Pay A Credit Card Bill With Another Credit Card – We no longer support this browser version. Using the updated version will secure your accounts and provide a better experience.

Let’s say you have high-interest balances on one or more credit cards and you’re looking to lower your APR. You may be asking yourself, “Can I pay off one credit card with another credit card?” In short – yes. You can pay a credit card with another credit card; There are multiple ways to do this. However, each method has its advantages and disadvantages.

Pay A Credit Card Bill With Another Credit Card

If you want to pay a credit card with another credit card. There are two main ways to make a balance transfer or cash advance. Both are options to consider in detail, but there are some important differences that are important to understand before proceeding.

Credit Cards Vs. Debit Cards: What’s The Difference?

Cash on delivery is often the most expensive option. With a bank transfer you withdraw money from your credit card just like you would at an ATM. You are responsible for depositing funds into your bank account to pay your credit card.

High fees and high interest rates often accompany cash advances. It is also important to understand that interest usually starts accruing from the day you withdraw the money. It does not enter at the end of your billing cycle like a standard credit card PUR. In other words, there is no grace period with cash advances.

With a balance transfer, you simply transfer the balance from one card to another. The main reason for doing this is to consolidate from high-interest cards to low-interest loans.

Many credit card issuers have special balance transfer offers to invite people to open a card with them. Offers include 6-15 months with zero percent initial APR. So those who want to pay their balance during promotion. Weight transfer is a great option.

Credit Card: Can I Pay One Credit Card Bill From Another Credit Card?

You’ll want to be aware of balance transfer fees. Sometimes it can be up to five percent of the transferred amount. It’s also important to check the interest rate that will be charged after the promotional period ends and how balance transfers can affect your credit score. Please read the card membership agreement carefully and contact your lender to confirm details before making a transaction.

For specific situations and for the right people. A balance transfer or cash advance may be the best option. With some instant benefits for credit card payments with other cards;

Low APR and interest savings: If you transfer a balance from a card with a high APR to one with a low APR, you’ll save on interest. This allows you to focus on paying off the main card that currently holds the full balance.

One Balance Management: If you don’t continue to use a card that has already been paid off. It is easier to pay one account against multiple accounts.

Can I Pay One Credit Card Bill With Another Credit Card? Try This Easy Way In Money Crunch

Paying off a credit card with something else isn’t everyone’s first choice. You may not be the best choice if:

Balance transfers and cash advances are not considered eligible purchases, so credit card issuers do not mark them as traceable transactions.

If you wish to proceed with a balance transfer or cash advance; Make sure it’s a smart financial decision. When in doubt, consult a financial professional for help choosing the best option.

What are credit card cash back rewards? Bonus rewards offered to customers when they use their card to create a wallet. Cash back rewards can be in the form of dollars or points.

How To Pay Credit Card Bills: Dbs, Uob, Sc & Other Banks

What is the debt to income ratio? Why is it important? Understand the debt-to-income ratio and its importance in personal finance. Learn how to calculate your debt-to-income ratio and which lenders use it.

How to Consolidate Your Credit Card Debt Debt consolidation is an effective way to save you money and simplify your payments. Here’s how to consolidate your credit card debt.

Its website and/or mobile terms; These privacy and security policies do not apply to websites or apps you visit See its terms to see how they apply to you. Please review the privacy and security policy. any products on third-party sites or apps, except products and services specifically bearing that name; No responsibility for service or content. Today, you can take advantage of various attractive credit card offers that offer benefits up to bonus miles and 10% cashback. These deals can maximize your financial benefits and make every transaction a rewarding experience

Despite the benefits, you must pay your credit card bills on time. As with other types of loans, such as personal loans, late repayment can incur huge interest.

Should You Only Pay The Minimum On Your Credit Card?

Keeping track of all your monthly expenses can be challenging, and credit card payments require extra care. Missed deadlines can result in heavy penalties.

This post will show you how to pay off your credit card bills. Special DBS; UOB We will provide advice and guidance on Singapore’s three major banks including OCBC and others.

Late interest rates; It is important to pay your bills promptly if you have a credit card in Singapore to avoid late payment fees and possible damage to your credit score.

When you pay your DBS credit card bill; There are many options for you. DBS understands the importance of convenience and offers various channels to streamline the payment process. One of the recommended ways is to use their Digibank mobile app.

Easiest Ways To Get A Credit Card Approved In Singapore

Note: Payment before 11:30 Monday to Saturday. or on the last working day of the month before 8:00, the next working day will be recorded.

Note: Made before 4:55pm Monday through Friday; access station; AXS E-Station; Payments made through AXS m-Station or AXS QuickBill will be refunded the next business day. Payments made on Friday will be credited on the second day after 4:55 PM.

UOB also supports different types of credit card bill payments. They offer a variety of convenient options for paying your credit card bills.

Note: If you want to save the information for future transfer, select “Add to Favorites” and swipe to confirm.

Rolling Over Credit Card Debt Is No Game

Standard Chartered Online or Mobile Banking; Credit cards offer a variety of bill payment options, including express payments and cash deposit machines.

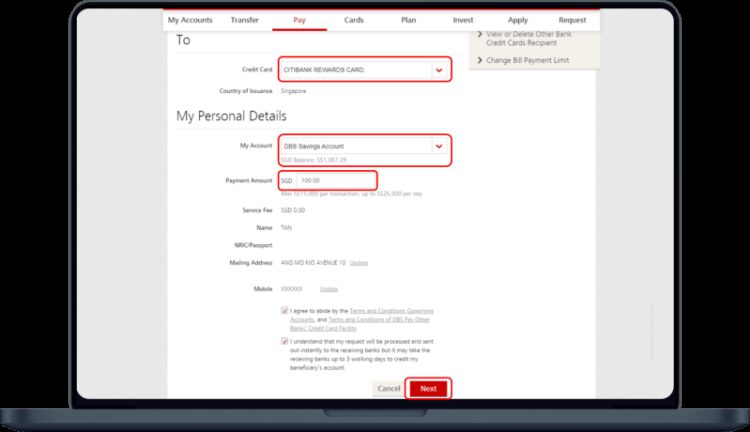

How to pay your Citibank credit card? You can pay them through mobile and internet banking. Also, you can pay your Citibank credit card with other banking platforms of other banks through FAST.

It’s important to pay your credit card bills on or before the due date to avoid interest and late fees that can add up quickly. Additionally, failure to pay on time can seriously affect your credit score.

Calendar reminders to help you remember payment dates and make payments on time; You can use smartphone apps or email alerts.

Postpe: Earn 0.5% Cashback On Credit Card Bill Payments

Automate your credit card bill payments for easy management and on-time payments. Automatic payments through your bank’s online banking system can eliminate the hassle of remembering due dates and late payments.

Automatic payments let you choose the payment amount that’s right for you Paying a minimum amount; You can pay off the entire balance or a fixed monthly amount. This means you can adjust your payments to meet your financial goals.

Paying more than the minimum will save you money over time. Pay off your credit card debt before the due date to avoid interest charges.

Building a good credit score will make it easier to get loans and other funding in the future (and save you money).

When To Pay Your Credit Card?

If you’re going to use a credit card, why not maximize the benefits by using a rewards card? A smart choice of incentives or cashback for shopping.

Use a rewards credit card to take advantage of this opportunity. This card allows you to pay off debt while earning points or cash back.

Check your credit card statements frequently for errors or fraud. Report the discrepancy to your credit card company immediately.

Paying off your credit card balance on time each month is essential to having excellent credit. If you have trouble making payments, contact your bank or credit card issuer for help or other repayment plans.

The Pros And Cons Of Owning A Credit Card

Be sure to proactively pay off your credit card obligations. Take these steps and get help to regain financial control and become debt free.

Personal Loans Best Personal Loans Singapore: The Ultimate Guide (2023) Personal Loans in Singapore You Should Consider Helping achieve your financial goals is essential. Before applying for a low interest personal loan in Singapore, let’s know more about it. Let’s find out if it can meet your needs or help you achieve your goals. […] Learn More Blogs and Opinions What are the Best Licensed Moneylenders in Singapore: A Guide to Borrowing from Legitimate Lenders Do you have a little money and plan to borrow from the best licensed moneylenders in Singapore? front car

Pay credit card bill with another credit card, pay bill online with credit card, pay any bill with credit card, can you pay one credit card bill with another, pay amex bill with another credit card, how to pay credit card bill with another credit card, pay electric bill with credit card, pay bill with credit card, can you pay credit card bill with another credit card, can we pay credit card bill with another credit card, can i pay credit card bill with another credit card, pay a credit card bill with another credit card