Proof Of Income Form For Self Employed – SUPPORT FORM FOR INCOME AND EXPENDITURE OF COOPERATION Fill out this form so that income and expenses are paid. Part I is a record of your business income (please provide the most recent

Gather all necessary documents such as tax returns, profit and loss statements and other relevant financial records.

Proof Of Income Form For Self Employed

Provide details of your self-employment, including company name, address and type of work.

Florida Kidcare ≡ Fill Out Printable Pdf Forms Online

Provide details of expenses related to self-employment, such as business expenses or transportation expenses, and supporting documents.

Individuals applying for loans, credits or financial assistance programs may be required to complete a verification form to prove self-employment.

Self-employed people who need to provide proof of their income for tax purposes may also need to complete a confirmation form to confirm their income.

Email, fax or share your URL to receive a free confirmation form. You can also download, print or export forms to your favorite cloud storage service.

Methods Landlords Can Use To Verify Proof Of Income

Create an account If you are a new user, click Start Free Trial and create a profile.

Just add a document Select Add New on the dashboard and transfer the file to the system by downloading it from your device or the cloud, online or from internal email. Then click Start Editing.

Change the model of verification of income from self-employment. Change text, add elements, rearrange pages and more. Then select the Documents tab to share, share, close, or open the file.

Save your file Select your records from the list. Then click on the right tool and choose one of the different export options: save in multiple formats, such as PDF, email, or download to the cloud.

Self Employment Ledger Template

It makes working with documents easier than you can imagine. Create an account to find out for yourself how it works!

Here are some ways to prove your self-employment income: Annual Tax Return (Form 1040) This is the most reliable and accurate way to show your income for the past year because it is an official legal document recognized by the IRS. 1099 form Bank statements. Profit/Loss Statements. Free activities.

If you are self-employed, you can show proof of income in the following ways: Use your client’s Form 1099, which shows how much you earned. Create a profit and loss statement for your company. Provide bank statements showing that the money is in the account.

Income statement and self-employment tax return (1099). These forms prove your wages and taxes when you are self-employed. Profit and loss statement or general ledger documents. Bank statements.

Sample Employee Job Verification Letter

Verification letters for independent contractors must, at a minimum, list dates of employment, rate of pay, and project hours/contract fees. This will help the auditors to assess the current income from the employer.

I confirm that I am (since then) self-employed and that I work under a business name (business or personal name). This is a company (partnership or just a partnership) and I own XX% of the shares.

This Agreement is dated on the 20th day between (name of engaged), hereinafter referred to as engaged and (name of artist), hereinafter referred to as

National Grand Lodge of Richest Free and Accepted Freemasons Ancient Prince Hall Origin National Compact, USA JEFFERSON D. TUFTS, SR. UNIVERSITY

Self Employment Proof Of Income

CCF Recommended Childcare Weekly Schedule Childcare Provisional Implementation and Applications CCFLC Recommended Weekly Attendance Schedule

IF YOU DO NOT SEE THE RED CIRCLES BELOW, GO BACK TO THE PREVIOUS PAGES AND FIND THE ANSWERS TO THE EXERCISES. Job Application Form 30/09/2016 Today

NYS SCHOOL HEALTH EXAMINATION FORM COMPLETED SPECIFICALLY BY PRIVATE HEALTH PARTY OR CHOICE OF SCHOOL HEALTH MACHINE Note: SAN required.

May 13, 2015 … For use only. Under Section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except for private foundations)

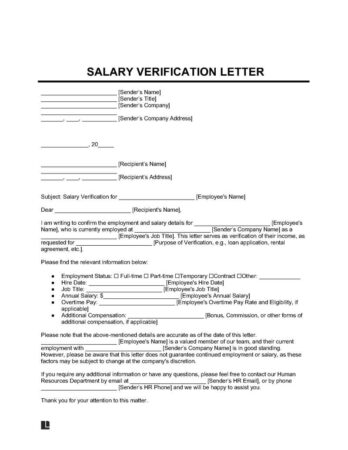

Employment Verification Letter

Application for enrollment in DE en El register DE weapon DE job * 1. PERSON’S DATE (Additionally with tetras muscular): Legal citizenship

Request to join DE en El registry DE activities y envasadoras * 1. PERSONAL HISTORY (free con tetras muscle): Hombre y spelling Del title

Request to join DE en El register DE motion * 1. PERSONAL HISTORY (Con tetras muscular Complimentary): Nature of justice (1) Mixed spelling

Application for membership in DE en El registry de envasadoras * 1. HISTORICAL PERSONS (mixed muscle tetras): Capacity (1) Spelling

Bir Income Tax Return Forms: 1700, 1701, 1701a: All You Need To Know!

If you believe this page should be removed, please follow the DMCA process here March 30, 2017 … The Department of Medical Assistance (MA) analyzed the Second Amendment findings on … MAGI? KONESHOP. ? HEALTH HOSPITAL. ADD or IA/IS #. Program / Course. Character

Provide details of your self-employment, including the type of work, the date you started and your average monthly income.

Self-employed individuals who need to submit their income documents for various reasons such as applying for credit or loans.

Entrepreneurs or business owners who may be asked for proof of income when applying for business loans or grants.

What Is Proof Of Income? Plus, Examples Of How To Show What You Make

Email, fax or share the URL of the free income verification form. You can also download, print or export forms to your favorite cloud storage service.

Sign in to your account If you don’t have a profile yet, click Start Free Trial and sign up for one.

Uploading a file Select Add new to the dashboard and upload a file from your device or export it from the cloud, online or from internal email. Then click Edit.

Editing Income Index Formats Add and edit text, add new items, change pages, add watermarks and page numbers, and more. After you finish editing, click Done and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

Iso Audit: What Is It & How To Get Prepared (checklist)

Save your file Select it from the list of records. Then move the cursor to the right tool and choose one of several export methods: save in multiple formats, download as PDF, send by email or save to the cloud.

Keep accurate and detailed records of your self-employment income and expenses. It could be a spreadsheet, an accounting software program document, a handwritten book, or something that records all of your company’s income and expenses.

Next, we’ll look at 10 ways to show proof of income if you’re paying in cash. #1: Make a payment. #2: Have an up-to-date spreadsheet. #3: Backup software. #4: Always pay and print bank statements. #5: Do it in text. #6: Create your accounts. #7: Use tax documents. #8: Use an app.

If you did not receive a 1099 form from your employer, you must still report your income on your tax return. You can do this using Form 1040 Schedule C. This form is for self-employment income and expenses. You will need to provide your company’s social security number and EIN if you have one.

Free Employment (income) Verification Letter

Here are some ways to prove your self-employment income: Annual Tax Return (Form 1040) This is the most reliable and accurate way to show your income for the past year because it is an official legal document recognized by the IRS. 1099 form Bank statements. Profit/Loss Statements. Free activities.

If you are self-employed, you can show proof of income in the following ways: Use your client’s Form 1099, which shows how much you earned. Create a profit and loss statement for your company. Provide bank statements showing that the money is in the account.

Welcome to self-employment. This is lesson 2, and our goal is to look at the income you earn if you are self-employed, as well as the additional taxes you may owe today, which is self-employment. self-employment income to understand and calculate self-employment tax and understand the tax forms used for self-employment income as well as related taxes, so what self-employed people and independent contractors are not. Workers are not the same as other people, so if you go out and have a baby, for example, you are self-employed, if you walk around your neighborhood mowing people’s lawns, you are self-employed. Obviously. A variety of self-employed people, from babysitters to those who actually run a business with their own employees, are self-employed or self-employed whose benefits and taxes are properly accounted for. say I haven’t looked at form 1040 yet, but if you have a private business, they always report on form 1040, but they are organized and posted on Schedule C first, if you have a profitable business, it is in your best interest. They don’t have to pay self-employment taxes for this job, which are also calculated and reported on the 1040, but come from Schedule S II where the tax is calculated when you claim the other person as an employee. You pay Medicare and Social Security with your employer, and they still pay Medicare and Social Security on your behalf.

Income proof for self employed, self employed proof of income form, income tax for self employed, personal loans for self employed with no proof of income, proof of income letter for self employed, proof of income for self employed template, loans for self employed with no proof of income, self employed income for mortgage, income statement for self employed, self employed mortgage proof of income, self employed proof of income, proof of income if self employed