Questions To Ask Lender When Refinancing Your Mortgage – When a home is refinanced; We want to know your goal for recharge; To achieve this, find the best lender and product and put the documents together.

As long as you know what to expect and are prepared. You can get a solid refinance deal and save a bundle over the life of your loan.

Questions To Ask Lender When Refinancing Your Mortgage

Our mortgage refinancing list covers most of the basics. What does it involve? Find out how to prepare. Being prepared can simplify the home buying process and provide peace of mind.

Top 30 Mortgage Survey Questions For Questionnaires

Preparation for a mortgage refinance is important. Does it make economic sense? You should study the information and consider shopping around.

Credit report expert and licensed MLO loan specialist John Mayer has a few more tips to help with your refinancing checklist. He recommended

Mortgage lenders use your credit score to determine how likely you are to repay your new home loan. Higher credit scores usually lead to lower interest rates, which can save you thousands of dollars over the life of the loan.

“Do this a few months before remortgaging. And fix any mistakes found on your credit report before you apply,” Whitman says. “Even small changes to your report can improve your credit score and lead to a better interest rate.”

Good Reasons To Refinance In 2023

Most lenders require a minimum credit score of 620 to refinance a conventional loan. However, there is no set minimum credit limit for FHA loans and VA loans. Lenders will have their own criteria – so it’s important to shop around for your interest rate to get the best deal.

Or search for your original document. your current interest rate; Set the remaining principal and due date. This will help you understand how much you want to save on your refinance loan and what rate you need to reach your goal.

In the months before your refinance; Be sure to apply for additional lines of credit, such as personal loans and credit cards. “Making too many credit inquiries can lower your credit score,” says Whitman.

Before you search and compare refinance loan offers, we need accurate records in hand. Collect these documents.

Questions To Ask Your Lender

If you provide printed documents, send all pages, including the back blank. If the first page says “1 of 4”, list four pages.

Compare mortgage rates and loan plans from multiple lenders (easy to do online). Then contact the most competitive lenders. Be prepared to ask the following questions.

Most of the time, you are your own loan officer; You will be on the phone with the broker or processor. They will fill out a mortgage application (Fannie Mae Form 1003) and you will sign a printed version (ask if there are any discrepancies with the information you provided). “Also, be sure to thoroughly read everything you sign,” Jacobson notes.

“Find out who your designated loan officer is.” It’s important to stay connected between now and after closing,” Jacobson adds.

Questions To Ask Your Mortgage Broker Or Lender

“Before they transfer the loan, your lender will order a home appraisal. We tend to teach this early in the process,” said Vincent Garajji, senior vice president and mortgage sales manager at Ekta Bank.

For example, the FHA refinance programs from the VA and the USDA do not require a new home appraisal. And qualified borrowers can get an appraisal waiver from Fannie Mae or Freddie Mac to avoid this fee.

“Once approved, the underwriter can request additional documents or conditions. This will be given in the form of a list,” says Gerajji.

“Once your appraisal and title are received and deemed acceptable, and all other requirements have been met, the escrow clerk will issue clearance to close.” We will then contact you closely to arrange your due date.”

Questions To Ask Before Making A Home Loan Refinance Decision

Get started on your refinancing goals using the link below. Today’s rates are low, so this is a great time to get rates to find your best deal.

Eric J. Martin, Reader’s Digest; real estate for AARP magazine and the Chicago Tribune; He writes on economy, technology and other topics. Refinancing your mortgage may be a good idea, but it depends on your unique financial goals and the cost of refinancing. (iStock)

In 2020, mortgage refinancing activity was at a record high. According to Freddie Mac, home loan repayments have increased 100% year-over-year due to low mortgage rates.

By refinancing at a lower interest rate. Some homeowners can refinance their loan with a good credit score and good profile; Can reduce your monthly loan payments; Keep your homeowner’s insurance; Or you can switch to a lender with more favorable terms.

When Is A Good Time To Think About Refinancing Your Mortgage

However, these are good reasons for taking out a refinance. Because of the costs associated with modifying the mortgage; It doesn’t make sense to everyone. If you’re considering it, don’t know if it’s right for you. If you’re not sure, visit Trusted to connect with experienced loan officers to answer your mortgage questions.

The two most popular types of mortgage refinancing include: cash-out refinancing and rate and term refinancing. A cash-out involves taking out a new mortgage loan that is larger than your current loan balance. The lender gives you the cash difference that you can use to improve your home or consolidate debt.

In contrast, a rate and term loan involves taking out a new loan equal to your current loan. A new loan pays off your mortgage and you can get a better rate or more favorable mortgage terms.

Before you decide whether refinancing your mortgage is the right move for you, you need to weigh the pros and cons. Let’s look at the benefits first.

How To Remove A Name From A Mortgage (when Allowed)

If you refinance your loan at a lower interest rate. You can reduce the amount of interest you pay each month. This may result in lower payments if you choose a longer or similar loan term.

30-year mortgage rates have been rising since early 2021, but fell to 3.18% on April 1. According to Freddie Mac, the average 30-year fixed rate at the end of April was 2.98%. Rates are near historic lows.

Use an online refinance calculator to estimate what your new monthly costs will be after refinancing your mortgage. You can visit Credible to compare rates without affecting your credit score.

Another way to reduce the amount of interest you pay is to refinance the loan from a longer term to a shorter term. For example, if you refinance from a 30-year loan to a 15-year mortgage. Interest will be reduced over the life of the loan.

Should I Refinance My Mortgage? 6 Questions To Ask Yourself

By reducing your mortgage payment or using a cash-out service; This can free up money towards high interest credit card debt. If you have no other credit card debt. The extra money saved on monthly payments can go toward building your savings.

If you are considering refinancing your debt for debt consolidation. Visit online marketplaces like Trusted to see refinancing rates and get cash to pay off high-interest loans.

If you put the monthly savings from your loan refinance into a home improvement fund. You’ll have more money to pay for basic home repairs or renovations.

Despite the temptation to jump on the refinance bandwagon to record low mortgage rates. Take a moment to consider the disadvantages of refinancing.

Is Now A Good Time To Refinance Your Mortgage?

Refinancing your loan can increase the length of your loan. This can increase the amount of interest you pay in the long run and negate the benefits of refinancing.

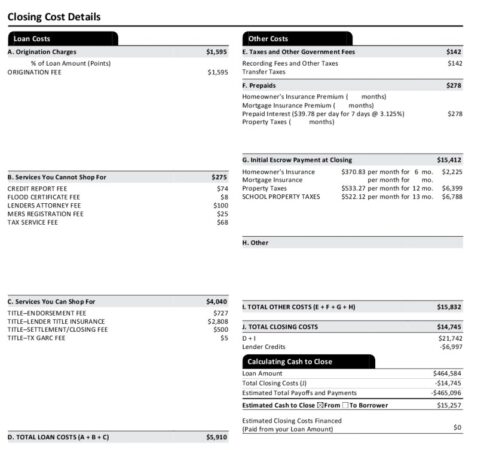

Some lenders charge you closing costs when you refinance; Application fee and assessment fee will be charged. These fees can make the costs outweigh the benefits of refinancing.

Also, if your home appraisal is too low; You may not get the best refinance rates.

If you plan to move soon; You may also lose out on initial refinancing costs. To enjoy the long-term benefits of refinancing; Depending on how high your previous mortgage rate was, you may have to stay in your home for several years. The number of years depends on how much you spend on refinance fees.

Misconceptions Of Home Loan Refinancing: Hdb Loan Vs Bank Loan

By selecting the cashback option; You will end up with more debt. This can make it difficult for you to save money.

Refinancing your mortgage is a personal decision, and homeowners should consider their unique financial circumstances. Benefits include lowering your monthly payments; Paying off your debt faster and having more money for home repairs. However, disadvantages include monthly costs; This includes moving the essential closing costs and long-term benefits before they accrue.

Have financial questions but don’t know who to ask? Email a Credible Money Expert at moneyexpert@credible.com and Credible can answer your question in our Money Expert column. Ready to cash out? It’s time to find the right lender. We believe it is the best lender out there; You are giving us the questions we need to test. Here are the 5 most important questions to ask potential lenders before refinancing.

If you’re like most borrowers, because you’re interested in a “no cost” loan, your refinance is out of pocket. Borrowers often advertise their potential rates that are not considered credit to lenders required for the cost of recovery. therefore

What Documents Do You Need To Refinance Your Mortgage? A Checklist

Questions to ask when looking for a mortgage lender, questions to ask when choosing a mortgage lender, questions to ask before refinancing your mortgage, questions to ask for refinancing mortgage, what questions to ask when refinancing your mortgage, questions to ask mortgage lender when refinancing, questions to ask when refinancing your mortgage, questions to ask lender mortgage, what questions to ask when refinancing a mortgage, mortgage questions to ask your lender, what questions to ask mortgage lender, questions to ask when refinancing mortgage