Personal Loan To Consolidate Credit Card Debt – The purpose here of Incredible Operations, Inc., NMLS Number 1681276, hereafter referred to as “Incredible,” is to give you the tools and confidence you need to improve your finances. Although we promote products from lenders who pay us for our services, all opinions are our own.

If you’re not sure how to deal with credit debt, this guide to debt consolidation and credit card relief can help. (iStock)

Personal Loan To Consolidate Credit Card Debt

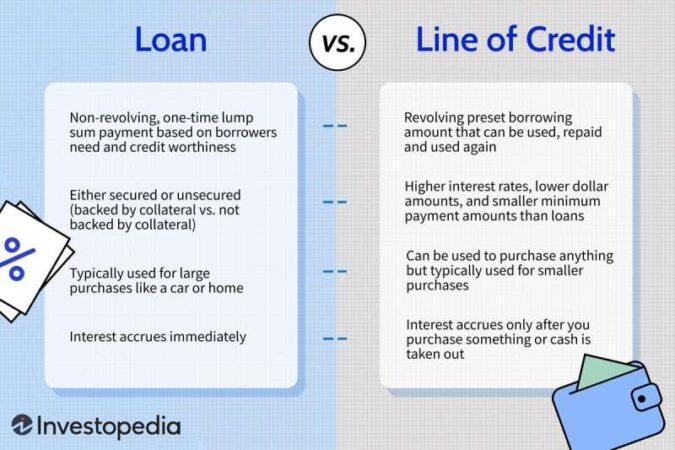

If your credit balances are difficult to manage, paying off your debt with a personal loan may be an option.

Debt Consolidation Personal Loans Up To $40,000

This is sometimes called debt consolidation. Others said that they lived on this street with a credit card. In either case, it means rolling your credit card balance into a personal loan that you pay off each month over time.

Here’s what you need to know about debt consolidation and how to live in this street. If you’re thinking about consolidating your debt into a lower interest personal loan, it’s easy for many people to compare.

A credit card balance is said to be when you use another financial product, often a personal loan, to pay off your credit card balances. You will then make monthly payments on that loan until it is paid off in full.

This process can allow for a lower interest rate (credit cards are very high compared to most personal loans), and it makes it easier to make as many payments as possible per month.

Debt Repayment Programmes In Singapore

Credit cards are said to have lived in this street because they are usually creditworthy borrowers who can qualify for personal loans with lower interest rates than credit cards.

Banks, credit unions and online lenders usually offer personal information that you can use to refinance your credit card debt. This check requires credit and a variety of financial documents.

The lender you choose depends on a number of factors, including your credit score and how quickly you need to pay off the loan. For example, some lenders can make a loan online as soon as the next business day after the loan is approved.

It’s a good idea to compare personal loan rates before deciding on a loan refinance. Lenders can easily consider your pre-qualification rates in minutes.

Should I Use A Loan To Pay Off Credit Card Debt?

In either case, you use a personal loan or other type of loan product to pay off credit card and other debts you may have. This essentially replaces your debt with a single loan that you can repay over time.

Checking your credit card and using a balance transfer card share the same principle, but the two can have very different results. He is said to have lived in this street. It makes many of your debts easier, and often results in lower transaction costs.

With a card balance transfer, you use your new credit card to get another card (or multiple cards). These cards have a low introductory rate, often as low as 0%, which expires after 12 to 18 months. At that point, the rate rises significantly.

Balance transfer cards can save you interest if you pay off the balance before the end of the introductory period, at which point you can’t repay the balance on your new card, which can be much more interesting in the long run.

How To Consolidate Credit Card Debt

The right choice depends on the balance, interest rate, credit score and other factors. Generally, a balance transfer can be beneficial;

Here’s an example: Say you have $10,000 in credit debt and your bank offers you a balance transfer card with 0% interest for 18 months. Under these terms, you must pay at least $555 each month to pay off the balance before the introductory rate expires. If that is not possible, a personal loan may be a better option, offering a longer repayment period and lower months.

You don’t need a perfect credit score to get a debt consolidation loan, but the higher your score, the better your chances of receiving the personal loan amount you need and a favorable rate. Generally, a score of at least 600,000 is required to qualify, and a score of 720,000 can give you a better chance of getting the best APR available.

If you are below these thresholds, you can try to get a bad loan or work in your better name before you apply.

Credit Cards And Bad Debt

When you’re ready to move forward with your loan application or credit card balance transfer, be sure to ask. Rates, fees, terms and eligibility requirements vary by provider, so compare at least a few lenders and credit card companies to make sure you’re getting the best deal. have a low credit score or perfect credit history. These are loans that help people with bad credit get the money they need for various purposes, such as debt consolidation, medical expenses, home improvements, or unexpected emergencies. Here are some key points in understanding bad credit personal loans;

1. Purpose: Personal loans are usually used for personal expenses and are not related to a specific purchase or investment. This means that borrowers have the flexibility to use the money as they see fit, to pay off debts or to cover unexpected expenses.

2. Higher interest rates: It is important to note about bad credit personal loans that they usually have higher interest rates compared to traditional personal loans. Lenders believe that people with bad credit are higher risk borrowers, so they adjust their interest rates accordingly to compensate for the higher risk.

3. Secured loans vs. Unsecured Loans: Bad credit personal loans can be done either unsecured. Borrowers require secure collateral, such as a car or house, in order to obtain a loan. On the other hand, secured loans do not require collateral, but are often priced higher.

Debt Consolidation Loans & Refinancing Options

4. Borrower terms: The repayment of a personal loan term can vary greatly depending on the credit profile of the lender and the borrower. The term of the loan can be between a few months and a few years. It is important that borrowers carefully review the terms of the loan, including the interest rate, repayment period and associated fees.

5. Improve credit score: By taking a personal loan for bad credit, borrowers can improve their credit score. By making timely payments, borrowers demonstrate responsible financial behavior that will help increase their credit over time.

6. Online Lenders: Many online lenders specialize in providing loans to individuals with bad credit. These lenders have a very fast application process and can provide approval for projects quickly. However, borrowers must be diligent and lender investigators must carefully ensure that they are honest and offer fair terms.

7. Loan Amount: The amount of loans available to bad credit personal creditors may vary depending on the income and credit history of the lender and borrower. Lenders often offer loans from a few hundred to several thousand dollars.

Transunion Study, “debt Consolidation In A Rising Economy”

8. Credit Check: Although bad credit personal loans are designed to help people with bad credit, most lenders will do a credit check as part of the loan application. But they may place more emphasis on other factors, such as income and employment history, when making mutual decisions.

As a result, bad credit personal loans can be a valuable financial tool for people with less than perfect credit. These loans provide access to funds for a variety of purposes, but it is important that the borrower carefully review the terms, including interest and payment terms. By using these loans properly and making timely payments, borrowers can not only meet their financial needs but also work to improve their credit.

If you have bad credit and need a personal loan, don’t worry – they are still available to you. Although borrowing with bad faith gets more difficult, it is not impossible. Here are some steps you can take to increase your chances of getting a bad credit personal loan:

1. Understand your credit: Before applying for a personal loan, it is important to know where you stand financially. Check your credit score and review your credit score to identify any errors or negative features that could affect your credit score.

How Much Personal Loan Can I Take In Singapore?

2. Explore different lenders: Traditional banks and credit unions are less likely to approve loans for people with bad credit. There are other lenders who specialize in loans with less than perfect credit. Research online lenders, peer-to-peer lending platforms and credit syndicates that work with bad credit loans.

3. Consider a secured loan: If you have valuable assets such as a car or a savings account, you can secure a loan by offering collateral. Secured loans typically have lower interest rates and higher approval rates because the lender has a way to recover losses if you default on the loan.

4. Find the signer: Yes

Personal loan to consolidate credit cards, loan to consolidate debt, personal loan to consolidate debt, best personal loan to consolidate credit card debt, consolidate personal loan debt, loan to consolidate debt with poor credit, consolidate debt loan, consolidate credit card debt loan, personal loan consolidate credit card debt, loan to consolidate credit card debt, personal loan to refinance credit card debt, consolidate credit card debt with personal loan