Should I Borrow From 401k To Pay Off Debt – Photo: A couple sits at a table in their living room and reviews their finances to decide whether they should use their 401k to pay off debt.

Deciding whether you should use a 401(k) to pay off debt depends on your financial situation. Early withdrawals from your 401(k) can cost you taxes and fees and are not recommended unless absolutely necessary.

Should I Borrow From 401k To Pay Off Debt

Editorial: Intuit Credit Karma is compensated by third-party advertisers, but that does not influence the opinions of our authors. Our third-party advertisers do not review, approve or endorse our editorial content. Information about financial products not available from Credit Karma is collected independently. Our content is accurate to the best of our knowledge at the time of publication.

How Much Should I Have Saved In My 401k By Age?

We think it is important that you understand how we make money. It’s actually very simple. The financial product offers you see on our site come from companies that pay us. The money we make helps us give you access to free credit scores and reports, and helps us develop our other great tools and educational content.

Compensation may affect how and where (and in what order) products appear on our site. But since we usually make money when you find and get the deals you want, we try to show you the deals we think are right for you. That’s why we offer features like your approval opportunities and savings plans.

Of course, the offers on our platform don’t represent every financial product out there, but our goal is to show you as many great options as possible.

With so many debt payoff methods, strategies, and tools available – from balance cards to debt consolidation loans – it can be difficult to decide which is the right solution for you. You might consider using your 401(k) to pay off debt. But remember that cashing out your 401(k) early can cost you penalties, taxes, and possible financial penalties. Although many people try to avoid it, there are certain situations where it can be a good choice.

Understanding The Interest Rate On A 401k Loan (2023)

You are actually retiring. You have two options: 401(k) withdrawal or 401(k) loan.

With certain exceptions for qualified hardships and special circumstances, initial distributions from a 401(k) plan are subject to both:

Even if your special needs or circumstances qualify for an exception, standard income tax rates will apply to your refund.

Another downside to 401(k) withdrawals is that once the money is withdrawn from your account, it’s gone for good. You may also lose the long-term benefit of compound interest, which is based on your principal and accrued interest from previous periods.

The 401k Loan: How To Borrow Money From Your Retirement Plan

A 401(k) loan differs from a 401(k) withdrawal because the money borrowed from the retirement plan must eventually be repaid. Keep in mind that not all plans allow 401(k) loans.

A 401(k) loan can give you early and tax-free access to part of your retirement savings. The advantage of borrowing against your pension over taking out a personal loan is that the interest you pay is repaid into your scheme, instead of you paying interest to the bank.

Keep in mind that a 401(k) loan must be paid back within five years. Before you decide whether taking out a loan against a 401(k) is a good option for you, carefully check the plan’s fine print.

Is it a bad idea to withdraw from a 401(k) to pay off debt? Short answer: it depends.

Solo 401k Loan Facts

If debt is causing you daily stress, you may want to consider serious debt settlement. Knowing that early withdrawals from your 401(k) can cost you additional taxes and fees, it’s important to assess your financial situation and do some calculations first.

Keep in mind that if you withdraw money from your 401(k) early, you may face penalties. (Some reasons are on the government’s exception list.)

For example, your 401(k) allows you to make early withdrawals for an “immediate and urgent financial need.”

These hardships include situations such as medical expenses, high school tuition, bills to avoid foreclosure or eviction, funeral expenses, or home repairs for the primary residence.

Thank You Ynab. The Last Of My Debt, My 401k Loan, Has Been Paid Off. Was $25k In 2018. I Am Now Debt Free Except For My Mortgage. And Because Of Ynab,

The withdrawal may not exceed the amount of financial support necessary to meet the need. You must also demonstrate that you do not have other sources that can meet the financial need.

If you want to consider a 401(k) loan, keep in mind that not all plans offer it. Check your 401(k) documents or contact a trusted financial advisor to see what you may qualify for.

Once you understand your eligibility, assess your financial picture. How much debt do you have? Try a budget calculator to see if you can allocate different amounts of money to the amount you owe.

For example, if you have $2,500 in credit card debt and a steady source of income, you can pay off the debt by changing your current habits. Cutting the cord on your TV, cable or streaming service can be a huge savings.

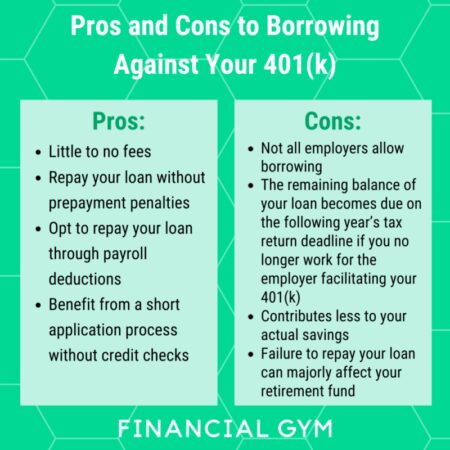

The Pros And Cons Of A Taking Out A 401(k) Loan

However, living on a tight budget may not be enough if you’re on the brink of a financial crisis. Tapping into your 401(k) may be an option worth considering.

, and the government is trying to strengthen it to your advantage. If you withdraw your earnings early, you may have to pay taxes and penalties on the amount you withdraw. Your tax rate depends on the federal income and state taxes where you live.

Suppose you’re in your mid-twenties and have forty years before you want to retire. You decide to take out €10,000 for your student loans. Assuming an automatic federal withholding rate of 20% plus a 10% penalty and a 4% state tax, you’ll get $6,600 of your $10,000 withdrawal. An additional $3,400 will be withheld.

The bottom line: No matter how quickly you cash out your 401(k), you’ll incur significant costs. These costs include federal taxes, state taxes, and penalties.

Why You Shouldn’t Withdraw From Your Retirement To Pay Off Debt

There are several strategies to help you achieve your goal of becoming debt-free without dipping into your 401(k). Paying off debt may not be easy, but it will benefit your future self and your current mindset.

Call the credit card service’s customer service department and ask them to lower your interest on high-interest accounts. View your current rates, billing history and competitor rates. After investigating, call your credit card company and discuss your transaction history.

If you find a competing credit card company that offers a better rate, try tracking your current card issuer to see if it matches the competitor’s rate. By guaranteeing a low interest rate, you can save on interest payments.

You can negotiate your medical bills based on financial concerns or see if your healthcare provider offers an interest-free payment plan.

Borrowing From Your Self Directed Solo 401(k): Become Your Own Rich Uncle

Every time you receive a bonus or other unexpected financial windfall, consider going into debt. This could be in the form of a pay increase, an annual bonus, a tax refund or a cash gift from your loved ones.

You can use this extra income to pay off all or part of your debts, reduce the total interest paid, or free up money from your monthly budget.

While a low-interest card won’t eliminate your debt completely, it can help you save on interest payments. Keep in mind that if you can’t find a credit card company that will waive your shipping charges, you may have to pay those fees as well.

If you can qualify for a lower rate than your current loan, a personal loan can help you consolidate your debt into one manageable monthly payment.

Solo 401k Loan Rules And Regulations

Personal loans are a type of installment loan, meaning you have a fixed interest rate and predictable monthly payments, just like a car loan.

If you own a home, you may also consider using the equity you’ve built to pay off the loan.

You can do this with a mortgage loan, a home equity line of credit (HELOC), or a cash-out refinance. But remember, this new loan is backed by your home, so you could lose your home if you default in the future. Do you have any tips for those of us who took out a 401k home loan before we became financially savvy mutants? Do I have to pay back the 3.15 percent soon? Does the refund count towards my investment percentage? It seems like he’s trying to go back and undo something he’ll later regret. How should he handle this? Yes, this is a common misconception about 401k loans. People think, “Well, I’m going to borrow from my 401k, and that’s fine. I’m going to pay myself back by earning interest.” You don’t realize the significant opportunity costs this entails. Would you say the debt is 3.15 percent? Oh, that’s great, I’m going to borrow 3.15, that’s going to be quite a lot. But the costs are not just 3.15 percent. You gotta pay yourself back

Withdrawal from 401k to pay off debt, 401k loan to pay off debt, should i take a 401k loan to pay off debt, loan from 401k to pay off debt, using 401k to pay off debt, can i borrow from my 401k to pay off debt, borrow from 401k to pay off debt, borrow from 403b to pay off debt, 401k to pay off debt, should i borrow from 401k to pay credit cards, should i borrow from my 401k to pay off debt, should i borrow from 401k to pay off debt