Lowest Interest Rate On A 30 Year Mortgage – When shopping for a home loan, you can find various loan options. Plugging this information into a loan comparison calculator can help you figure out which option is best for you.

If your loan is $250,000.00 you can be offered a 30-year loan with an interest rate of 3,250% with 1,000 points and a closing cost of $1,200.00, or you can be offered a 15-year loan with an interest rate of 3,000% with 2,000 points. 0.50% and a closing cost of $700.00.

Lowest Interest Rate On A 30 Year Mortgage

Your total closing cost with the first loan option is $3,700.00 and the second loan is $6,950.00 at closing. The first loan amount is $1,088.02 per month. The second loan amount is $1,726.45.

Charted: The History Of Interest Rates Over 670 Years

All told you will pay less on the second loan as well. Of course with a second loan you will save $80,923.95. This is because the first loan is $391,685.69 and the second loan is $310,761.74.

Are you looking at quotes for several different loans? Use this free loan calculator to see multiple loan quotes side-by-side. And choose the best deal For each quote you can choose rates, terms, points, origination fees. And different closing costs can help a 15-year loan build home equity faster. Meanwhile, a 30-year mortgage offers a lower monthly payment.

For your convenience, the current New York 30-year and 15-year mortgage rates are displayed below the calculator to help you make accurate calculations that reflect current market conditions.

Compare local mortgage rates and save with your mortgage savings tips: Lock in a low New York 30-year mortgage rate today.

Housing Is Expensive … But Mortgage Bonds Are Cheap

How much can you save? Compare lenders working in New York to find the best loan that fits your needs and get the lowest interest rates today!

Loans with initial 30-year fixed interest rates are listed in the table below. Filters allow you to change the loan amount, term or loan type.

The filters at the top of the rate table allow you to adjust your mortgage options. By default the exchange rates will be displayed. You can edit your loan settings to change a 30-year fixed-rate $250,000 loan on a $312,500 home in New York City to a different term, location, or loan amount. Don’t forget to change the price of the house. Some lenders only lend up to a certain LTV value. Each lender will show you the best rates for different loan situations.

The rate table below is automatically configured to display the details of your second credit status. This is a 15-year, $250,000 fixed-rate loan for a $312,500 home.

Best Fixed Deposit Accounts In December 2023

Loans with fixed interest rates starting at 15 years are shown in the table below. Filters allow you to change the loan amount, term or loan type.

Fixed rate loans provide fixed monthly mortgage payments. So you can create a solid budget. This is different than an adjustable rate mortgage. There are no surprises with fixed rate loans. And you don’t have to worry about resetting charges or increasing your payments.

It is important to consider the pros and cons of each type to choose the type of fixed rate loan that is best for you.

With a 15-year fixed-rate loan, you can pay higher monthly mortgage payments. But you will pay less interest over the life of the loan.

U.s. Mortgage Application Flow Plunges To Lowest Since 1995

For example, if you have a 30-year fixed home loan worth $272,000. With an interest rate of 4.5 percent, you would pay $224,146.26 in interest. Only for the life of the loan. However, if you had a 15-year fixed-rate loan on the same terms, you would only pay $102,540.71 in interest. Compared to debt

Of course, you’ll pay a little more toward your monthly mortgage payment. For a 15-year loan, your monthly mortgage payment would be $2,080.78 (not including variables like property taxes and insurance), and for a 30-year loan, your monthly mortgage payment would be $1,378.18 each month. You will pay very low interest over the life of the loan. And you will quickly build equity in your home.

The main advantage of a 30-year fixed rate loan is that you can lower your payments to a more affordable level. Without taking out risky loans like adjustable rate mortgages, the downside is that it will take you a long time to pay off the loan. This can put you in a difficult position if you want to move or sell your home. If you haven’t been home for a long time you may not have enough stock to sell when you are ready to go out. If you want to retire early you may not be able to because you are still paying your mortgage.

A 30-year loan is “slow and steady” with less risk. But you may need a loan that will help you reach your financial goals sooner.

Mortgage Rates Retreat Again Today, Nov. 20, 2023. That’s Good News

Not all fixed rate loans are equal. Variables such as interest rates and fees associated with each loan make apples-to-apples comparisons difficult. However, you can use the above calculator to compare the terms. Options for your financial goals. The calculator takes into account interest rates, credit scores and account opening fees. and final cost for each item so you can compare expected monthly expenses.

Even though terms vary so you can understand exactly what you can expect to pay each month. and the interest you expect to pay over the life of the loan. Then you can decide if you want to pay off the loan early or make as few payments as possible. Which option is best for your short-term and long-term financial goals?

A 30-year fixed-rate loan is a popular option among American homebuyers. 15-year fixed-rate loans are a common choice for people refinancing their homes. Some buyers with relatively high incomes may choose other terms, such as 20 or 10 years, for their first home purchase. We have a range of calculators that make it easy to compare two terms side by side for existing conditions. All common fixed rates : 10 or 15, 10 or 20, 10 or 30, 15 or 20, 15 or 30, and 20 or 30 at. At the bottom of each calculator is a button to create a printable amortization graph. This allows you to view monthly data for each loan over time. Each calculator includes the points value and loan origination fields. “Closing Costs” (instead of the allocation in the calculator above)

You can use this calculator to compare fixed-rate loans with ARMs and interest-only loans if you want to explore adjustable rate options.

Mortgage Rates Drop Back Near All Time Low As Delta Variant Spreads

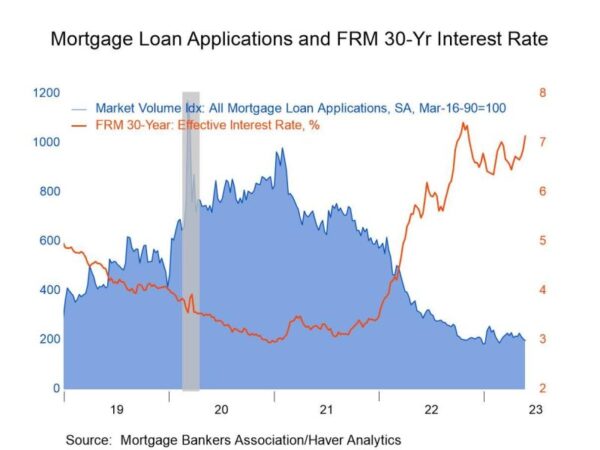

Explore conventional mortgages, FHA loans, USDA loans and VA loans to see which option is right for you. After falling 4.6% (-35.0% y/y) in the week ending May 19, mortgage applications fell 3.7% (-36.0% y/y) in the week ending May 26. Application numbers were the lowest since late February. This information comes from the Mortgage Bankers Association’s weekly mortgage application survey.

The number of home loan applications decreased by 2.5% (-31.1% y/y) last week. After falling 4.3% (-29.8% y/y) last week. Applications for existing loan refinancing fell 6.9% (-45.1% y/y) last week. After falling 5.4% (-44.3% y/y) last week.

The share of outstanding mortgage refinance loans fell to 26.7% for the week ending May 26 after holding steady at 27.4% over the past two weeks. The share of loans with adjusted interest rates increased slightly to 6.8% in the week of May 26 from 6.7% in the previous week.

The effective interest rate on the 30-year fixed-rate loan rose to 7.15% in the week ending May 26, up from 6.88% the previous week. and reached levels not seen since early November 2022. 15-year fixed-rate loan-mortgage rates rose to 6.62% from 6.33% last week. This reached the highest level since early November. The 30-year jumbo mortgage rate rose to 7.01% in the week of May 26, up from 6.74% the previous week. And that’s the highest level since support began in 2011. For five-year ARM loans, the effective rate fell to 5.56% from 6.17% last week.

Current Mortgage Interest Rates

Average mortgage loan volume decreased 0.7% (+1.4% y/y) to $391,000 for the week ended May 26, from $393,600 the previous week. The average purchase loan amount decreased 0.6% (+1.4% y/y) to $439,400 from $442,000 last week. Average refinance loans decreased 2.5% (-8.4% y/y) to $258,400 week to date. From May 26, week of $265,10 to May 19.

The Mortgage Banker Survey covers 75% of all retail mortgage applications

Lowest interest rate mortgage, lowest 30 year mortgage interest rate, lowest interest rate 30 year fixed mortgage, 30 year mortgage interest rate, 30 year fixed rate mortgage interest rate, today's 30 year mortgage interest rate, lowest interest rate refinance mortgage, current interest rate on 30 year mortgage, lowest interest rate for 30 year mortgage, lowest interest rate on a 30 year mortgage, lowest interest rate mortgage lenders, lowest mortgage interest rate today