Sample Profit And Loss Statement For Restaurant – Financial statements are statements prepared to show the overall financial position of a company. They are the official records of financial affairs. These records are important because they reveal the financial health of the business.

Income statement, balance sheet and cash flow statement are completed every three months or four times a year. That is why they are called “quarterly reports”.

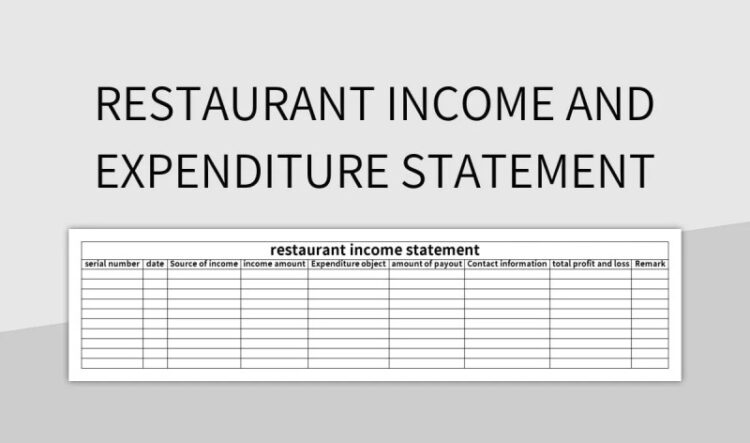

Sample Profit And Loss Statement For Restaurant

You will also prepare an annual version of the same reports after the first year. Use year-round data as the reporting period.

What Is A Restaurant Profit And Loss Statement?

Finally, you’ll also create accounts that compare years of data. This shows the financial status of the restaurant over the years.

It shows the “good years”, “bad years” and rate of growth (or loss) over the life of the company.

Next, we’ll take a closer look at each account. You will learn how to read a bill and how to top up your bill.

A restaurant’s P and L income statement. It uses a very simple formula that tells you how much money you have left over after taking into account all the expenses associated with the business.

Restaurant Profit And Loss Statement Templates In Pdf

The terms used in a P&L are sometimes used interchangeably, so it can be a bit confusing when learning it for the first time. It’s important to know what people are talking about.

Remember this, everything becomes much simpler. When discussing income and expenses, these terms are used interchangeably, even though they mean the same thing.

The balance sheet shows the net worth of the restaurant. You can think of a balance sheet as a set of scales showing liabilities on one side and assets on the other. They show balance, hence the name.

The purpose of the balance sheet is to see how the “scale” is tipped. In other words, if you lose money, make money or break.

Free Small Business Profit And Loss Templates

Some terms used in the balance sheet are used interchangeably. Remember these terms when studying the balance sheet. Another name for liabilities is debt.

An example of debt is a loan. The loan amount is recorded in the Liabilities column of the balance sheet.

But the result of the loan is that the amount of cash given to you by the bank is recorded as an asset. Equipment or property purchased by the business with long-term value is also recorded in the Assets column.

Even though you are still paying for them, these things are your assets. The remaining amount you owe is a liability.

How To Manage Restaurant Business Projected Income Statement

A negative number means you owe more than your restaurant. This is what they call “being in the hole”, “up” or “being in the red”. Ideally, a balance between your assets and your liabilities. Or better yet, assets exceed liabilities.

But when you open a new restaurant, there may be times when your business is more in debt. For this reason, it is dangerous to open a restaurant. A business needs a large amount of capital to start generating revenue.

A cash flow statement is used to track money coming in and out of a business. In other words, it controls the cash flow during the period.

A cash flow statement gives readers an idea of a company’s health. This will help you understand the difference between “paper money” and valid dollars in your account.

Figure 7 From ”asian Bbq House” Restaurant Business Plan

Because the statement of cash flows is a tool for understanding how cash flows into the business, accounts receivable (sales on credit) are not counted.

Restaurant debt is recorded on the statement of cash flows only when debt service is paid. The total debt balance is not recorded on the cash flow statement because it does not affect your available cash.

Changes in capital statements are one way to measure a restaurant owner’s contribution to the business. It also shows the increase or decrease in the value of the restaurant.

Financial statements are the primary documents that a company uses to support and inform investors. Knowing the four basic accounts is an important first step to owning a restaurant.

Profit And Loss Statement Templates & Forms [excel, Pdf]

Accounts are made quarterly and annually. Four-year accounts are income statements, balance sheets, cash flows, and changes in equity.

These reports are an important part of the restaurant business plan. Once you’ve completed them, you’ll have a better understanding of your restaurant’s financial situation.

This free resource is brought to you and is part of our resource library for restaurants and managers. is a leading developer of hospitality management systems.

Our mission is to help business owners like you achieve greater success through innovative and affordable technology solutions. Contact today for a free restaurant consultation. Find out more on our website.

Restaurant Financial Projection Template

Is a trademark of Guest Innovations, Inc. “Making Restaurants More” – Guest Innovations, Inc. company’s service mark. iPad, iPhone, and iPod Touch are trademarks of Apple Inc., registered in the United States and other countries. trademarks of the company. App Store is a service mark of Apple, Inc. Android is a registered trademark of Google. Windows is a registered trademark of Microsoft. Other logos and trade names belong to their respective owners. Use of POS and this website is subject to the terms of use and privacy policy. Here it is: You want to grow your bar or restaurant. And to grow it, make decisions that drive growth, increase margins to improve the bottom line of how much bars earn with controlled costs, even with your Valentine’s Day promotion ideas for restaurants. You will spend a lot of money to begin with learning how to get a liquor license, so from there you need to focus on profit and find your bottom line and cost of goods sold (COGS).

Strategic decisions based on restaurant accounting, restaurant SEO promotion and restaurant swot analysis. The reality of your restaurant is funded. That’s what running a successful bar and restaurant is all about.

Enter the restaurant’s income statement. Perhaps the shortest measure of your restaurant’s financial health is a large part of knowing how to manage restaurant accounts.

All successful food service and hospitality operators know how to calculate, generate and track restaurant income and expenses. You will need more than just reading a few books on restaurant management.

How To Read A Restaurant Profit & Loss Statement

Knowing how gives them all the information they need to slowly turn their profits around. And that means a lot in a business with narrow margins like food and beverage. Let’s take a look at what a restaurant P&L statement is and how they are created.

A restaurant income statement, also called a P&L or profit and loss statement, is a financial document that describes the total revenues and expenses of a business over a period of time. A restaurant P&L provides a picture of the most important performance of a business: how much profit is being made and where.

Most importantly, these are costs deducted from sales. Knowing this will allow bar and restaurant managers to lean toward useful items or strategies and vice versa.

By calculating the three costs (labor, operations, and goods sold) and subtracting them from total sales, the company is left with a net income or net loss. This is stated in the P&L statement.

Simple Profit & Loss Templates

Every four weeks. If you use a column management program like BinWise Pro, it will be immediately available for you to review whenever you want.

This is the most important document created by your accountant or restaurant accounting software. The more often you can look back and make course corrections based on his numbers, the better.

Another way to understand a restaurant’s P&L statement is to look at what it isn’t. Your restaurant P&L does not include information about your total cash, inventory, equity, debt or liabilities.

This is your restaurant balance. While the P&L provides a snapshot of profitability, the balance sheet provides a full spectrum of short-term and long-term financial health.

Free Restaurant Templates For Google Sheets And Microsoft Excel

The restaurant’s P&L information is included in the balance sheet. However, as you can see, the balance sheet is a more detailed picture of finances.

How to calculate profit and loss in a restaurant is a matter of pulling numbers from your POS, accounting software, or inventory management system. Then remove them from the general sale.

Net Profit/Loss = Total Sales – COGS – Labor Costs – Operating Expenses Net Profit/Loss = $8,000 – $2,500 – $2,000 – $1,235 Net Profit/Loss = $2,265 Total Sales

You need to calculate the sales of each item, each stream, that contributes to your total revenue. Fortunately, you can pull this from a POS or bar inventory software like BinWise.

Free Profit And Loss Templates (monthly / Yearly / Ytd)

In fact, BinWise Pro’s SmartView report shows you what you sold, when and for how much. You can then use the information to set cost percentages and conduct pricing experiments (psychological pricing, anyone?) to maximize profits.

COGS, or cost of goods sold, is the total amount of your business

Sample profit and loss statement pdf, sample profit and loss statement for llc, sample profit and loss statement for self employed, sample profit and loss statement, sample restaurant profit and loss statement, profit and loss sample, restaurant profit and loss statement, profit and loss statement for self employed, profit and loss statement for small business, profit and loss statement, sample quarterly profit and loss statement, profit and loss statement for 1099 employee