Profit & Loss Account And Balance Sheet Examples – Printable templates are pre-designed documents or designs that can be easily customized for different purposes. They are available in digital formats that can often be downloaded for free or at minimal cost. The possibilities are practically limitless, from organizational planners and to-do lists to artwork and business cards. These templates save time, effort and resources while providing a polished and professional finish.

Printable templates are a great way to save time and money when creating documents. These are pre-designed templates that you can download and print for free. There are many different types of printable templates available online, including calendars, to-do lists, budget planners, and more.

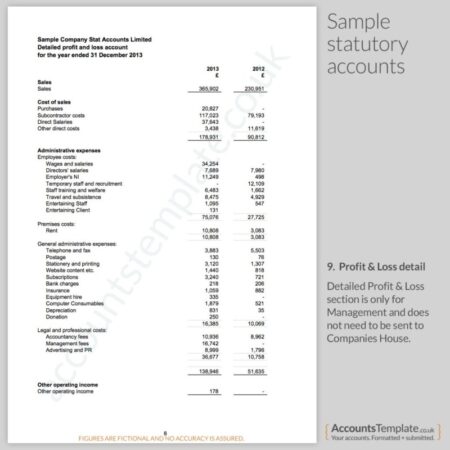

Profit & Loss Account And Balance Sheet Examples

One of the best things about printable templates is that they are customizable. You can customize them to your specific needs and preferences. For example, if you download a budget planner template, you can add or remove categories to suit your budgeting needs.

Accumulated Depreciation: Everything You Need To Know

Another great thing about printable templates is that they are easy to use. You don’t need any software or special skills to use them. All you need is a printer and some paper.

The beauty of printable templates is their versatility. They meet a wide range of professional needs and ensure that individuals from different industries can take advantage of their functionality. The options are extensive, from project management templates to meeting agendas, expense reports and performance reviews. These easy-to-use templates save time and ensure documentation is consistent and accurate.

Time management is a skill that can make or break a professional’s success. Printable planning templates like calendars, to-do lists, and goal trackers help you effectively manage tasks and deadlines. By visually organizing priorities and breaking down complex projects, professionals can stay focused, meet deadlines and reduce stress.

For professionals dealing with large amounts of data, table templates are a game changer. Whether it’s financial reports, project budgets or sales forecasts, pre-designed spreadsheet templates ensure data accuracy and simplify complex calculations. This enables professionals to make informed decisions and allocate resources efficiently.

Svb Highlights $620 Billion Hole At U.s. Banks

Printable templates have become indispensable for professionals who want to optimize their productivity and efficiency. From organizing daily tasks to creating impressive presentations, these templates meet a variety of needs and save valuable time. Whether you’re a business owner, manager, or employee, harnessing the power of printable templates can lead to streamlined processes, improved communication, and an enhanced professional image. Invest in these valuable resources to unlock your full potential and succeed in a dynamic and competitive professional environment.

Resources. We do not claim ownership of any trademarks, images or text displayed on this site. If you believe that any content on this site infringes your intellectual property rights or violates any law, please contact us here and we will remove your content. Please compensate us. A financial dashboard is a management tool that helps you track all important financial KPIs, enables effective cash management, and allows you to track expenses, sales, and profits in detail to meet and exceed your department’s or company’s financial goals. .

More than ever, financial professionals and departments are under intense pressure to provide fast insights, clear and reliable financial reports, while simultaneously improving business performance. Using financial dashboards, a business can quickly understand and measure all data accurately and in real time. They enable financial professionals to confirm numbers more quickly and analyze financial details as needed, increasing productivity and ultimately ensuring a stable financial environment. Data at your fingertips, rich analytical options from a single access point and financial KPIs with built-in smart alarms that immediately detect anomalies – all this creates limitless possibilities and eliminates tedious traditional means of data analysis and reporting. With modern financial business intelligence, you have the opportunity to consolidate all your financial data and create the fastest possible insight.

Here are 7 professional finance dashboards created for different roles and levels within the finance industry or department:

What Is A Cash Management Account?

Cash Management Dashboard – Financial KPI Dashboard – P&L Dashboard – CFO Dashboard – Actual vs. Forecast Dashboard – Financial Performance Dashboard – Operating Expense Dashboard

This financial dashboard template provides an overview of your current liquidity and cash flow status, while providing a clear indication of how you can improve these metrics by optimizing the processes that manage payables and receivables. Detailed gives you a quick overview of your Quick Statement, Current Statement, Cash Balance and Outstanding Debts.

The cash management dashboard first looks at current and quick reports. The short-term ratio is a financial measure that shows a company’s liquidity and its ability to meet short-term obligations (liabilities and liabilities) with its short-term assets (cash, inventory, receivables). This KPI is simply the ratio of current liabilities to current assets and shows your company’s flexibility in using cash immediately to make purchases or pay off debt. You should always aim for a ratio greater than 1:1 to ensure you can always meet your obligations. This financial dashboard allows you to instantly ensure that your business has the financial liquidity it needs to survive and thrive.

The quick ratio, also called the acid test ratio, gives a more conservative picture of the liquidity situation and does not include inventories and other less liquid assets as part of short-term liabilities. If your short-term assets include a lot of stocks, your acid test ratio will be much lower than your current ratio. Similar to the current ratio, a quick ratio greater than 1 means that your business can meet its current liabilities with its most liquid assets. Both reports in this financial dashboard template are heavily influenced by your accounts payable turnover, which measures how quickly you pay your bills on the one hand, and how quickly you collect overdue payments on the one hand.

Archimago’s Musings: Review / Measurements: Drop + Thx Aaa 789 Linear Headphone Amplifier. And On Audioholics’ Thx Onyx Dac/amp

Finally, our sample financial dashboard provides instant insight into your current liabilities and receivables. It allows you to quickly think about your current expenses and the money that needs to be collected to ensure that no payments are late, and consequently, the payments you owe. At the bottom of the dashboard, receivables information is broken down over the year, allowing you to analyze payment and debt collection patterns against your current and quick indicators, two litmus tests of liquidity and financial stability. your company.

Our next financial dashboard example provides an overview of the most prominent KPIs that can be applied to almost any financial or business department that needs stable and proactive management and operational processes. Using financial analysis software, this dashboard was created to answer critical questions related to an organization’s liquidity, invoicing, budgeting and overall financial stability. Let’s take a closer look at each of them.

A financial KPI dashboard begins with an overview of your current working capital, which consists of current assets and liabilities. This information will allow you to make an immediate decision about whether your organization is liquid, operationally efficient and financially sound in the short term. If the working capital is quite high, you have the potential to invest and grow. On the other hand, the risk of bankruptcy is higher if your current assets do not exceed your current liabilities. We can see that in our financial dashboard example, the working capital is $61000 and the current ratio is 1.90, which means that the company has enough financial resources to remain solvent in the short term, and from this dashboard you can conclude that immediately .

The core of this dashboard focuses on the cash conversion cycle (CCC) over the past 3 years. It is important to monitor trends in CCC to see if the cycle is decreasing or increasing. A brief look at these charts shows us that the company has effectively converted its investments, inventories and resources into cash flows over the past 3 years, as the cash cycle has steadily declined over time. Really great leadership.

Ratio Problems 1

As part of the cash conversion cycle, this dashboard describes the status of the billing and payment process. Incorrect addresses, double payments and incorrect amounts affect and increase the rate of supplier payment errors if accounting does not effectively control these processes. We see that this rate has had several peaks in the past year, raising the overall average and hitting the division, especially in September. This month, it would be wise to dig deeper to see exactly what happened and what processes need to be updated or adjusted. The following months brought a general decline, which could mean that the lesson was learned.

We finish our financial dashboard example with the net profit, quick and current ratio statistics, followed by the budget variance. You can access the entire domain from the control panel in full screen mode. A quick and current ratio will show us the liquidity status of our business, while the net profit margin is one of them

Profit and loss vs balance sheet, balance sheet vs profit and loss statement, profit loss balance sheet template, how to make profit and loss account and balance sheet, difference between profit and loss account and balance sheet, profit and loss account examples, profit and loss and balance sheet examples, profit & loss account and balance sheet examples, profit and loss statement and balance sheet, profit loss and balance sheet, balance sheet v profit and loss, profit and loss with balance sheet