Steps To Get Prequalified For A Home Loan – First-time buyers find the mortgage approval process confusing. We know, because we get their questions by email all the time! So we created this guide to walk you through the different steps of the typical mortgage approval process.

Note: The lending process may vary from one borrower to another due to various factors. So your experience may differ slightly from what is shown below. These are six steps

Steps To Get Prequalified For A Home Loan

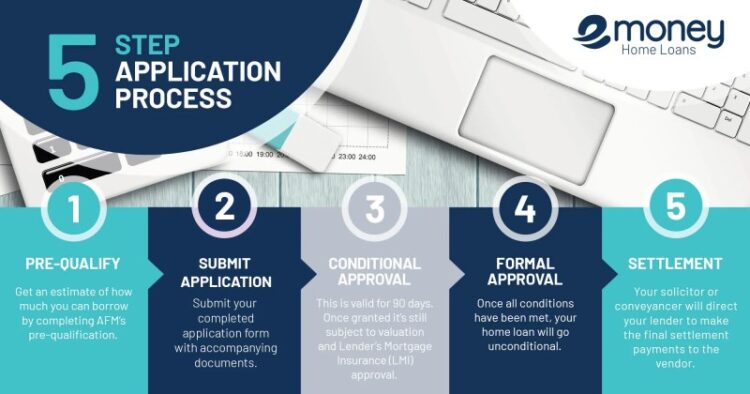

We find that people have an easier time understanding the mortgage approval process when it’s explained as a series of steps. So let’s talk about six important steps along the way (as shown in the image above).

Pre Qualified Vs. Pre Approved

You can think of a pre-approval as a kind of financial pre-check. It has “advance” in its name because it occurs at the first end of the mortgage loan approval process.

Pre-approval is when a lender reviews your financial situation (especially your income, assets and liabilities) to determine if you are a good candidate for a loan. They will tell you how much they are willing to lend you and give you a pre-approval letter. Lenders can look at your credit report and score at this stage.

This is a useful step in the mortgage approval process because it allows you to narrow down your housing search. If you skip the pre-approval and jump right into the house hunting process, you could end up wasting time looking for homes that are above your price range.

Once you’ve been pre-approved for a certain amount, you can buy more safely at that price. This takes you to the second major step in the mortgage approval process – house hunting.

Homebuyer Tips When Applying For A Mortgage

We’ve written a lot about the house hunting process. Here are some house hunting tips designed specifically for first-time buyers.

Your mortgage lender is not very involved at this stage. House hunting is primarily conducted by buyers and their estate agents.

Come back to the picture once you’ve made an offer to buy the house. When you move on to the next step in the mortgage approval process – filling out the application.

You have been pre-approved for a loan. You’ve found a home that meets your needs and you’ve made an offer to buy it. The seller has accepted your offer. Now it’s time for the next step in the mortgage approval process, which is the loan application.

What You Need To Know Before Getting A Home Loan

This is an easy step in the process as most lenders use the same standard format. They use the Uniform Residential Loan Application (URLA), also known as Fannie Mae Form 1003. The application asks for information about the property being purchased, the type of loan being used, and you as the borrower.

You can find a sample loan application form online: Do a Google search for “Fannie Ma Form 1003.”

Once you have a purchase agreement and a complete loan application, your file will move to the processing stage. This is another important step in the mortgage approval process.

The loan adjuster collects various documents related to you, the borrower and the property to be purchased. They will review the file to ensure it contains all the documents required for the writing process (step 5 below). These documents include bank statements, tax returns, employment letters, purchase agreements and more.

Getting Prequalified And Preapproved For A Mortgage: Know The Difference

The exact steps that the loan processor takes may vary slightly from one company to another. It also varies depending on the type of mortgage used. But that’s how it usually works. Then you move on to the most important step in the mortgage approval process – the deposit.

Underwriting is where the “rubber meets the road” in loan approval. It is the underwriter’s responsibility to carefully review all loan documentation provided by the loan servicer to ensure compliance with loan requirements and guidelines.

The underwriter is the most important decision maker in the mortgage approval process. This person (or group of people) has the authority to reject the loan if it does not meet predetermined criteria. The guarantor will double-check to ensure that both the property and the borrower meet the eligibility requirements for the specific mortgage product or program being used.

Related to your credit. He will review your credit history, your debt to income ratio, your assets and other aspects of your financial picture to estimate your ability to make mortgage payments.

The Most Important Step When Buying A New Home In Idaho

If the underwriter encounters problems during this review process, he or she can provide the borrower with a list of conditions that should be addressed. This is called conditional approval. A common example of a “condition” is when an insurer requests a letter of explanation regarding a particular bank deposit or withdrawal.

Of course, and borrowers can resolve them in time to continue with mortgage loans and eventually be approved. However, if the depositor finds a serious problem outside the eligibility parameters of the loan, it may be rejected outright. Some borrowers go through the issuance process without problems. This is changing.

The deposit can be the most important step in the mortgage approval process, as it ultimately determines whether or not the loan will be approved. You can learn more about the process here.

If the mortgage guarantor is satisfied that the borrower and the purchased property meet all the guidelines and requirements, he will mark it as “ready to close”. This means that all requirements are met and the loan can be financed. Technically, this is the final step in the mortgage approval process, but there is one more step before the deal is done – it closes.

Pre Approval: A Homebuyer’s First Step

Before closing, all supporting documents (or “loan documents”, as they are called) are sent to the title company appointed to handle the closing. And there is

From the documents. Home buyers and sellers must then review and sign all relevant documents for the funds to be disbursed. This occurs in “closure” or liquidation.

In some states, the buyer and seller can close separately by arranging separate meetings with the title or escrow company. In other states, buyers and sellers sit at the same table to sign documents. The procedure may vary depending on where you live. You can ask your real estate agent or loan officer how this works in your area.

Prior to closing, borrowers must receive final disclosures. This is a standard five page form that you will receive

The Triangle Home Buying Process

Mortgage loan details. This includes the terms of the loan, your estimated monthly payments and how much you need to pay in fees and other final expenses.

We hope you found this guide to the mortgage approval process helpful, and we wish you the best of luck with your home purchase.

Brandon Cornett is an experienced real estate market analyst, reporter and founder of the Home Buying Institute. He has covered the US real estate market for over 15 years. Shopping for a car dealership often starts with a loan application at the lender’s office, not an open house. Most sellers expect the buyer to be pre-approved for financing and usually prefer to negotiate with someone who can prove they can get a loan.

A mortgage prequalification can be useful as an estimate of how much you can afford on a home, but a pre-approval, which is often valid for 60 to 90 days, is more valuable. This means that the lender has verified the customer’s credit, proven assets and employment to approve a specific loan amount.

The Only Home Loan Approval Process Flowchart

Customers benefit from consulting with the lender, getting a pre-approval letter and discussing loan options and budgets. The lender will provide a maximum loan amount, which helps determine the price range for the home seller. A mortgage calculator can help customers estimate costs.

Mortgage pre-approval requires a buyer to complete a mortgage application and provide proof of assets, income verification, good credit, employment verification and important documents.

Pre-approval depends on the customer’s FICO credit score, debt-to-income (DTI) ratio and other factors, depending on the type of loan.

Except for jumbo loans, all loans follow Fannie Mae and Freddie Mac guidelines. Some loans are designed for low-to-moderate income homebuyers or first-time homebuyers. Others, such as Veterans Affairs (VA) loans that do not require a down payment, are for US veterans and service members.

Demystifying The Mortgage Approval Process: A Step By Step Guide

Forward rates for Fannie Mae and Freddie Mac home loans changed in May 2023. Rates go up for homebuyers with credit scores of 740 or higher and go down for homebuyers with credit scores below 640. Another difference: Your down payment will affect your rate. The higher the down payment, the lower the rates, but it still depends on your credit rating. Fannie Ma provides loan pricing arrangements on its website.

Prospective homebuyers must provide W-2 pay stubs and tax returns for the past two years, current pay stubs showing income and year-to-date income, and proof of additional sources of income.

Steps to get prequalified for a home loan, get prequalified for home loan online, prequalified home loan, when to get prequalified for home loan, steps to getting prequalified for a home loan, getting prequalified for a home loan, how to get prequalified for a home loan, get prequalified for home loan, how do you get prequalified for a home loan, best place to get prequalified for a home loan, how to get prequalified for home loan, how to get prequalified for a mortgage loan