Relationship Between Income Statement And Balance Sheet And Cash Flow – In previous modules, we learned that the income statement summarizes the income and expenses of a business that has net income or net loss. Therefore, we mention only one income account and one small expense account. So take a full-service hotel, for example, with room revenue, food and beverage revenue. And for hotels, resorts, you can have golf fees, health club fees, spa fees and more. There are many types of hotels. Therefore, a “one-step” income statement that identifies net income in one step by subtracting all expenses from income, while valid, may not contain sufficient information. Therefore, there is a “multi-step” income report that shows two important steps:

In the following two examples, all the accounts have the same value, but the way the accounts are organized is different, providing additional information to management and owners of the multi-step income statement.

Relationship Between Income Statement And Balance Sheet And Cash Flow

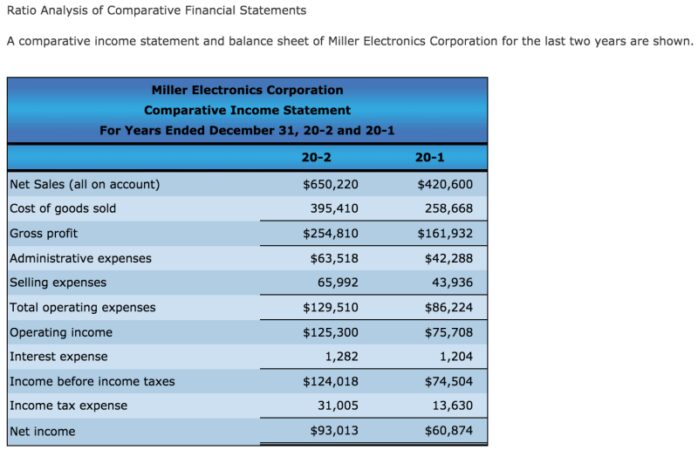

With multi-step income reporting, gross profit can be easily determined. You may have heard the term GOP accounting. So what is gross profit or gross operating profit (GOP)? Gross profit is simply revenue or sales minus cost of goods sold. So if you had $460,000 in sales and $316,000 in sales, your total profit would be $144,000. Gross profit is an important number because it tells you how much money you have left over to cover all other expenses. In the hospitality business, food/beverage and service costs are recognized as prime costs. They can easily add up to 60%-70% of sales. Thus, gross profit is an important measure and an important performance indicator.

How To Analyze A Company Through Its Financial Statements

In addition to showing gross profit in dollars, it can also be shown as a percentage known as gross profit margin or gross profit. Using the same number, the profit margin or maximum profit is calculated below.

From gross profit, all other operating expenses are subtracted to arrive at net income or net loss.

In addition to making a profit while “running” the business, there are times when the business has “non-operating” activities that can provide revenue and income for the business, and at the same time non-operating expenses are also incurred from the activity or those materials. that is not controlled or controlled by the operator. Some examples of passive income may include: income, expenses, income, interest or other income (rental income from antennas, billboards or rental walls, retail space). And some examples of non-operating expenses may include: rent/lease (land, building or real estate and other equipment), real estate and other taxes (taxes and fees – employment taxes, taxes and other assessments, personal property taxes , real estate .taxes) insurance (housing and liability content) or other (renovation costs, profit / loss on the sale of fixed assets, depreciation, increase or loss of passive foreign exchange) recognized).

In multi-department operations, such as hotels or country companies (and even for restaurants, they can be divided into food, catering and transport), departmental tax information allows the disclosure of income for each department (room). food and beverage, telecommunications, parking/valet, etc.) so that managers and owners can review the performance and profitability of each sub-unit. Once you’ve entered all of the department’s revenue information, you’ll be presented with a consolidated income statement that allows for revenue to be displayed for the entire business. Below are examples of departmental income reports from the food and beverage industry and consolidated income reports (known as summary operating statements or SOS) both in accordance with Uniform System of Accounts for Employers (USALI) guidelines.

Reading Business Financial Info I Finance Course I Cfi

After the income statement, the retained earnings report should come next. However, retained earnings information is often placed in the owner(s) section of the balance sheet. And now that you’ve written down most of the accounts, it’s time to look at the split balance sheet. Again, like the single and multi-step income statements, additional balance sheet accounts are separated, making the balance sheet much wider.

First, assets and liabilities are further divided into non-current (or long-term) current accounts. Current means that the asset or liability is expected to be realized, used or settled within one year from the balance sheet date. These accounts include accounts receivable (AR), accounts payable (AP), inventory, food, taxes, and more. Current does not mean that the asset or liability is not expected to be realized, used or settled within one year from the balance sheet. looks like. This includes accounts such as computers, appliances, vehicles and home loans.

Current asset accounts include cash and other resources that are reasonably expected to be settled as cash or sold/traded within one year from the balance sheet date. These accounts are usually listed in order of liquidity, meaning how quickly they will turn into cash. Of course, money is already money, so money is always the first consideration. Examples: cash, short-term investments (eg, certificates of deposit), receivables (not liquid), inventory and prepayments.

.png?strip=all)

Long-term investments can also be made in cash. It’s just that cash conversion is expected to take more than a year from the balance sheet date. Such assets are not for use in commercial activities. Example: Investing in shares of another company.

Financial Ratio Based On The Balance Sheet

Real estate, plant and equipment are real natural resources of a permanent nature that are used in the business but not for sale. These are assets that depreciate (land is an exception). Examples: land, buildings, machinery and equipment, transportation, furniture and equipment, and computers.

Intangible assets are non-current resources that aren’t physical, so you can’t “touch” them like you can touch a computer, desk, clothes, chair or equipment. Examples: patents, copyrights, trademarks and trade names. These assets will also be depreciated (depreciated intangible assets) as they are used.

Current liabilities are obligations that are reasonably expected to be settled by creating current assets or other current liabilities. Examples: accounts payable (paid to vendors), wages/salaries (paid to employees) and short-term loans (paid to financial institutions), interest payments and current premiums on long-term debt.

On the other hand, long-term debt is a liability that is not expected to be repaid next year. Examples: loan repayment, installment payment, long term repayment, rent loan and employee pension plan loan.

Balance Sheet Income Statement Royalty Free Images, Stock Photos & Pictures

The expression of owner’s equity depends on the type of business (sole trust vs. corporation vs. partnership). For a company, OE is usually divided into two accounts, common stock (invested in the business) and retained earnings (earnings retained for business use). An overview of all these customizations can be found in the key collection below.

The income statement tells the consumer whether the business is making a profit or loss, and the balance sheet provides the consumer with a list of assets, liabilities, and equity. But are these two words related? If so, how are they related? From the closing items in the previous model, you know that in dollars, on a net income basis, they are closing to saved income through the income group account. You can also see this on a worksheet when the income statement and balance sheet columns are balanced with net income figures or net loss.

While income statements are useful and tell us how a business makes money, net income is not the same as money. Because under GAAP, we prepare financial statements using the basis of income in the income statement, which may not yet be earned and expenses that are included in the income statement. We probably haven’t paid yet. But having enough money is important in any business. Without cash, businesses cannot pay their bills on time. Without money, business cannot survive. Furthermore, income data only tells us how the business is “performing”. What if the business owner or board makes some good or bad investment decisions? However, how is money involved? And what if the business owner or board makes a good or bad financial decision (like getting a loan with a high interest rate)? Again, how is money involved?

Thus, the Statement of Cash Flows (SCF) provides information about the entity’s cash inflows and outflows over a period of time. These cash inflows and outflows are classified according to the activities that generate them: operating, investing and financing activities (respectively). Thus, SCF starts with the initial cash balance of the business (the number of cash accounts at the beginning of the accounting period from the balance sheet), adding cash inflows and outflows from operations, investing and financing activities to arrive at the final for the. Balance The amount shown on the balance sheet at the end of the same accounting period. On the other hand, SCF describes what happened to the financial account of the business.

Understanding Financial Statements

Create cash flow statement from balance sheet and income statement, balance sheet income statement cash flow relationship, balance sheet income statement cash flow template excel, balance sheet income statement and cash flow, relationship between balance sheet and cash flow statement, relationship between balance sheet and income statement, what is the relationship between income statement and balance sheet, relationship between income statement and balance sheet and cash flow, difference between balance sheet and cash flow statement, cash flow statement from income statement and balance sheet, difference between income statement and balance sheet and cash flow, cash flow statement balance sheet