Proof Of Income For Self Employed Template – An employment verification letter or proof of income confirms the income earned or salary of an employed person. This type of verification is most often used when someone is looking for a house or applying for a loan.

Please accept this letter as confirmation that [employee name] is employed and employed by us, providing the following details:

Proof Of Income For Self Employed Template

If you have any questions or need more information, please do not hesitate to contact me at [employee phone number].

Free Affidavit Of Financial Support Template

Each state’s Secretary of State or equivalent searches the user database for business entity directors. Ask the interviewer to obtain a cover letter from the director or employer. After receiving the letter, you can check online whether the company profile of the person signing the letter matches the country.

To be sure that the employer has actually signed the letter, it is best to call during working hours. If no subscribers are found, it is best to return the phone or ask someone who can help check it.

When requesting a letter, it is best to ask the employer for two previous pay stubs. If this is not available, it is best to ask the person for a bank statement for the last month. This will show not only their income, but also their spending habits and prove that they are financially responsible.

Typically, self-employed people are paid in cash. In such cases, it is best to declare your income tax for the last two years. All residents of the United States must pay taxes to the federal government. Therefore, if a person earns some type of money, the document can be easily obtained.

Employment Verification Form (evf) ≡ Fill Out Work Income Pdf

*Applicants may also require individuals to file IRS Form 4506-T, which asks the federal government to verify a self-employed person’s income for the previous year. It takes about one business day and is free of charge.

If none of the above solutions seem promising, your best bet is to obtain the person’s credit report. This can be easily done by collecting an individual’s information through a background check authorization form. Once you have all the necessary information, you can conduct a search on Equifax, Experian, or Transunion.

By using the website, you consent to the use of cookies to analyze website traffic and improve the comfort of using our website. March 30, 2017… The Department of Medical Assistance (MA) reviewed the results of the second preliminary assessment of the change. .. MAGIC? TRADITIONAL. ? Health.ADD or IA/IS#. program/course. processing

Provide detailed information about your startup, the nature of the company, when you started and your average monthly income.

Télécharger Gratuit Employment Income Verification Form

Self-employed people who need to prove their income for various purposes, such as applying for a loan or mortgage.

Entrepreneurs or business owners may be required to provide proof of income when applying for a business loan or grant.

Get your free proof of self-employment income by email, fax or share your URL. You can download, print, or export the forms to your favorite cloud storage service.

Log in to your account. If you don’t have a profile, start your free trial and sign up.

What Valid Proof Of Income Do You Accept?

Send file. Select Add new to your panel and upload the file from your device or import it from the cloud, web or internal email. Then click Edit.

Edit your income verification template. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click OK when you finish editing and go to the Files tab to merge or split the file. If you want to lock or unlock the file, click the Lock or Unlock button.

Save your file. Select it from the Notes list. Then move your cursor to the right toolbar and choose one of several export options: save it in different formats, download it as PDF, send it by email or save it in the cloud.

All accurate and detailed records of your company’s income and expenses. This could be a spreadsheet, an accounting software file, a handwritten notebook, or anything else that records all of your self-employment income and expenses.

Sample Income Verification Letter For Self Employed Download Printable Pdf

Next, we’ll look at 10 ways to prove your income if you’re paying cash. #1: Create a checkout. #2: Keep your spreadsheet current. #3: Accounting software. #4: Always print payments and bank statements. #5: Write it down. #6: Create your own coupons. #7: Use tax documents. #8: Use an app.

If you haven’t received a Form 1099 from your employer, you will still be required to report your income on your tax return. This can be done by using Form 1040, which reports self-employment income and expenses. If you need to provide your Social Security number and business EIN.

Here are some ways to prove self-employment income: Annual Tax Return (Form 1040) This is the official legal document recognized by the IRS and is the most reliable and direct way to show your previous year’s income. Form 1099. Bank Statement. Profit and loss accounts. Independent salaries.

If you’re self-employed, you can provide proof of income in the following ways: Use a Form 1099 from your client to show how much you earned from them. Prepare your company’s profit and loss statement. Provide a bank statement showing the amount credited to your account.

Vetassess Employment Reference For Self Employment Template

Welcome to Self-Employment In this lesson 2 we will look at the income you earn if you are self-employed, as well as the additional taxes that may arise from our current goals. Self-Employment Income Understands and calculates self-employment taxes and what tax forms should be used for self-employment income and related taxes for self-employed individuals to be independent contractors. If you’re away from home and you’re a babysitter or mow lawns for people who shovel snow, you’re considered self-employed. From self-employed people at all levels, from childminders to self-employed people who run their own business and employ their own staff – we have done a good job of reporting our income, profits and tax burden as self-employed or independent workers. If there is only a sole proprietorship, they are often reported on Form 1040, but they are organized and filed first on Schedule C if your business is likely to be profitable. This profession requires self-employment taxes, which are calculated and reported on Form 1040, but come from Schedule S II, which is structured and taxed when you work for someone else as a Medicare-paying employee. Social Security Your employer pays Medicare and Social Security, so what you pay to your employer is the same as what you pay to your employer, and if you run your own business you have to pay twice as much and Schedule SE calculates it for you, what are so examples of expenses related to self-employment? When you run a business, you record your income, but you also record all your expenses, and these expenses are subtracted directly from your income to give you your net profit, an example of which is the advertising you have to run. Your business may have a car, truck or travel expenses, legal fees for equipment, office expenses, loan interest, separate insurance payments, and you may even rent things, so if you’re self-employed, everything related to the business you control your expenses because they can be deducted directly from your income when you think about how much tax you owe. You pay taxes on your gross income You pay taxes on your net income, so how does your gross income and all your expenses affect your net income as a sole proprietor? Think of it like an employment tax, your income is taxed like a regular self-employment loss, but less…

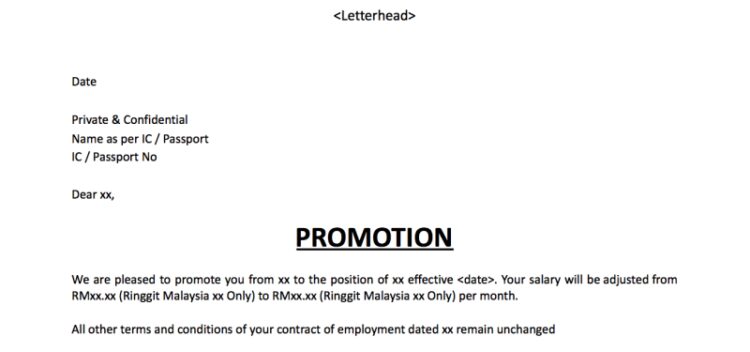

An employment verification letter, also known as an “employment verification letter,” is a form that verifies the income or salary earned by an individual. This type of verification letter is often used when someone is looking for a home or applying for a mortgage loan.

Self-Employed Income Verification… Use this form to register

Personal loans for self employed with no proof of income, self employed no proof of income, proof of income if self employed, self employed proof of income template, loans for self employed with no proof of income, how to show proof of income self employed, income proof for self employed, how to provide proof of income if self employed, self employed proof of income letter template, how to show proof of income if self employed, self employed proof of income, self employed mortgage proof of income