Preparing Cash Flow Statement From Income Statement And Balance Sheet – John Houston, CEO and founder of Home Store, Inc., discussed the company’s income statement and balance sheet for the last fiscal year ended December 31, 2012. Home Store grew rapidly during the year past, with sales and revenue increasing significantly. to 2011. Although John is happy with the increase in profits, he sees a decrease in cash flow. John decided to follow this up with Linda Nash (CFO) and Steve Bauer (Cost) in their weekly meeting:

John: I received the income statement and balance sheet for 2012. Profits are good, but our financial situation seems to be deteriorating. We started the year with $130,000 in cash and ended with only $32,000. I’ve noticed that the cash flow has been going down every year when I look at our monthly financial statements, but I’m amazed at how low our balance is. Steve: You’re right, John. Despite growing sales and profits, we experienced cash flow problems several times throughout the year. I have had to delay payments to creditors many times due to cash flow problems. John: I don’t think we should have this problem. Where does our money go? Linda: That’s a good question. Let me summarize our financial statements for the year. I’ll have something for you next week. John: Thank you! I would like to start next week’s meeting by talking about the income we received in 2012 from our daily activities. I understand that net income is shown on net income, but I would like to know the net income in cash. Linda: No problem. I will bring it to you next week.

Preparing Cash Flow Statement From Income Statement And Balance Sheet

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg?strip=all)

The Home Store, Inc. has cash flow problems common to most fast growing companies. While the income statement and balance sheet provide important information about financial activities and financial position, neither statement provides information about cash flows during a specific period. This chapter focuses on preparing statements that provide cash flow information. This word is the same as the name

Indirect Method Of Cash Flow Statement Preparation

Question: Most organizations prepare four financial statements for external reporting purposes: the income statement, the balance sheet, the statement of owners’ equity, and the statement of cash flows. Accounting courses cover the first three accounts in detail and often provide an overview of the cash flow statement. This chapter will focus on the preparation of financial statements and the data obtained for analytical purposes.

Answer: Cash flow statement A cash flow statement that contains information about cash receipts and payments and describes changes in cash flow over time. Provides receipts and payment information and reconciles currency conversions on time. Cash flow and cash flow are summarized and classified as operating activities, investing or financing activities. In short, the financial statement shows where the money came from and where the money went over a period of time.

Let’s say you keep track of all your financial transactions throughout the year in a ledger (eg, written checks and deposit returns), and let’s say you have hundreds of transactions throughout the year. Instead of showing every transaction in a regular account, the cash flow statement summarizes these transactions. For example, all the incomes from the payroll are combined and shown as one item, all the rents are combined and shown as one line, all the food payments are combined together, and others. you. The idea is to start with a cash balance at the beginning of the year, add all the cash flow for the year, subtract all the cash flow for the year, and get the cash flow at the end of the year. Although the daily cash flow statement is simpler, the concept is the same.

Answer: The statement of cash flows is created because of the lack of information in the income statement, balance sheet, and owners’ equity. The income statement shows the income and expenses based on the calculations, but it does not show how much was earned in profits or paid for expenses. The balance sheet shows the assets, liabilities, and owners’ equity at a given time, but it does not show the amount of money received or paid for these items. The only financial information provided in this statement is the change in money from the end of the last period to the end of the current period, which is found in the cash section of the balance sheet (often called).

Direct Vs Indirect Cash Flow Methods

Owners, creditors and managers want more information about cash flow. They used to ask questions like: Why is the currency falling? What is net income relative to net income? How much did they pay for the equipment? How much money was made in this issue? Due to the need for more information about cash flow, the FASB created the formal cash flow statement in 1987 (Standard Accounting Report 95, available at http://www.fasb.org). Most companies are now required to prepare a cash flow statement with three other statements. We will begin to explain the correction of this statement in the next section.

Southwest Airlines was in a good position to generate $1,600,000,000 in cash from operations for the year ended December 31, 2010. However, cash on balance increased by only $147,000,000 in right this time. Why did the total amount increase by such a small amount compared to the $1,600,000,000 in operating income? A financial statement provides the information needed to answer this question. Southwest used $493,000,000 in goods and services (aircraft, parts, etc.) and $155,000,000 in long-term debt. Southwest also purchased $772,000,000 in short-term capital.

Answer: Cash flows are classified as operating, investing, or financing activities in the cash flow statement, depending on the type of activity. Each of these three types is described as follows.

Figure 12.1 “Examples of cash flow from operating, investing and financing activities” shows examples of cash flow activities that generate cash or require cash outflows over time. Exhibit 12.2, “Examples of Cash Flow Activities by Section,” provides a more detailed list of examples of items included in the operating, investing, and financing sections of the cash flow statement.

How To Calculate Cash Flow For Your Business

Income from equity investments and interest on loans to other entities is included in operating activities, as both are related to income. like that,

Also, activities include earning interest on bank loans or bonds issued, as these things also mean income.

Which part of the cash flow statement is considered the most important by most financial professionals?

Answer: The operations section of the financial statement is considered to be the most important section because it provides the cash flow information related to the day-to-day operations of the business. This section answers the question, “How much do we get from the day-to-day operations of our big business?” Owners, lenders, and executives are more interested in cash flow from day-to-day operations, not one-time stock issuance or one-time asset sales. The performance section allows stakeholders to assess the company’s current performance. We will discuss how to use financial information to inform organizations in the next chapter.

Solved] I Don’t Know How To Prepare The Cash Flow Statement For Aspe, Or…

A large warehouse. Inc. and Lowe’s Companies, Inc., are major home improvement retailers with stores throughout North America. A review of the financial statements of both companies shows the following cash flows. Good values come in and bad values go out.

Services; $4,600,000,000 for Home Depot and $3,900,000,000 for Lowe’s. It is interesting to note that both companies have spent a lot of money on equipment and long-term investments, which is a negative sign.

The actions were to purchase common stock. Both companies appear to have chosen to return cash to shareholders through share buybacks.

Determine whether each of these items should appear in the operating, investing, or financing sections of the cash flow statement. Explain your answer to each item.

How To Prepare A Statement Of Cash Flows: 13 Steps (with Pictures)

Question: Remember in your accounting lesson that the accounting principle recognizes revenue when it is earned and expenses when it is earned, regardless of when the money is transferred. In contrast, the cash basis of accounting recognizes income when money is received and expenses when money is paid, regardless of when goods or services are exchanged. The income statement, balance sheet, and statement of owners’ equity are created based on the accounting value. However, the cash flow statement is based on cash inflows only so adjustments must be made to convert the accrual basis information to cash flows.

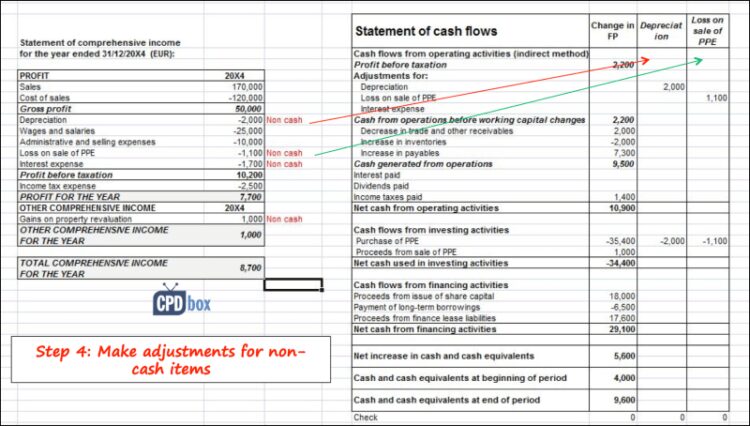

Answer: When preparing the cash flow statement, several other details are required to make the following adjustments:

Way. Because more than 98 percent of companies surveyed use it

Preparing cash flow statement from balance sheet, balance sheet income statement and cash flow, balance sheet vs income statement vs cash flow, preparing cash flow statement from income statement and balance sheet, cash flow statement balance sheet, relationship between income statement and balance sheet and cash flow, make cash flow statement from balance sheet, balance sheet income statement cash flow template excel, create cash flow statement from balance sheet and income statement, balance sheet income statement cash flow relationship, preparing balance sheet and income statement, cash flow statement from balance sheet and income statement