- Pay Off My Home Loan Faster Calculator

- Easy Ways To Repay Your Home Loan Faster

- Private Home Loan

- How The ’50/50 Path’ Helped One Couple Pay Off Their Mortgage In Four Years

- Early Mortgage Payoff Calculator: How Much Should Your Extra Payments Be?

- Taking A Hdb Housing Loan: Should You Keep More Than $20,000 Or Let Your Cpf Oa Be Wiped Out

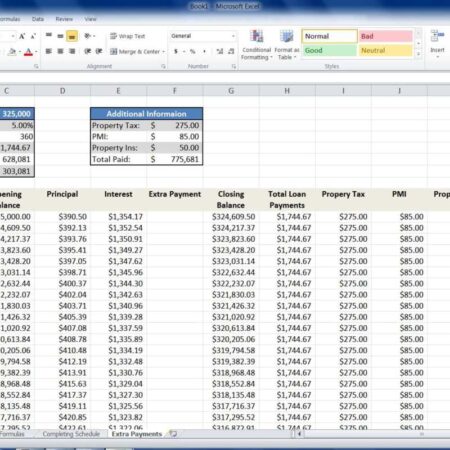

Pay Off My Home Loan Faster Calculator – Use this calculator to find out how much interest you can save by paying half your mortgage every two weeks instead of paying the full amount every month. The net effect is that you only have to make one additional mortgage payment a year, but you save a lot on interest.

This calculator also has the ability to add an additional amount (additional payment) to your monthly mortgage, significantly increasing your savings interest. This unique four-column format allows you to compare scenarios side-by-side, print amortization graphs, and plan your payment strategy.

Pay Off My Home Loan Faster Calculator

If you’re not sure how much additional payments you’ll need to pay off your mortgage by a certain date, try our mortgage payment calculator here to calculate your payments based on time instead of interest saved. please.

Full Function Mortgage Calculator

Once you implement your mortgage payment strategy, learn how to grow your equity even faster with this 5-lesson video series. Everything is free.

“Discover a comprehensive estate planning process proven by over 20 years of coaching that will give you complete confidence in your financial future.”

Wealth Planning for Expectations shows you how to create a financial roadmap for the rest of your life.

This 2-week mortgage calculator makes the calculations easy. Interest savings and payment terms are calculated for different payment scenarios.

Easy Ways To Repay Your Home Loan Faster

You can also make biweekly payments instead of monthly payments or make additional principal payments to see how your payments speed up.

Making your mortgage payments every two weeks is a strategy that can save you a lot of money on interest and pay off your mortgage sooner.

Instead of making one payment every month, make one payment every two weeks. This biweekly pattern differs from bimonthly mortgage payments, which may or may not include additional payments.

Biweekly payments result in 26 smaller payments instead of 12. The net effect is equivalent to one additional monthly payment (13) per year.

Private Home Loan

The end result of biweekly payments is that you pay more each year, regardless of whether you make additional repayments on top of your biweekly payments. As you’ll see by entering your mortgage payment information into this two-week mortgage calculator, it requires little sacrifice but can lead to big savings.

Before you start biweekly payments, make sure it’s right for your situation. Important points to consider are:

Once you decide that biweekly payments (and/or additional payments) are right for you, it’s time to set them up and start saving.

Many banks and mortgage companies allow you to convert your existing mortgage to a biweekly payment plan. They usually don’t advertise this feature, so you’ll have to call and ask.

What Is An Amortization Schedule? How To Calculate With Formula

Alternatively, you can split your mortgage payment in half and pay that amount every two weeks. The end result is the same, but it’s not as easy to automate as I would like. However, check with your bank first to make sure you meet the payment terms and that there will be no prepayment penalties or other issues.

If you choose to add additional principal to your required payment, you will need to ask your mortgage holder to have the additional money paid directly to your principal, rather than simply prepaying the required payment. There may be cases.

The great thing about biweekly mortgage payment plans is that they can easily shorten your mortgage term by 6 to 8 years.

Additionally, if you receive a paycheck every two weeks, it may be more convenient to use biweekly mortgage payments instead of monthly payments.

Buying A House With Cash Vs. Getting A Mortgage

If you’re still not sure if this payment method is right for you, use the 2-week mortgage calculator above to see all the savings. Be sure to also print out your principal payment schedule so you always know what’s going on.

We will email you a screenshot of what your newly completed calculator will look like. We do not store any data about you. It’s just a photo. You can unsubscribe at any time.

Where can I send you two video guides that show off-beat strategies for calculating exactly how much money you need to retire… Mastering Your Mortgage Repayments: A Guide to Your Mortgage Repayments 1. What is it? How does it work?

When taking out a home loan, it is important to understand how repayments work. Mortgage repayment means paying off your mortgage with regular monthly payments. Each payment consists of both principal and interest, and the amount of each payment that covers the loan balance changes over time.

How The ’50/50 Path’ Helped One Couple Pay Off Their Mortgage In Four Years

One way to understand depreciation is to think of swings. At the beginning of the loan term, most of the payment goes toward interest and only a small portion toward principal. Over time, interest decreases and principal increases until the loan is repaid in full.

1. Amortization Schedule: Mortgage lenders provide an amortization schedule that shows how your monthly payment is divided into principal and interest over the life of your loan. This schedule helps you understand how your payments change over time.

2. Interest Rate: Your mortgage interest rate has a big impact on your repayment schedule. The higher the interest rate, the more of your monthly payment will go towards interest, and the lower the interest rate, the more of your monthly payment will go towards the principal.

3. Loan Term: The length of the loan term also affects the repayment schedule. A longer term means your payments are spread over more years, resulting in lower monthly payments but potentially higher overall interest costs.

Early Mortgage Payoff Calculator: How Much Should Your Extra Payments Be?

4. Prepayment option. Some mortgages allow you to prepay without penalty, allowing you to pay off your loan faster and lower your overall interest costs. For example, making an extra yearly payment can shorten your loan term by several years and save you thousands of dollars in interest.

Understanding your mortgage payments is an important step in becoming a smart homeowner. By knowing how your payments are spread out over time, you can make informed decisions about your mortgage and work toward paying it off faster.

What is mortgage repayment and how does it work – Mastering mortgage repayment: Mortgage repayment guide

Paying off your mortgage early may seem like a daunting task, but it can also be very beneficial in the long run. Not only does this allow you to own your home outright, it also saves you money on interest payments over the life of the loan. Additionally, paying off your mortgage early can give you financial stability and peace of mind.

Online Mortgage Calculators: Free Personal Finance Calculation Tools

1. Savings on interest: One of the main benefits of paying off your mortgage early is that you can save thousands of dollars in interest payments. When you pay your mortgage each month, a large portion of your payment goes toward interest. By prepaying your mortgage, you can reduce the interest you pay over the life of your loan.

2. Debt Reduction: By paying off your home loan early, you can also reduce your debt burden. When you own your home outright, you don’t have to worry about monthly mortgage payments. This frees up your cash flow so you can focus on other financial goals, like saving for retirement or paying down other debts.

3. Increased financial security: Paying off your mortgage early gives you financial security and peace of mind. If you own your home, you no longer have to worry about potentially losing it to foreclosure. This is especially important during times of economic uncertainty and unemployment.

4. Build equity: By paying off your mortgage early, you can build equity in your home faster. Equity is the difference between the current market value of the home and the amount owed on its mortgage. Increasing your capital increases your financial flexibility and increases your net worth.

Taking A Hdb Housing Loan: Should You Keep More Than $20,000 Or Let Your Cpf Oa Be Wiped Out

5. Retirement Planning: Paying off your mortgage early is a wise retirement planning strategy. If you own your home outright, you won’t have to worry about paying your mortgage in retirement. This can help you save more for retirement and increase your financial security during your golden years.

Paying off your mortgage early has many benefits, including saving on interest, reducing debt, increasing financial security, building equity, and assisting with retirement planning. Paying off your mortgage early may require sacrifice and effort, but the long-term benefits are worth the effort.

Benefits of paying off your home loan early – Learn how to pay off your home loan: A guide to paying off your home loan

One of the most important decisions when taking out a mortgage is choosing the right repayment schedule. A payment schedule determines when payments are made.

Simple Ways To Pay Off Your Home Loan Early

Pay off home loan faster calculator, pay home loan faster calculator, pay home loan faster, pay off my car loan faster calculator, pay off debt faster calculator, loan pay off calculator, pay off your home loan faster calculator, pay off loan faster calculator, pay off loan faster, how to pay off my home loan faster, pay off my loan faster calculator, pay loan faster calculator