, purchasing homeowners insurance and finding a rental property. For these reasons, it is best to take steps to recover the damaged account before it reaches a normal status.

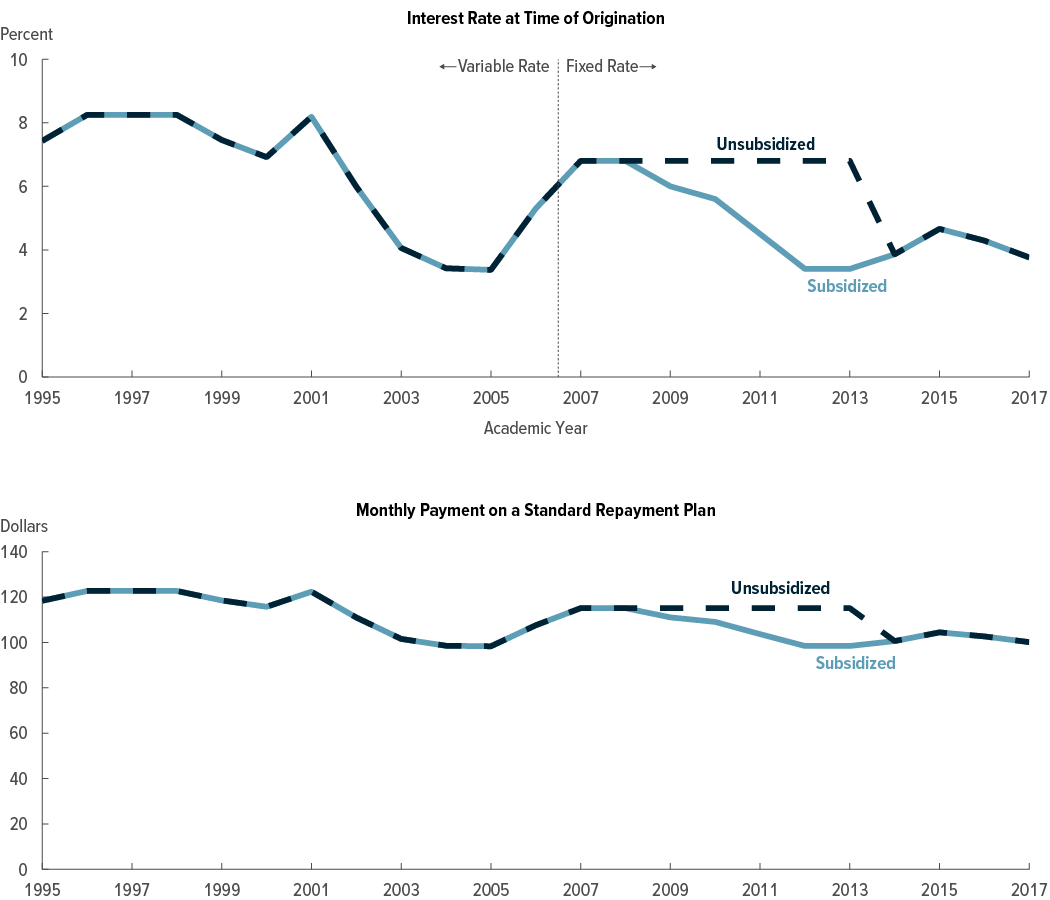

The difference between default and late payment is no different for student loans than it is for other types of loan agreements. However, the options and consequences of defaulting on student loans can be unique. The rules and specifics for late and default payments depend on the type of student loan you have (non-private and public, subsidized and unsubsidized, etc.).

Almost all students with debt have a student loan. If you can’t pay off a loan, the federal student body stops providing aid and starts collecting the money. Student loan delinquencies can lead to calls and loan repayment assistance from lenders. Consequences of student loan forgiveness can include a refund of your taxes, your wages, and the loss of eligibility for other financial aid.

There are two main strategies available to student borrowers to help avoid delays and delinquencies: patience and procrastination. Both options offer the option to defer payment for a certain period. However, delaying is always better because depending on the type of loan, the federal government may pay interest on your student loans until the transfer deadline. With a forbearance, your account will continue to be charged interest even though you don’t have to pay it until after the forbearance expires.

Mitigating The Growing Impact Of Student Loan Debt

Unfortunately, if you don’t pay your bills on time, your credit score will be affected. Bad information, such as late payments, can remain on your credit report for up to seven years.

The best way to find out if you are making mistakes on your credit report is to check it at least annually, if not more often. Late payments or other negative information are found when you review your credit history using your report. You are required by law to make one copy of your credit report every 12 months from the three major credit reporting companies: Equifax, TransUnion and Experian. You can also purchase a credit report at any time.

Delinquent payments are removed from your credit report seven years after the first day of default. If you find false information on your credit report, you can contact your creditor to deny the claim or negotiate to have the claim removed from your credit report.

As mentioned above, late payments can remain on your credit history, affecting your credit score for up to seven years. However, you can combat the effects of late payments by improving your credit in other ways, such as keeping your credit card balance low, paying your debts on time and using your credit card wisely. It can improve your credit score even if you have a deficit. Additionally, the number of payment days (for example, 30, 60, or 90) is a factor when comparing credit scores.

How To Handle Federal Student Loan Default

If you pay your taxes late, you risk fines from the Internal Revenue Service (IRS). According to the IRS website, until May 2023, the late payment penalty is 0.5% of the tax due after the due date for each month or half of the month the tax is not paid, up to 25%.

Delays and delinquencies indicate debt-related problems due to missed payments or late payments. Late payments on your loan can cause you to become unable to pay your debts, whether it’s rent, mortgage, student loans, or credit card debt. Delays can result in higher fees and interest charges, as well as impact your overall credit score.

Not borrowing money will change your relationship with your lender and could make it more difficult to borrow money in the future. Suppose you notice that you are behind on your loan payments. In that case, it is important that you contact your lender to reach a resolution before you ultimately default on your loan and have a negative impact on your credit and credit prospects.

Ask authors to use primary sources to support their work. Includes white papers, government news, original reports and interviews with industry experts. If necessary, we also provide original research to other renowned publishers. Learn more about our standards for delivering accurate content in our messaging policy. How can people get rid of their student debt and when is forgiveness an option? Statistics show how much student debt there is in the United States, and these numbers could be a warning sign for individual borrowers. Fortunately, students can take advantage of the government’s income tax and forgiveness programs to alleviate their debt.

The Current Student Loan Landscape And Recent Developments

Only Direct Loans from the federal government and Stafford Loans, which were replaced by Direct Loans in 2010, are eligible for the forgiveness program.

If you have other types of federal loans, you can apply for a single direct loan, which can give you access to additional cash as a result of your repayments. Non-profit and private loans and credit unions are not eligible.

Until 2020, student loan borrowers who attended for-profit colleges seeking loan forgiveness because their school had defrauded them or violated certain laws were resolved when President Donald Trump canceled a bipartisan solution that would have repealed new rules that made it difficult to get credit. The new, extensive regulations came into effect on July 1, 2020.

In August 2022, the Biden administration, along with the U.S. Department of Education, approved $32 billion in student loans for more than 1.6 million borrowers, a program launched in October. However, in November 2022, a federal court ruled against the student loan relief program. On June 30, 2023, the Supreme Court ruled that the Biden administration did not have the authority to pay off nearly $20,000 in public student loans.

Student Loan Default Rates On The Rise

For federal student loans, the typical repayment period is 10 years. If the 10-year repayment period makes your monthly payments impossible, you can enter into a repayment plan (IDR).

With a repayment plan, the payments are extended for 20 or 25 years. After that time, assume that you have paid off the loan and that the remaining balance on the loan has been written off. Historically, payments are based on household income and size, and are typically capped at 10%, 15%, or 20% of your preferred income, depending on the plan.

Here are four IDR programs offered by the U.S. Department of Education, plus periodic and monthly payments:

IDR

The Ins And Outs Of Student Loans

How do i get my student loans out of default, if my student loans are in default, what to do if student loans are in default, what to do if your student loans are in default, what happens if you default on federal student loans, default in student loans, student loans out of default, what happens if you default on student loans, what to do when your student loans are in default, what happens if i default on my student loans, my student loans are in default, what to do when student loans are in default