Prequalify For Home Loan First Time Buyer – Buying a home can be stressful. This is often the biggest source of stress? Figure out how much you can afford and stick to that budget.

For many homebuyers, this means getting a mortgage before they even start looking for a home. Mortgage pre-qualification and pre-approval are two ways to better understand how much home you can afford. While the two terms are often used interchangeably and definitions may vary depending on your financial institution, it’s important to understand both when you start thinking about buying a home.

Prequalify For Home Loan First Time Buyer

Pre-qualification is one of the first steps in buying a home. This is usually an informal process in which you self-report basic information to your lender, such as your income, assets, debt, and ability to repay. Depending on the financial institution you choose, pre-qualification can be done in person, over the phone, or online. Based on the information you provide, you will get an estimate of how much you can afford to pay for your new home.

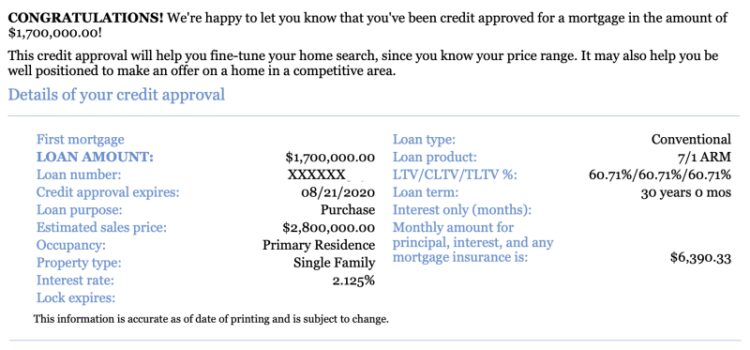

What A Preapproval Credit Letter Looks Like For Buying Property

What are the benefits of pre-qualification? Prequalifying is easy and quick for anyone. There are also no hard inquiries, so your credit score will not be negatively affected. What are the disadvantages? The amount you are entitled to receive is only an estimate and does not matter if provided to the seller.

Pre-approval on the other hand is a long and thorough process. After approval, the lender will want to see documents such as pay stubs, W2s, residency history, bank statements, and tax information. You’ll also need to share some form of identification (such as a driver’s license) and your Social Security number to check your credit history and score.

Once these documents are reviewed and verified, you may qualify for a pre-approval letter that states how much the lender is willing to lend you and the interest rate. What will be the rate? This is beneficial to both buyers and sellers when making an offer. This gives you confidence in your purchasing power while proving to sellers that you are a serious buyer.

The downside to getting a pre-approval letter is that it can take anywhere from a day to several weeks, depending on the lender’s process, so allow more time for this step.

Steps To Buying A Home

There is no standard definition for pre-approval or pre-qualification. As such, both processes vary from mortgage lender to mortgage lender.

With that in mind, consider working with potential lenders and speaking with a representative so they can walk you through the process and explain what they offer, whether pre-approved or not. or pre-qualification. You need to make sure it is defined. .

Going through the mortgage pre-qualification or pre-approval process can be a useful indicator of how much you can afford based on your income. You can also find out if you need to work on improving your credit score before applying for a loan. The housing pre-approval process relies on self-reported information and does not require a rigorous credit score search, so you can take your time to research your credit score if you wish.

Pro tip: As you consider your options with different financial institutions, some may take a hard look at your credit score. As long as it all happens within a relatively short period of time (usually 30-45 days), it will count as just one inquiry on your credit history.

How To Get A Mortgage Preapproval

The amount of time it takes depends largely on the lender’s procedures, but pre-qualification usually takes a day (or less), while pre-approval takes at least a day ( often from a few days to a week). Work with your lender to understand what you can expect and when you’ll qualify or be approved.

A mortgage pre-approval letter represents a promise from the lender, but it’s not a guarantee that you’ll get a loan. To get the original funds, you must go through the mortgage underwriting process as well as a third-party appraisal and inspection.

You can also add lenders to your shopping list because a pre-approval letter is not required. If you are pre-approved by multiple mortgage lenders, you have more financing options. Remember: Loan offers may be the same, but what may seem like a small difference in interest rates can add up over time.

Simply put, it depends on where you are in the home buying process. A pre-qualification is a relatively easy way to find out how much you can afford to buy a home without affecting your credit score, and it’s a great first step in the home buying process. While you don’t need a pre-approval letter to make an offer on a home, a pre-approval letter can help you stand out from other buyers and increase your chances of getting an offer accepted. Keep in mind that pre-approval letters are valid for 60 to 90 days (depending on the lender). So, take this step only if you have found a home and are close to making an offer.

How And Why To Get Pre Approved For A Mortgage

Today’s market moves quickly, with some homes taking less than a day to come on the market. Pre-approval makes it more attractive to sellers. Not only does this show that you are serious about your purchase, it also shows that you are more likely to be approved for a loan.

Once you receive your pre-approval letter, you can start narrowing down your search for homes that fit your budget. When it comes time to make an offer, your offer to the seller will include a letter. In this competitive housing market, where many homes sell quickly, getting pre-approved for a mortgage can be beneficial.

Our pre-approval process is informal and usually only takes a few minutes to complete. By providing us with information such as your desired tenure, income and assets, we can determine the types of loans available to you. We will also run a soft check on your credit history, but this will not affect your credit score.

Additionally, home buyers can create a custom pre-approval letter for each home they bid on. You may not want to show the seller that you can pay more than your offer, so you may receive a pre-approval letter that is less than your original pre-approval amount.

Get A Pre Approval For Your Home, Investment Property, Land, Or Home!

When buying a home, it’s important to know how much you can afford. Both mortgage pre-qualification and pre-approval can help you reach your home buying goals. When the time is right to make an offer, you’ll be better prepared and one step closer to making your dream home a reality. When looking for a home, getting pre-approved for a mortgage can be an important step. Talking to your lender and getting a pre-approval letter gives you an opportunity to discuss your loan options and budget with your lender. You can use this step to figure out your overall house-hunting budget and the monthly mortgage payment you can afford.

As a borrower, it’s important to know what mortgage pre-approval does (and doesn’t) do and how to increase your chances of getting one.

Think of a mortgage pre-approval like a financial exam. Lenders can push their way into every area of your financial life to make sure you’re making your mortgage payments.

You may have heard the term “pre-qualification” used interchangeably with pre-approval, but they are not the same. Pre-qualifying allows you to review your finances, income and credit to the mortgage lender. Your lender will then provide you with an estimated loan amount.

First Home Mortgage Pre Approval Checklist By Sammamish Mortgage

Thus, a mortgage pre-qualification can help you estimate how much you can afford to spend on a home. However, the lender will not obtain your credit report or verify your financial information. So while pre-qualification is a useful starting point for determining how much you can afford, it’s not critical when bidding.

On the other hand, pre-approval involves filling out a mortgage application and providing your Social Security number so the lender can perform a hard credit check. When you apply for a home loan, a rigorous credit check will begin. In this process, lenders take your credit report and credit score before deciding to give you a loan. These checks will be recorded on your credit report and may affect your credit score.

In contrast, a soft credit check is when you take credit back on your own or when your credit card company or lender pre-approves an offer without you asking. Soft credit checks do not affect your credit score.

It also lists all the information about your bank accounts, assets, loans, income, employment history, past addresses, and other important details that lenders will want to see. This is because lenders want more than anything else to make sure you can pay off your debt. Lenders use the information you provide to calculate your DTI and LTV ratios, which are key factors in determining your ideal interest rate and loan type.

Mortgage Pre Approval Vs. Prequalification: What’s The Difference?

All of these require prior approval.

Prequalify for home equity loan, prequalify for first time home buyer loan, prequalify first time home buyer loan, prequalify for first time home buyer, prequalify for mortgage first time buyer, prequalify first time home buyer, first time home buyer loan application, apply for first time home buyer loan, prequalify first time home loan, prequalify for home loan online, prequalify for va home loan, prequalify for home loan