Profit And Loss Statement And Balance Sheet Template – Enter your email address below and get personalized help from our team (real people!) and tips on how to automate your financial reporting.

Join hundreds of accountants and finance teams and automate their workflows, saving hours of work every week.

Profit And Loss Statement And Balance Sheet Template

What is Comparative Month and Year Dates – Profit and Loss and Balance Sheet Template 101? PL by YTD

Financial Modeling Assumptions

The sheet displays the monthly financial data for the specific month selected in cell B13 and the year-to-date data from the beginning of the current calendar year. It also compares the figures for the same period of the previous financial year. Column A provides an overview of all profit and loss accounts. Columns D and H show the percentage changes for the monthly and year-to-date comparisons noted above. These numbers, along with percentage changes, automatically update as you move from one month to the next. This sheet contains a detailed income statement based on the “Profit and Loss” data in the “Month” sheet.

How to Compare YTD Sheet PL Monthly and Year to Date – Profit and Loss and Balance Sheet Template

This worksheet, like PL by YTD, provides a detailed balance sheet based on “Balance Sheet by Month” data. The data set provides information about the monthly balance of the end of a particular month selected in cell B3 and the same month of the previous year. The change in quantity of each item is shown in column D. On the right side of the dataset; You can see the latest balance along with the % change in each item compared to the same month of the previous financial year.

What does YTD Balance Sheet look like on Comparative Month and Year Date – Profit and Loss and Balance Sheet Template

Bar Profit And Loss: Complete Guide [free Template]

These sheets include the income statement and balance sheet compiled from your QuickBooks account. By default, each sheet in the template contains monthly financial data for the past two years. You don’t need to calculate statistics, because the two sheets mentioned above automatically calculate the differences between items and show the percentage of changes.

Thank you for your interest in learning more about Comparative Monthly and Year-to-date Profit and Loss and Balance Sheet Template. In this post, we’ll give you all the information you need to quickly compare your monthly finances, what to look for, and how to create your own. We’ll also share tips to help you increase your workflow efficiency tenfold.

With comparable monthly and yearly profit and loss and balance sheet templates, you can easily compare current monthly financial information to the same period last year. The template not only displays a comparison of financial data, but also automatically calculates the percentage change for each item.

Why is it beneficial to compare monthly and yearly?

How To Build A (better) Advisory Firm Chart Of Accounts

Checking monthly financial information and comparing it to the same period last fiscal year is essential for several reasons: As a small business owner, you always want to innovate and grow your business. But how do you know if your business, sales and expenses are driving or failing?

A profit and loss statement is a detailed financial statement that shows you and your investors where you’re making money and where all production and operating expenses are going. It shows your ability to generate profit and channel costs appropriately, giving you important insight into the financial health of your business.

Our guide will take you through all the necessary steps to prepare your first profit and loss statement (free template included!) and get a flawless view of your company’s finances.

A profit and loss statement, also known as a P&L statement, is used as an important indicator of how a company is performing. Also called an income statement, this document shows the company’s revenues, expenses, and net income.

Excel Of Non Profit Balance Sheet Statement.xlsx

Other common terms you may come across include statement of operations, statement of financial performance, income statement, and profit and loss statement, all of which refer to the same financial statement.

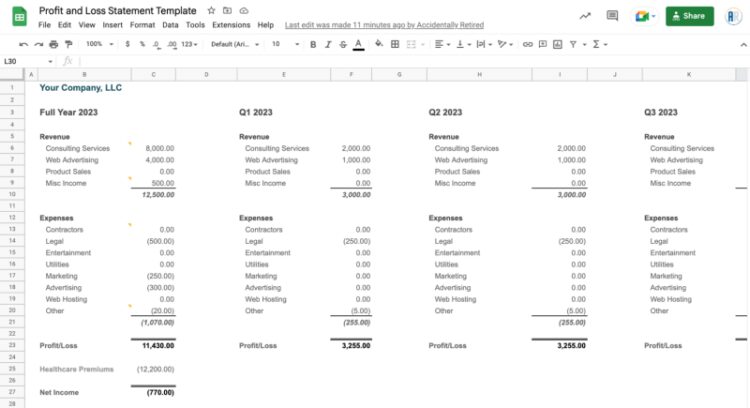

Here is a template for a simple profit and loss statement that you can edit according to your income and direct expenses. Just click “Make a copy” and your own editable version will appear in Google Sheets.

As well as being a key indicator of your business’s financial health, it also shows investors and creditors how much money you’ve brought in and spent so far. This allows you to see if your business is profitable and predict how your business will grow in the future based on past growth rates.

Not to mention it is a useful tool for estimating future budgets and eliminating unnecessary expenses.

Income Statement Definition And Example

Depending on the industry you are in, a company’s profit and loss statement can provide you with different statistics and metrics.

Do you run a construction company? A P&L statement shows a clear representation of your labor costs. Do you run a restaurant? Yes, a detailed description of which dishes sell well and if you lose a dish no one will order.

Along with balance sheet and cash flow statement, every public company has to publish profit and loss statement on quarterly and annual basis. These financial statements are filed with the US Securities and Exchange Commission and can be examined by any investor or business analyst.

A balance sheet paints a complete picture of your company’s finances. This includes your company’s assets, capital structure, liabilities and working capital – aspects not included in a P&L statement.

Solved Excel Income Statement & Balance Sheet Create An

Meanwhile, a profit and loss statement is used to analyze your profit and loss over a specific and often longer period of time. This allows you to spot red flags, such as your expenses growing faster than your income. This will help you determine if your profits are decreasing despite increased sales.

You can also use the P&L statement to evaluate the feasibility of starting a new project. In fact, the profit and loss statement plays a big role in the decision-making process because it can help you determine whether you can:

Large companies add dividend and interest income, as well as expected taxes, interest payments, and depreciation or amortization to all expenses.

To accurately determine whether or not your business is profitable, go to the bottom line: your net income.

Top 3 Financial Statements In Excel: Income Statement, Balance Sheet & Cash Flow

The first step in creating a P&L statement is to decide on the time frame you want to analyze. Weekly, monthly or quarterly time frames are common options. That said, think about why you need a report.

For example, a quarterly report gives you a big picture of your profit and loss for a quarter of the financial year. Once a year does not allow you to monitor fluctuations or potential risks.

Make periodic decisions and generate regular profit and loss reports. By running these reports at regular intervals, you can easily compare all changes in your business.

You can allocate income to different segments and revenue streams. Your general ledger and accounts are two good sources of this information.

Financial Profit And Loss Statement Excel Template And Google Sheets File For Free Download

Complete the second part of the report by including how much your raw materials cost, the wages to produce those raw materials, and additional manufacturing costs.

Now that you know how much money you put into your business and what your income is, let’s subtract expenses from your gross income.

The long section of this financial statement may include business expenses such as travel expenses, salaries, rent and real estate, office supplies, utilities and maintenance services, insurance, telecommunications, marketing and advertising, and shipping costs.

To get your pre-tax income, you need to subtract your expenses from the gross profit we calculated in the previous step.

Free Profit And Loss Templates (monthly / Yearly / Ytd)

You may have noticed that we did not include income from investment dividends and interest in step 1. Because they were added later. At this point, you have your EBITDA (earnings before interest, taxes, depreciation and amortization) total.

Before calculating your final net income, add all expected taxes and depreciation or amortization to all expenses and interest payments.

Remember you can always use our own profit and loss template to determine your exact income and expenses.

Go to your accountant and/or accounting software when creating this financial statement and save it to Google Drive or with other operational documents in the payroll application.

Customizable Profit And Loss Template For Smbs

If you’re still not sure if you need a profit and loss statement, the answer is: Yes! If you’re a small business just starting out, documentation provides valuable insight into your company’s development from day one.

Now that you have this aspect of your business’s financial health under control, you’re ready to put together your first profit and loss statement. Need more help with payroll and expense reporting? Use it to manage pay periods, calculate overtime, pay your employees and more

Balance sheet vs profit and loss statement, financial statement profit and loss balance sheet, rental property profit and loss statement template, monthly profit and loss statement template free, profit & loss statement and balance sheet, projected profit and loss statement template, monthly profit loss statement template, small business profit and loss statement template, profit and loss statement and balance sheet template, profit and loss statement and balance sheet, profit and loss statement sheet, profit and loss statement with balance sheet