Refinance Mortgage To Pay Off Student Loans – Or simply “ref” refers to the process of revising and replacing the terms of a credit agreement, usually related to a loan or mortgage. When companies or individuals decide to restructure their debt obligations, they are essentially trying to make favorable changes to their interest rates, payment schedules, or other contractual terms. If approved, the borrower receives a new contract that replaces the original contract.

Borrowers often choose to refinance when the interest rate environment changes significantly, potentially saving money on new business loan payments.

Refinance Mortgage To Pay Off Student Loans

Consumers typically refinance certain debt obligations to obtain more favorable credit terms based on changes in economic conditions. Co-financing goals include lowering the fixed rate, reducing down payments over the life of the loan, changing the term of the loan, or changing from a fixed rate mortgage to an adjustable rate mortgage (ARM). .

How To Pay Off $200,000+ In Student Loans

Borrowers can also repay loans as their credit profile improves due to changes in long-term financial plans or by consolidating loans into one low-cost loan.

The biggest driver for refinancing is the interest rate environment. Because interest rates are cyclical, many consumers choose to refinance when interest rates drop. A country’s monetary policy, economic cycles, and market competition can be important factors that drive interest rates high or low for consumers and businesses.

Discrimination in mortgage lending is illegal. If you believe you have been discriminated against because of your race, religion, sex, marital status, access to public assistance, national origin, disability, or age, you may take action. One of those steps is reporting to the Consumer Financial Protection Bureau or the US Department of Housing and Urban Development (HUD).

These factors can affect interest rates for a variety of credit products, including revolving credit and revolving credit cards. As interest rates rise, variable rate borrowers pay more. The opposite is true in a declining interest rate environment.

What Is Refinancing?

To refinance, a borrower must apply to an existing lender or a new lender and submit a new loan application. Refinancing involves reassessing the credit terms and financial situation of an individual or company. Consumer loans that typically qualify for refinancing include mortgages, car loans, and student loans.

Companies can also try to refinance commercial real estate mortgages. Most business investors evaluate their corporate assets for business loans from lenders who can benefit from lower interest rates or improved credit profiles.

There are different types of financing. The type of loan taken by the borrower depends on the needs of the borrower. Some of these financing options include:

This is the most common form of financing. Interest and term financing occurs when you repay your original loan and switch to a new loan agreement that requires a lower interest rate.

How Long Does It Take To Pay Off Student Loans?

Profits often occur when the value of the underlying asset that serves as collateral for the loan increases. A trade-in involves buying back the value of an asset or equity in exchange for a higher loan amount.

In other words, when the value of a paper asset increases, you can acquire it by borrowing rather than by selling it. This option increases the total amount of the loan, but gives the borrower immediate access to cash while retaining ownership of the property.

A cash-out refinance allows the borrower to pay off part of the loan at a lower loan-to-value (LTV) rate or to pay off smaller loans.

In some cases, debt consolidation can be an effective way to refinance. Consolidation can be refinanced when investors take out a single loan at an interest rate lower than the current average interest rate of different loan products.

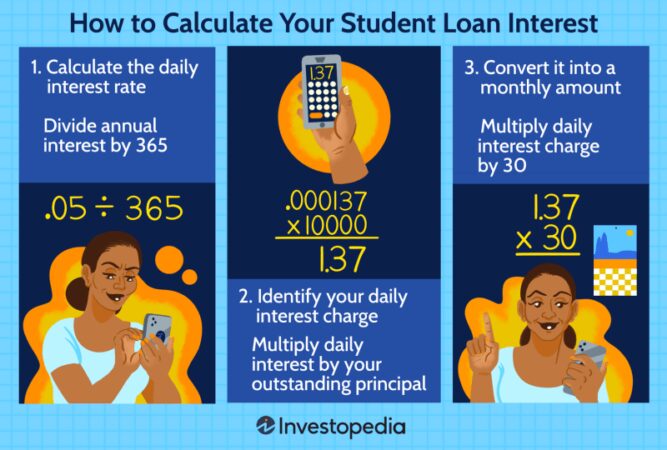

How To Calculate Student Loan Interest

This type of financing requires the consumer or business to apply for a new loan at a lower interest rate and then pay off the existing loan with the new loan, leaving the principal at a significant interest rate.

Here’s a hypothetical example of how the financing might look. Let’s say Jane and John have a 30-year fixed-term mortgage. Since their rates were first locked a decade ago, they’ve been paying 8%. Interest rates are falling due to economic conditions.

The couple contacted the bank to refinance their existing mortgage at a current 4% interest rate. This would allow Jane and John to lock in a new interest rate for the next twenty years while reducing their regular monthly mortgage payments. If interest rates fall again in the future, they will refinance and lower their spending even further.

Corporate refinancing is the process of restructuring a company’s financial obligations through a debt swap or restructuring. Corporate financing is often done to improve a company’s financial situation, or when a company is having difficulty restructuring its debt. Corporate financing often involves issuing old corporate bonds whenever possible and issuing new bonds at low interest rates.

Your Guide To Student Loan Refinancing For Psychiatrists

When you pay off your mortgage, you replace your old mortgage with a new mortgage. There are different principal amounts and interest rates. The lender pays off the old mortgage with the new mortgage, leaving you with only one mortgage. Generally more favorable terms (lower interest rates) than before.

There are several reasons why people consider remodeling their home. The main reason is to get more favorable loan terms than before. This usually translates into a lower interest rate on your mortgage, which makes your mortgage cheaper and lowers your monthly costs. Other reasons to refinance your home include changing the term of your mortgage or taking cash out of your home loan and paying off the debt or renovating your home.

Refinancing can hurt your credit score because a credit check is done when you refinance your mortgage. However, this is temporary and your account will settle over time. Additionally, your overall credit score may improve after refinancing because you have less debt and lower monthly mortgage payments.

Refinancing allows you to make changes to your current loan agreement, usually replacing the original agreement with a new one. Refinancing is beneficial to borrowers because it leads to more favorable loan terms. Refinancing is a great way for homeowners to lower their mortgage costs when interest rates drop, allowing them to get a lower interest rate than their current rate. If interest rates drop, it may be worth looking into refinancing.

Lower Your Student Loan Interest Rate → Now ←

Require writers to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. Where appropriate, we also cite original research from other reputable publications. You can learn more about the standards we use to create accurate, unbiased content in our editorial policy. Cash-out is a mortgage repayment option that allows you to convert your equity into cash. The new mortgage is taken out more than your previous mortgage balance. The difference will be paid to you in cash.

In the real estate world, refinancing is a fairly common process where replacing an existing mortgage with a new loan usually offers more favorable terms to the borrower. By refinancing your mortgage, you can reduce your monthly mortgage payments, negotiate a lower interest rate, modify the terms of your loan, remove or add borrowers to your loan obligations, get a cash top-up, and access AMD. Your home equity.

With a cash-out refinance, you can use your home as collateral for the new loan as well as some of the cash, creating a new mortgage that is larger than your current loan. Investing in your home equity can be an easy way to find money for emergencies, expenses and needs.

:max_bytes(150000):strip_icc()/remove-a-name-from-a-mortgage-315661-Final-ce467fa819be434898d17ff3d815e642.png?strip=all)

Borrowers looking for a cash-out loan can find a lender willing to work with them. The lender will check the current mortgage details, the balance required to repay the loan and the borrower’s credit profile. The lender makes an offer based on the acceptance analysis. Borrowers receive new loans that pay off their previous loans and lock them into a new monthly payment plan. Amounts above the mortgage amount are paid in cash.

Tips For Paying Off $400k In Student Loan Debt

With standard financing, the borrower has no cash on hand, just a lower monthly payment. The money from a cash-out can be used by borrowers, but most people typically use the money to pay off major expenses like medical or educational expenses, debt consolidation, or as an emergency fund.

Cash-out financing results in less equity in your home, which means the lender is taking on more risk. As a result, closing costs, fees or interest rates may be higher than standard processing. Borrowers with special mortgages, such as US Department of Veterans Affairs (VA) loans, include cash-out loans.

Pay off mortgage or student loans, refinance home to pay off student loans, refinance mortgage to pay student loans, refinance house to pay student loans, best refinance student loans, cash out refinance to pay off student loans, refinance student loans into mortgage, refinance student loans before mortgage, mortgage programs that pay off student loans, should i refinance my home to pay off student loans, refinance to pay off student loans, refinance house to pay off student loans