- Need A Consolidation Loan With Bad Credit

- Understanding Pros And Cons Of Debt Consolidation Loans For Bad Credit Borrowers

- What Is Debt Consolidation Loan?

- Debt Consolidation Loans Or Debt Relief: Best Option For Bad Credit Debt Reduction

- What Are The Risks Of Debt Consolidation Loans If You Have Bad Credit?

- How Personal Loans Affect Your Credit Score

- Loan Bad Credit

Need A Consolidation Loan With Bad Credit – Managing finances with bad credit is difficult. A personal loan can seem impossible if you have bad credit. However, a low credit score does not prevent you from getting a loan. Personal loans are available even with bad credit.

This article will help you achieve financial stability by exploring these options. From knowing your credit score to identifying other financing alternatives, we’ll cover how to get a personal loan with bad credit.

Need A Consolidation Loan With Bad Credit

Creditworthiness in Singapore is generally measured by a 4-digit Credit Bureau of Singapore (CBS) score. This score, which ranges from 1,000 to 2,000, shows your payment history and predicts whether you are in default on your loan.

Understanding Pros And Cons Of Debt Consolidation Loans For Bad Credit Borrowers

CBS credit history reports cost SGD 8 plus applicable GST. This report shows your credit behavior that affects your score. A credit score of 1,000 to 1,723 is considered “HH” risky.

Many factors affect credit scores. This includes your credit utilization, recent credit applications (including credit cards), credit score inquiries and late payments. The more good credit you have, the higher your score will be.

A complicated loan approval process makes it difficult to get a personal loan with bad credit. There is hope. Credit repair and small loans are available.

Your credit score is a numerical representation of your creditworthiness based on a number of financial habits. CBS calculates this result in Singapore. The following factors can lower your score:

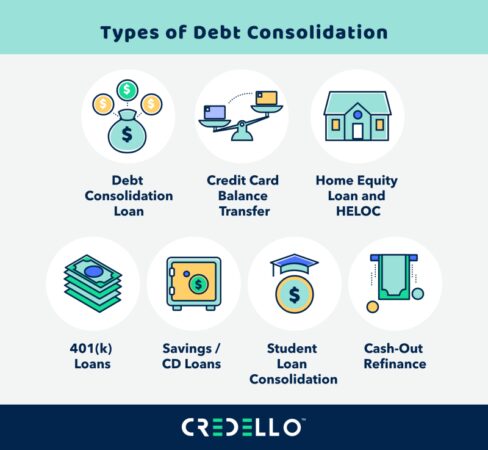

What Is Debt Consolidation Loan?

These elements help you understand how your actions affect your credit score. By managing these areas you can improve your credit score.

It can take months or years to improve a low credit score. You can rebuild your credit through strategic preparation and intentional execution. Three Action Strategies for Low Credit Scores:

Credit counseling. Contact Credit Counseling Singapore, a non-profit organization that helps people manage debt. They provide financial guidance, identify the reasons for your debt and help you negotiate a loan with banks. This intervention can help you get out of debt and improve your credit score.

:fill(white):max_bytes(150000):strip_icc()/Upgrade-Logo-bc0ec4b2fc0b48daaefbde361ccabe98.jpeg?strip=all)

Debt restructuring. If you have debt, try to restructure it, as many people with bad credit do. Debt consolidation or balance transfers may be required. Both methods attempt to consolidate high-interest debt, such as credit card bills, into lower-interest debt. This will help you repay your loan faster.

What To Do If You’ve Been Denied Consolidation Loans For Bad Credit

He will be back in time. Sticking to a repayment plan is one of the best strategies for improving your credit score. Pay the loan quickly and in full. This will eliminate your debt and show your creditors your credibility and financial discipline. Your credit score will gradually improve.

This strategy takes effort and discipline, but it can improve your financial health and credit score. Every step counts in the marathon of improving your credit score.

How to apply for a personal loan in Singapore if you have poor or poor credit score?

A personal loan with bad credit is fictitious. Regardless of your credit score, the application is the same. However, getting through this process with a poor credit score requires some strategic steps:

Personal Loans For Debt Consolidation: What’s The Average Amount?

Every application is an opportunity to prove your creditworthiness. Understanding the process, knowing the limitations, and applying strategically can help you get a personal loan with terrible credit.

Being turned down for a personal loan because of bad credit can be frustrating. Rejection is not the end. There are several options:

If you have bad credit in Singapore, look for small loans. Even with bad credit, this approach can improve your chances of being accepted.

Smaller loans pose less financial risk to lenders. Even with bad credit, lenders can offer you a smaller loan.

Is Applying For A Debt Consolidation Loan A Wise Move?

Smaller loans have lower monthly payments, making it easier to plan and pay on time. If you have bad credit, consistent and on-time payments can help you fix the problem.

Applying for smaller loans and paying them back over time can improve your credit score. Making payments on time improves credit ratings.

Small personal loans are available from banks, credit unions and authorized lenders in Singapore. Each comes with different eligibility requirements and interest rates, giving you options.

You can also explore microloans. These short term small loans are easier to get than personal loans. They are great for quick cash.

Debt Consolidation Loans Or Debt Relief: Best Option For Bad Credit Debt Reduction

If you have a poor credit score, non-bank financial institutions may be an alternative. These companies, such as Hong Leong Finance and Singapore Finance, are registered with the Monetary Authority of Singapore (MAS) and must follow certain rules to protect borrowers.

Non-bank financial institutions are subject to weaker eligibility criteria than banks. They may prefer your current loan repayment capabilities rather than your credit history.

These banks offer personal, commercial and secured loans. This option offers additional loan options based on your needs.

Non-bank financial institutions often offer personalized customer service. They can analyze your finances and recommend a loan that suits your needs.

Achieving Financial Freedom Through Debt Consolidation

Before signing the loan agreement, it is important to read the terms and conditions. Understand interest rates, fees and repayment terms. Avoid penalties and credit score damage, knowing you’ll make your payments on time.

A bad credit alternative is a licensed money lender. Chartered lenders have more liberal loan approval standards than banks.

Fair and regulated lenders can lend to you. They are regulated by the Singapore Ministry of Law. These lenders continue to lend to people with bad credit ratings because they value other aspects.

Lenders prioritize your ability to repay the loan over your credit history. Your loan application is assessed based on your income, employment and financial responsibilities.

What Are The Risks Of Debt Consolidation Loans If You Have Bad Credit?

They approve loans faster than banks, which can take weeks. This can help if you need money fast.

They also follow strict laws to protect borrowers. Interest rates, fees and repayment terms should be clearly disclosed before signing the loan agreement.

Authorized moneylenders in Singapore can be a good option, but beware of the risks. Borrow wisely and only if you can repay the loan on time. This will help you avoid credit pitfalls and damage to your credit score.

It can be hard to say no, but it’s an opportunity to reassess your finances, improve your credit score, and look for other lenders. Remember that every step towards financial responsibility brings you closer to debt.

Fast Cash Loan Singapore

There are bad debt consolidation loans in Singapore, but they can be challenging. A debt consolidation loan combines several obligations together, usually with better repayment terms, such as a lower interest rate or monthly payment. Over time, this can improve debt management and financial health.

Citizenship, age, annual income and balance to income (BTI) ratio affect DCP eligibility. The PTI report, which compares all of your unsecured debt to your typical monthly income, is important for loan approval. High CPI rates can discourage lenders due to high credit.

DCP for Singaporeans with unsecured debt exceeding 12 times their monthly salary. If so, DCP can help you manage and reduce your debt.

The risk of default due to a negative credit score can make obtaining a DCP very difficult. Financial institutions may reject your application or offer you a higher loan interest rate. Before applying for a consolidation loan, improve your credit score. In extreme cases, non-bank financial institutions may have lower criteria.

How Personal Loans Affect Your Credit Score

In conclusion, getting a personal loan with bad credit score is difficult but not impossible. Even with bad credit, there are ways to get financing.

First, find out how your credit affects loan applications. Responsible credit management, on-time payments and moderate credit utilization can improve your credit score.

If you have a low credit score, authorized lenders and non-bank financial institutions can approve your loan. Because of the higher risk involved, these lenders may have more flexible loan terms but higher interest rates.

Small personal loans and cosigners can improve your chances of loan approval. A co-signer on a secured loan helps insure the borrower, and a smaller loan amount reduces risk.

Debt Consolidation Loans For Bad Credit: A Complete Overview

Debt consolidation loans can help people with multiple debts. Negative credit is possible. Secured, cosigned loan and credit counseling options.

Remember that smart money management, honest communication with your creditors, and effective financial advice are the keys to managing debt. Bad credit is a setback, but not the end of your financial journey. You can overcome this obstacle and achieve financial stability with the right mindset. Debt consolidation loans are a popular choice for people struggling with multiple debts. These loans allow you to consolidate all your debts with low interest rates and long repayment periods. However, if you have bad credit, getting a debt consolidation loan can be difficult. In this section, we will review bad credit debt consolidation loans and help you understand how they work.

A bad credit debt consolidation loan is a loan for people with bad credit scores who have difficulty getting traditional loans. These loans are specifically designed to help people consolidate their debts into one manageable payment. Bad credit debt consolidation loans typically have higher interest rates than traditional loans, but offer lower interest rates than credit cards.

Debt consolidation loans work by combining multiple debts into one loan. This loan usually has a low interest rate, a fixed monthly fee and a long repayment period. With credit coordination, you can pay off all your loans and focus on one monthly payment. Loan consolidation loans can be secured or unsecured. Secured loans require surety-like collateral while unsecured loans do not.

Loan Bad Credit

Low monthly payments: Loan consolidation loans typically have lower interest rates than credit cards, so

Need debt consolidation loan, loan consolidation for people with bad credit, i need a debt consolidation loan with bad credit, i need a debt consolidation loan with poor credit, need a consolidation loan with bad credit, consolidation loan with bad credit, i need a consolidation loan with bad credit, bad consolidation credit loan people, bad credit debt consolidation loan lenders, private student loan consolidation bad credit, need consolidation loan, need a debt consolidation loan bad credit