- Profit And Loss Statement And Balance Sheet Of Any Company

- Difference Between The Profit And Loss Account And Balance Sheet

- Prepare Trading, Profit Loss A/c And Balance Sheet For The Year End 31st March ,2009 Name Of Account

- Trial Balance Vs. Balance Sheet Vs. P&l Vs. Income Statement

- Financial Statements Activity

- Free Comparative Monthly And Year To Date

- Exercises Financial Statement

Profit And Loss Statement And Balance Sheet Of Any Company – Financial statements can be scary. There can be multiple line items. Learn to navigate the company’s balance sheet and financial statements – divided into sections.

In this post, we’ll break down Apple’s ($AAPL) financial statements into key sections so you can better understand and learn what’s most important.

Profit And Loss Statement And Balance Sheet Of Any Company

First, let’s talk about why balance sheets and financial statements are important. Especially what they are here to discuss with investors.

Financial Statement Templates: Everything You Need To Know

If any of you like to keep track of your net worth as well as your liabilities and assets (like your house), then it’s like a company’s balance sheet.

A budget plan for a large company may have some specific resources for the business. Examples include inventory or receivables (sales made but not yet converted to cash).

Your income statement is similar to a profit and loss statement. The higher is your gross income, and that’s like the company’s income. Taxes are then deducted to arrive at the mortgage payment, which is your income.

Just like an individual, a company has income that is calculated after tax, but also includes expenses necessary to run the business. Examples include the cost of employees and the cost of purchasing parts to produce goods.

Difference Between The Profit And Loss Account And Balance Sheet

As a human being, we can tell about the overall financial situation of a company just by looking at the balance sheet and cash flow.

Let’s take a look at Apple’s annual report (10-K). We will focus on the balance sheet and additional income.

When it comes to budgeting, the most important metric is actually intelligence. We should pay close attention to total assets, total liabilities and equity.

Shareholder’s equity is simply total assets minus total liabilities. You can think of it as the value of the company, and that number is called Book Value in Wall Street World.

How To Build A (better) Advisory Firm Chart Of Accounts

Total assets are exactly what they sound like. That’s what society has. Maximize income from assets, i.e. the more assets a business has (in general), the more profitable it will be.

In general, be careful when making deductions for full liability businesses. These are expenses that the company will pay no matter what. Assets can be sold to generate income, they can move; But the debt will eventually be repaid, and you cannot escape that fact.

If you want to see how good a company is in the short term (“its liquidity”), you can look at two metrics:

When the trade and financial battles are over, companies that don’t have a lot of cash can find themselves in serious trouble, even bankruptcy.

Prepare Trading, Profit Loss A/c And Balance Sheet For The Year End 31st March ,2009 Name Of Account

You can use simple measurements like the quick and current ratio to look at a company’s short-term assets and liabilities and see how safe (or not) they are.

As a balance sheet with a few numbers, we can feel the value of the company. (Remember, it’s profit for the balance sheet and long-term health for the balance sheet).

Revenue or sales will be the number at the top of the income statement. It tells us how much money the company will bring in before expenses or taxes are deducted.

You may hear analysts or other entrepreneurs talk about “top quality development”; The first line refers directly to revenue or sales because it is the first line of the financial statement.

Trial Balance Vs. Balance Sheet Vs. P&l Vs. Income Statement

Revenue or sales can refer to a business, it is the amount of money a company has for its products or services. This number is usually less volatile than net income, which we’ll discuss later.

This is the final figure after the company has paid all its expenses, taxes and other non-financial adjustments (such as depreciation or amortization). Don’t worry about learning the details, just the basics.

At its most basic, earnings are where a company will increase its business growth, so clearly something is better.

The last number to consider is EPS, or earnings per share. This is the net number divided by the number of shares in the process.

How To Read A Profit And Loss Statement?

All this means is to say, as a shareholder, how much money you will get for the share you buy.

As with net income, even better, you can compare EPS year-over-year to see how the company has been doing recently. Income growth goes hand in hand with long-term stock prices and is a source of income.

To better understand the main drivers of a company’s net income, you can look at two metrics:

These parts represent the various costs necessary for running a business. For gross profit, the capital cost of producing the product or service is deducted. Other expenses such as marketing (“SG&A”) and research and development (“R&D”) are excluded from the profitability perspective.

Financial Statements: List Of Types And How To Read Them

You can get into the weeds with these ideas. They are so important that Wall Street is watching them closely. But like eating pizza, you can’t do it right away.

Take the time to digest them and check out our other step-by-step guides on profitability metrics, financial statement (line-by-line breakdown) and balance sheet (line-by-line breakdown) to get a better feel. for senior drivers. business.

Andrew always believes that average investors have great potential to build wealth through the power of patience, long-term thinking and compound interest. 2022-07-13 00:00:00 2022-07-14 00:00: 00 https:/ //r/accounting/balance-sheet-vs-profit-and-loss-select/ accounts english Among the three financial statements, that companies provide, confusion may arise regarding the transitional use of income statements and budgets. . . This is the difference. https://oidam/intuit/sbseg/en_us/Blog/Graphic/balance-sheet-vs-profit-loss-header-image-us-en.png https://https://https://https:/ //// r/accounting/balance sheet-statement-income-statement/ Balance Sheet vs Income Statement: Understanding the Relationship –

When you look at your financial statements, there are three main types of statements that you prepare on a regular basis: the balance sheet, the income statement, and the income statement.

Financial Statement Basics: What Is A Balance Sheet?

Of these three terms, two are often confused: the balance sheet and the income statement. So what are the differences and similarities you should be looking at, and how can each statement contribute to your company’s bottom line?

The balance sheet and income statement contain similar financial information; However, there are differences to consider. The main difference is that the balance sheet presents information about a company’s assets, liabilities, and equity, while the income statement summarizes information about revenues and expenses.

The balance sheet is an accounting statement that reports on the company’s assets, liabilities and equity. It is used to collect information over a fixed financial reporting period, such as monthly, quarterly or annually.

The balance sheet is also known as the statement of financial position because it summarizes the financial situation of the company. This includes:

Financial Statements Activity

The balance sheet contains three items used to determine the value of a business: assets, liabilities, and equity.

To start off on the right foot, here is a basic example budget as an example for reference. The template includes a table where you can customize the rows and columns to suit your needs, such as adding new accounts and changing names.

The profit and loss statement is another of the three basic financial statements. They include collection of income, expenses and total production costs. The income statement provides insight into a company’s ability to generate revenue by reducing costs or increasing sales.

A company’s income statement shows the difference in production over a period of time, usually monthly, quarterly, or annually, depending on your accounting method. Unlike the balance sheet, the income statement contains several other categories. These include:

Free Comparative Monthly And Year To Date

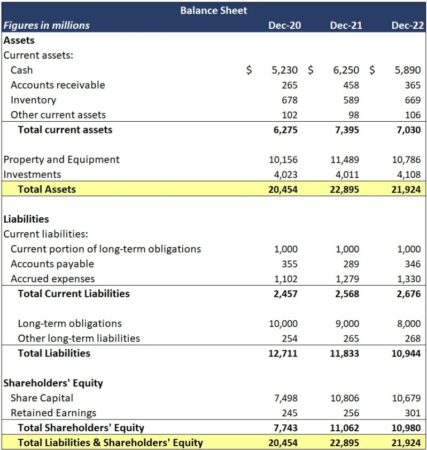

In the image above, we can see that all sales, expenses, and taxes are listed, which equals the net income for the year. This will be completed with the budget you created earlier and the net income will appear in the income statement element of the balance sheet.

The balance sheet and income statement can be used in different situations depending on the financial period and the need to understand your company’s financial situation. For example, here are some cases where a balance sheet and a profit and loss statement are required:

Although the balance sheet and income statement may be similar, there are several key differences that set them apart, including:

The three financial statements always work to create a complete picture of the company and its financial situation. They must be prepared in a system where information from one group affects others. The procedure is as follows:

Exercises Financial Statement

As we mentioned earlier, the balance sheet and the income statement provide very different information. One has a business element while the other shows how money is spent. The group is divided as follows:

Let’s say someone is interested in investing in your company and is interested in how the company is run. A serious investor may ask to see your company’s financial statements to make sure the investment is a good one.

Profit and loss statement with balance sheet, year to date profit and loss statement and balance sheet, profit and loss statement sheet, balance sheet and profit and loss statement example, profit and loss statement and balance sheet template, profit and loss statement and balance sheet, profit and loss statement and balance sheet of any company, difference between balance sheet and profit and loss statement, balance sheet and profit and loss account of any company, profit & loss statement and balance sheet, sample balance sheet and profit and loss statement, balance sheet vs profit and loss statement