Refinance Interest Rates Today 30 Year Fixed – Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to below as “Credible,” is to provide you with the tools and confidence to improve your financial situation. Although we promote products from our lending partners who pay us for our services, the ideas are our own.

Three mortgage financing rates were unchanged and one rate increased yesterday, according to data compiled by Credible.

Refinance Interest Rates Today 30 Year Fixed

:max_bytes(150000):strip_icc()/1106-d31b12dcbd0c41a280502c03fb174b7a.png?strip=all)

Rates were last updated on September 2, 2022. These rates are based on the assumptions stated here. Actual rates may vary. Credible maintains a “good” Trustpilot rating with 5,000 reviews.

Mortgage And Refinance Rates Today, June 30, 2023

What it means: Rates for the 30-year term have increased today, while rates for other keywords are flat. Homeowners may want to refinance to lock in a 10- or 15-year rate — more than half a point lower than long-term rates. But with 20-year rates higher than 30-year rates, buyers who want lower monthly payments should stick with 30-year amortization.

According to data compiled by Credible, three homebuyer prime mortgage rates were unchanged and one rate increased from the previous day.

Rates were last updated on September 2, 2022. These rates are based on the assumptions stated here. Actual rates may vary. A trusted personal finance marketplace, it has over 5,000 Trustpilot reviews with an average rating of 4.7 stars (out of a possible 5.0).

What it means: With 30- and 20-year mortgage rates around 6%, homebuyers looking to save money should consider shorter terms. Ten and 15-year rates are more than half a unit lower than long-term rates. Shorter terms come with higher monthly payments, but buyers who can swing these higher payments can save money by not taking out a mortgage early.

Compare Today’s Mortgage And Refinance Rates, November 30, 2023

To find the best mortgage rates, use the secure website Credible, which shows you current mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s mortgage calculator to estimate your monthly mortgage payment.

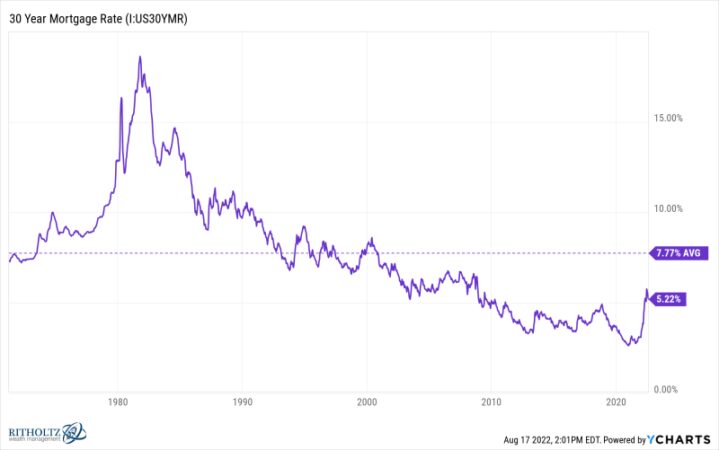

Today’s mortgage interest rates are lower than the highest average annual rate recorded by Freddie Mac – 16.63% in 1981. A year before the Covid-19 pandemic hit the world economy, the average 30-year fixed-rate mortgage rate for The year was 2019. 3.94%. The average rate for 2021 is 2.96 percent, the lowest average rate in 30 years.

Lower interest rates mean that homeowners with mortgages starting in 2019 and beyond can see significant interest savings by refinancing at one of the lowest rates today. When considering mortgage or purchase financing, it’s important to consider closing costs such as appraisals, applications, originations and attorney fees. These factors, along with the interest rate and loan amount, all go into the cost of a home loan.

Looking to buy a house? Credit can help you compare current rates from multiple mortgage lenders instantly in minutes. Use Credible’s online tools to compare rates and benchmarks today.

Higher Rates Reduce Mortgage Demand

Changes in economic conditions, central bank policy decisions, investors’ willingness and other factors affect the movement of mortgage rates. The actual average mortgage rates and mortgage repayment rates reported in this article are calculated based on information provided by trusted lenders.

This rating assumes the borrower has a credit score of 740 and is borrowing on a single-family home as their primary home. Rates are also not discounted (or very low) with a 20% discount.

The actual mortgage rates reported here will give you an idea of the current average rates. The rate you receive will vary based on a number of factors.

A mortgage is the largest debt you will carry in your life – it will take years to pay off. It is therefore important to ensure that you choose a mortgage and mortgage that suits your needs and financial situation.

Chart: Mortgage Rates Climb To Highest Level Since 2002

If you’re struggling to find the right mortgage rate, use Credible. You can use Credible’s free online tool to easily compare multiple lenders and see pre-arranged rates in minutes.

Have a financial question but don’t know who to ask? Email a Credible Money Expert at moneyexpert@credible.com and Credible can answer your question in our Money Expert column.

As a trusted authority on mortgages and personal finance, Chris Jennings has covered topics including mortgages, mortgage financing, and more. He has been an editor and contributor to Personal Finance Online for four years. His work has been featured by MSN, AOL, Yahoo Finance and others. The table below shows the current New York 30-year mortgage rate. You can use the menu to choose another loan term, change the loan amount, determine the value of the house, choose a purchase loan or change your location.

When buying a home, one of the hardest parts of the process is choosing a loan. There are many different types of financial products to choose from, each with advantages and disadvantages. The most popular mortgage product is the 30-year fixed-rate mortgage (FRM).

Year Mortgage Rates: Compare Current Rates

This article discusses how the 30-year compares to other mortgage products, the benefits of the 30-year, and the costs to avoid when choosing a 30-year mortgage.

In recent years, nearly 90 percent of borrowers used a 30-year FRM to purchase their home. The reason for the popularity of this loan is that it is offered at low rates.

Economists predicted that the economy would recover in 2010. However, the economy was slow and growth was beyond that for several years. The economy slowed in the first quarter of 2014, but economic growth picked up in the second half of 2014. As oil prices fell, the Federal Reserve scaled back its asset purchase program. Consumers’ perception of inflation and inflation expectations are determined by the price they pay at the pump when they fill up. Interest rates are expected to rise increasingly for the next two years through 2020, even to the brink of recession. The table below shows the 2019 rate forecast from the leading agencies in the housing and mortgage market.

NAHB saw the 30-year rate rising to 5.08% in 2020, while they expected ARMs to jump from 4.46% to 4.63% in 2019.

Here Are Today’s Refinance Rates, June 20, 2023: 30 Year Rate Ticks Up

Although the data is old, the predictions above are published on this page to show how large companies and elite billion-dollar companies are connected even in simple environments. The average forecast rate for 2019 is 5.13% and the average rate for the whole year is 3.94%.

Traders can thrive in simple situations. A real problem can make accurate predictions difficult.

As the COVID-19 health crisis unfolds, governments around the world are tightening restrictions that have kept many economies at record levels. In the second quarter of 2020, the US economy contracted at an annual rate of 31.4%.

As the global economy collapsed, the Federal Reserve cut interest rates twice, said it would make an unlimited number of rate cuts, and issued guidance that is unlikely to raise rates in 2023.

Year Fixed Mortgage Rates Explained

As the Federal Reserve bought Treasuries and mortgages as the economy cooled, credit rates fell to new records. In the fifth week of November, the 30-year average fell to 2.78%. 2020 will be a record year for mortgage originations, with Fannie Mae forecasting $4.1 trillion in originations and contributing $2.7 trillion in total refinancing.

When choosing a mortgage, there are different mortgage products and terms to choose from, each with different interest rates. Although 30-year rates are near historic lows, and have recently been below 4 percent, they are higher than other shorter-term loan options. 30-year rates are convertible to the following popular products:

15-year rates are lower than 30-year rates, and depending on the lender, the interest rate difference is from 0.50% to 0.75%. These rates are low because the term is short and the risk to the lender is low. Although the interest rate is lower, the 15-year payment is higher than the 30-year payment because the loan must be repaid in half the term.

ARMs typically come with a lower interest rate than a 30-year term (although this may change slightly in the mid-2020s). With an ARM, the borrower receives a fixed interest rate for an introductory period, typically 1 to 7 years, before the rate is adjusted to reflect general market conditions. In general, the shorter the initial grace period, the lower the interest rate. A typical ARM product is a 5-year mortgage offered at an interest rate of 0.25% to 1% under 30 years. After the introductory period, the loan rate increases and is adjusted every 6 months to one year depending on reference rates such as reference rates. London Interbank Offered Rate (LIBOR) and 11 Interest Rate Index (COFI).

Mortgage Rates Just Hit Another Record Low

30 year fixed jumbo refinance rates, current interest rates refinance 30 year fixed, refinance rates today 30 year fixed, mortgage interest rates today 30 year fixed refinance, cash out refinance rates 30 year fixed, current va refinance rates 30 year fixed, refinance interest rates 30 year fixed, va refinance rates 30 year fixed, best refinance rates 30 year fixed, refinance rates 30 year fixed, today's interest rates 30 year fixed refinance, mortgage interest rates refinance 30 year fixed