Mortgages For People With Low Credit Scores – Here is a summary on the subject. This is a collection of discussions about it on various blogs. Each topic is linked to the original blog.

Your credit score plays an important role in determining your mortgage interest rate. It is an indicator of your creditworthiness and your ability to repay the loan. Lenders use credit scores to assess the risk of lending money to applicants. The higher your credit score, the lower your borrowing risk and the more likely you are to get a lower mortgage interest rate. In this section, we’ll look at the role your credit score plays in mortgage interest rates and how you can improve your credit score to get a better interest rate.

Mortgages For People With Low Credit Scores

Your credit score is a three-digit number ranging from 300 to 850. It is calculated based on your credit history, including payment history, loan amount, length of credit history, type of credit and the new credit. The most widely used credit scoring model is FICO, which is used by 90% of lenders. FICO scores range from 300 to 850, with higher scores being better.

What Is A Credit Score?

Your credit score has a significant impact on your mortgage interest rate. Lenders use your credit score to determine your mortgage interest rate. The higher your credit score, the lower the interest rate you will be offered. For example, a credit score of 760 or higher may offer an interest rate of 3.5%, while a credit score of 620 may offer an interest rate of 5.5%. This can save you thousands of dollars over the life of your loan.

If your credit score is low, there are steps you can take to improve it. First, make sure you pay all your bills on time. Late payments can have a big impact on your credit score. Second, pay off your debt. High debt levels can also lower your credit score. Third, don’t apply for new credit unless you absolutely need it. Having too many credit inquiries can also lower your score. Finally, check your credit report regularly to ensure there are no errors or fraudulent activity.

Besides your credit score, many other factors can affect your mortgage interest rate. These include loan amount, loan term, down payment, and loan type. For example, a 30-year fixed-rate mortgage may have a higher interest rate than a 15-year fixed-rate mortgage. Likewise, a larger down payment may result in a lower interest rate.

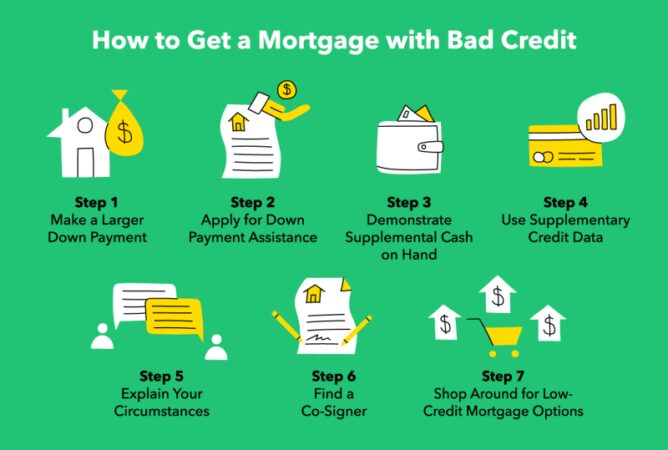

If your credit score is low, you still have the option of getting a mortgage loan. One option is to work with a lender who specializes in loans for people with low credit scores. Another option is to consider an FHA loan, which has more lenient credit requirements. However, these loans often come with high interest rates and mortgage insurance premiums.

Keyword:mortgages Credit Score

Your credit score is an important factor in determining your mortgage interest rate. To get the best mortgage interest rate, it is important to maintain a good credit score. By paying your bills on time, repaying your debts and checking your credit report regularly, you can improve your credit score and save thousands of dollars over the life of your loan.

The Role of Credit Scores in Mortgage Rates – Credit Score: How PMI Affects Mortgage Rates

The role of credit score in obtaining mortgage insurance is an important aspect that lenders consider when assessing the risks of approving a mortgage. Credit scores provide valuable information about a person’s creditworthiness and financial stability, allowing lenders to assess their likelihood of repaying their loans on time. In this section, we’ll take a closer look at the importance of credit scores in purchasing mortgage insurance, explore different perspectives, and provide detailed information for understanding this aspect of the underwriting process.

A credit score serves as a reliable indicator of a person’s credit risk. Lenders use your credit score to measure the likelihood that you will default on your mortgage payments. A high credit score generally indicates a low-risk borrower, while a low credit score may indicate a high-risk borrower. For example, if an applicant has a credit score of 700 or higher, they demonstrate responsible financial behavior and may offer more favorable mortgage insurance terms.

Mortgage With Low Credit Score

Your credit score plays an important role in determining the cost of mortgage insurance premiums. Borrowers with high credit scores often qualify for lower premiums because they are considered less likely to default on their loan obligations. Conversely, people with lower credit scores may charge higher premiums due to the increased risk associated with their repayment history.

Lenders typically set minimum credit score requirements for borrowers seeking mortgage insurance. These requirements vary depending on the type of loan program and the lender’s guidelines. For example, some government-backed loans, such as FHA loans, may have more lenient credit requirements than conventional loans offered by private lenders.

Certain credit score criteria can have a major impact on your decision to purchase mortgage insurance. For example, borrowers with credit scores below 620 may be considered subprime and may have difficulty obtaining mortgage insurance or obtaining favorable loan terms. On the other hand, borrowers with a credit score of 760 or higher can benefit from more competitive interest rates and lower mortgage insurance premiums.

Borrowers with a low credit score can take steps to improve their credit before applying for a mortgage. Paying your bills on time, reducing outstanding debt, and maintaining a low credit utilization rate are some effective strategies for increasing your credit score. By demonstrating responsible financial behavior, borrowers can increase their chances of obtaining favorable mortgage insurance terms.

How To Improve Your Credit Score For Mortgage Loan In Singapore

Credit scores play an important role in purchasing mortgage insurance by providing lenders with valuable information about an individual’s creditworthiness and risk profile. understanding

Credit scores play an important role in mortgage pricing because they are one of the main factors lenders use to determine the risk of lending money to a borrower. Generally, the higher your credit score, the lower the interest rate you can expect to pay on your mortgage. This is because lenders consider borrowers with higher credit scores to be less likely to default on their loans and therefore less risky to lend money. On the other hand, borrowers with low credit scores are considered high risk and may be charged higher interest rates to compensate for this risk.

1. How Credit Scores are Calculated: Credit scores are calculated using a variety of factors including payment history, loan amount, length of credit history, types of credit used, and new credit. The most commonly used credit score is the FICO score, which ranges from 300 to 850. Borrowers with scores above 700 are generally considered to have good credit, while scores below 600 are considered to have poor credit. credit.

2. How your credit score affects your interest rate: The impact of your credit score on your interest rate can be significant. For example, a borrower with a credit score of 760 may be offered an interest rate of 3.5% on a 30-year fixed mortgage, while a borrower with a credit score of 620 may be offered an interest rate of 5.5%. Over the life of your loan, this interest rate difference can add up to tens of thousands of dollars in additional interest payments.

Jumbo Loans With Low Credit Scores

3. Options for borrowers with low credit scores: There are options available even if your credit score is low. One option is to work on improving your credit score before applying for a mortgage. This may include paying off debt, making all payments on time, and not applying for new credit. Another option is to consider an FHA loan, backed by the Federal Housing Administration. These loans are designed to help borrowers with low credit scores qualify for a mortgage.

4. Importance of shopping around: When applying for a mortgage, it is important to shop around and compare rates from multiple lenders. This can help you find the best deal and potentially save you thousands of dollars over the life of your loan. However, it’s important to remember that shopping around can also affect your credit score, as each lender typically pulls your credit report, which can lower your score quite a bit.

5. Role of other factors in mortgage pricing: Credit score is an important factor in mortgage pricing, but it is not the only one. Other factors that can affect your interest rate include your down payment amount, the type of loan you choose and current market conditions. When considering a mortgage, it’s important to consider all of these factors and work with a lender who can help you find the best deal for your specific situation.

Overall, credit scores play an important role in mortgage pricing, and borrowers with higher credit scores generally have access to better interest rates. However, there are also options available for borrowers with low scores. It is therefore important to shop around and take into account all the factors that can affect the value of the mortgage loan. By doing so, you can get the best deal and save money over the life of your loan.

Get A Mortgage With A Bad Credit Score

The Role of Credit Scores in Mortgage Pricing – Loan Origination Fees:

Mortgages for bad credit scores, loans for people with low credit scores, home loans for people with low credit scores, mortgages for poor credit scores, mortgages with bad credit scores, mortgages for self employed people, credit scores used for mortgages, mortgages for low credit scores, credit scores for mortgages, credit cards for people with low scores, mortgages for fair credit scores, home mortgages for low credit scores