Pay Credit Cards Off With Personal Loan – Personal loans and credit cards allow you to borrow money that you can use for any amount. They have similar features, but they also have significant differences.

With personal loans and credit cards, you can get money from a lender at a certain interest rate. Then you make monthly payments including principal and interest. As with credit, any loan can damage your credit rating if you don’t use it properly.

Pay Credit Cards Off With Personal Loan

Personal loans and credit cards also have important differences to consider, such as repayment.

Which To Choose: Credit Card Vs Personal Loan

Banks, credit card companies and other financial institutions consider many factors when deciding whether to approve a loan. One of the most important things is your credit score. Your credit report is based on your past credit history, including credit defaults, inquiries, accounts and loans. Based on this record, you are assigned an interest rate, and that rate will affect your approval and the interest rate you will receive.

The three largest US credit bureaus—Equifax, TransUnion, and Experian—are leaders in setting credit score standards and partnering with credit bureaus to begin approving loans.

Paying your credit card balances in full and paying off your debts on time can help you build your credit.

With a personal loan, lenders offer a large amount of money that you pay back over time, usually in fixed payments. Personal loans have a fixed term, usually two to five years, but sometimes longer.

Can I Use A Personal Loan To Pay Off My Credit Card?

Personal loans don’t offer the same access to cash as a credit card, but they often have lower interest rates, especially for borrowers with good and high credit.

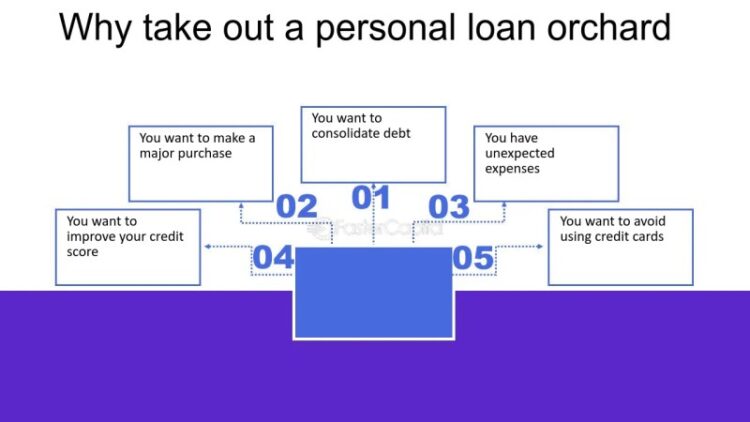

A personal loan can be used for any purpose. For example, you can use it to buy new equipment, including credit card debt, home improvements or renovations, or to pay for vacations. Personal loans are usually unsecured, meaning they are not backed by collateral.

Personal loans usually have a down payment and can have additional payments. This can add to their total income.

Starting from Oga. 14, 2023 to Sept. 15, 2023, 962 U.S.C. An international survey of young people was commissioned to find out how they use their credit and how they will use their credit in the future. Debt consolidation is the most common reason for debt consolidation, followed by home improvement and other major expenses.

What Is Revolving Credit? What It Is, How It Works, And Examples

A revolving loan gives the borrower access to the specified amount up to the credit limit. But you can’t get all the money. Instead, you can use the money as you wish. You only pay interest on the money you spend, so you can have an open account with no interest if you don’t have any money.

Unlike personal loans, where your monthly payment stays the same throughout the repayment period, credit card payments change each month. Your loans are based on your income and interest rate. You will have a small payment, but you usually don’t have to pay the full amount. The remaining amount will be carried over to the next month and you will be charged interest.

Many credit cards offer benefits such as rewards or 0% introductory time. It can be used in retail stores or online shopping, or to provide shopping opportunities anywhere that accepts electronic payments. You can also increase your credit limit over time.

Among their drawbacks, credit cards have higher interest rates than personal loans. And some have monthly or yearly fees.

Snowball Vs Avalanche: Which Is The Best Method For Paying Off Your Debts?

Most credit cards are unsecured, but borrowers with poor or no credit history can use secured cards that require an amount that can be used as a deposit.

Credit cards have different methods of charging interest. Some credit cards offer the borrower the benefit of a statement grace period where there is no interest on the borrowed amount. Some cards charge interest on a daily basis, plus final interest at the end of the month.

If you have a credit card with a high interest rate and are struggling to pay off your debt, you may want to consider switching your bank to a card with a lower interest rate.

In addition to your personal loans and credit cards, you can choose other types of loans and credit products. Which type is right for you depends on your financial situation. Here are some examples:

Understanding Different Loan Types

The monthly cost of a $5,000 loan depends on the interest rate and the term. You can use an online loan calculator to determine the monthly loan cost for various conditions.

You may be denied a loan if your credit score is too low, your income is insufficient, you have too much debt or if you fail to meet other lender requirements.

Applying for a personal loan can take a long time, taking a small hit to your credit score. Once you take out a loan, how you pay affects your credit score. If you make all the payments on time, your results will be good. If you don’t pay on time, your results may drop.

Remember that all your loans and credit cards can pay off your bills, but they are not the same. Personal loans have lower interest rates than credit cards, but they must be repaid over time. Credit cards offer regular access to cash and you only pay interest on the loan.

Line Of Credit (loc) Definition, Types, And Examples

Whether you choose one or both, your credit score is important to getting approved and getting a good quote.

Authors should use primary sources to support their work. These include white papers, government data, preliminary reports and interviews with industry experts. We also cite original research from other reputable publishers where appropriate. You can find out more about the principles we follow in creating accurate, unbiased content in our editing policy.

The contributions presented in this table are from the pay groups. This can affect how and where the listings appear. It does not include all offers in the market. Having credit card debt can be frustrating, especially if you’re one of the 34% of Americans who have three or more credit cards. How much will I pay for each card? Can I pay my credit cards on time without accumulating too much debt? Should I start by paying more cash or cards with higher interest rates?

Pay off credit cards and personal loans can help you solve all of these problems. Let’s say you have three or four cards with different interest rates and balances. In this case, you can easily pay off your loan with a lower interest rate and pay the balance in your current account. This way, you will be able to repay the loan with a lower interest rate and monthly payments.

Help & Support: Credit Card

We weigh the pros and cons of using your personal loans to pay off your credit cards before pursuing other options if you’re not comfortable taking on another loan.

How Much Credit Card Debt Do Americans Have? 807 billion on 506 million card accounts. And with interest rates ranging from 17%-24%, spending thousands is a huge challenge for families. If you’re struggling to manage all of your credit cards, you’re not alone. So why should you use your credit to pay off your debts? How can taking out more debt help you pay? This will help you find a solution that will cost you less money and allow you to pay off your debt faster. This is where personal loans come into play.

The average interest rate on credit cards ranges from 17% to 24%. These fees add up quickly if you open multiple accounts with balances. One of the advantages of using a loan to consolidate your credit card debt is that you can get a lower interest rate. The average personal loan is around 9.41%. However, this number can vary depending on your credit score. Most personal loans are cheaper than credit cards.

Juggling fees can be frustrating, especially if you have more than one card. The benefit of using your credit to pay off your credit cards is that you make your debt repayment goals easier by reducing the number of accounts payable. Instead of paying for three or four credit cards, you are now paying for just one loan.

How To Lower Your Credit Card Payments By Consolidating Into A Personal Loan

Interest rates offered by personal loan companies are often lower than credit cards, so paying off your debt can save you money.

If you’re making less monthly payments on your credit cards, you may have more debt. In some cases, it can take up to 30 years to pay off the first $5,000 and the full $24,000. By consolidating your credit and debt, you

Best way to pay off personal loan, personal loan pay off debt, getting a personal loan to pay off credit card debt, best personal loan to pay off credit cards, best personal loan to pay off credit card debt, personal loan to pay off car, personal loan to pay off credit debt, pay off personal loan with credit card, paying off credit cards with personal loan, personal loan to pay off student loans, personal loan to pay off student debt, personal loan to pay off credit cards