Lowest Interest Rate On 30 Year Mortgage – Advertising Display: Content displayed on this site comes from paid companies. This charge may affect how and where products are displayed on this site (including, for example, the order they are displayed). does not include all companies or all offers on the market. Learn more here.

Editorial note: We receive services through affiliate links and . Commissions do not reflect the opinions or analysis of our writers or editors. Learn more here.

Lowest Interest Rate On 30 Year Mortgage

After falling for decades, mortgage payments may be on their way. In fact, it’s still close to 15 percent or more of consumers paying 30-year mortgages in the mid-1980s. The best you can do. That’s what we’re going into here.

Current Mortgage Rates And How To Compare Offers

Let’s take a look at each of these factors and what it takes to qualify for the best mortgage rates.

Improving your credit score is one of the best ways to save money on all types of financing – from home loans to car loans and even car insurance. With a mortgage, a good credit score can save you tens of thousands of dollars over the life of the loan. The best mortgage rates go to those with a FICO score of 760 or higher.

Here are three basic tips to improve your credit score. But you can check this long list of tips for more details.

If you’re good at paying your bills on time, be sure to sign up for Experian Boost™. This is an easy way to improve your credit score. If you pay utility bills or phone bills on time, your FICO® score may see an improvement. The best part is that it is free to use!

Mortgage Rate Lock Guide

If you don’t know your FICO score, there are several ways to find it. First, you can purchase direct access to your score through myFICO. It’s inexpensive to get your FICO score from all three credit bureaus. Since each company’s financial report may be slightly different, this can give you a better picture of what potential lenders will see.

If you don’t want to pay for your points, many credit card issuers offer free options as well. You can find a list of credit cards that offer credit scores here.

Finally, you can get a free credit score through sites like Credit Karma. This score is not based on the FICO system. But it does a good job of replicating the FICO score. It also provides a lot of information and ways to improve your score. And like I said, it’s free.

It may be a good idea to start with the free option if you are not ready to apply for a mortgage. But before you apply, consider paying FICO for your credit score and current report. In this way, you can see any problems that may occur at the last minute in detail.

Best Mortgage Rates Ireland 2023 Ultimate Comparison Review

Home prices and income also affect mortgage rates. Here, mortgage loans fall into one of three categories (Source: FreddieMac):

The bottom line here is that, all other things being equal, a conforming loan has a lower rate than a conforming loan. And a conforming loan has lower cost than a jumbo mortgage.

Using our loan tool, I found that the difference between subprime and jumbo loans is almost 50 basis points.

GOOD LINE: Choose a flexible loan if you want the lowest possible interest rate. If you live in an expensive area, you may want to look for an unsecured loan.

Ocbc Ohr Update

As mentioned above, the most expensive areas of the country can qualify for well-financed loans. In these cases, the rate may be lower than if the loans are jumbo loans. Buying in the suburbs can also affect your loan options in a unique way. Shop around for loans to see what different lenders have to offer for your area.

Lenders like to carry as little risk as possible. The more risk you take, the more interest they pay to minimize losses. The more equity your home has up front, the lower your interest rate will be.

Think about it: You buy a house and default on the mortgage after one year. Does the lender get their money back if you put down 5 percent or 20 percent? A higher down payment means that the lender can get their money back during the foreclosure sale if you default on the loan.

Although you can still get a loan with less than 20 percent, this is a good mark to try to reach. Otherwise, you’ll pay higher interest rates and private mortgage insurance (PMI).

Fixed Rate Vs Adjustable Rate Mortgage: Which Is Right For You?

Also, lenders often offer you lower interest rates while mitigating risk. So, a longer loan term can be longer or interest rate – always important. You may pay a lower interest rate on a 15-year note than a 30-year mortgage, although you will receive a higher interest rate in return.

Interest rates aren’t the only thing you should consider when deciding between a 15- and 30-year mortgage. But this is an important factor.

Whether the interest rate is fixed or variable affects the rate. All other things being equal, an adjustable rate mortgage starts at a lower rate than a fixed rate loan. Keep in mind that adjustable rate loans go up around rate increases. And if rates rise significantly, so will your payments.

This adjustable rate loan can be another way to take advantage of low rates. An option like a 5-1 ARM, where your rate is fixed for five years and changes every year after that, starts with a lower interest rate up front. But again, with a rate increase around, your interest and payments will also increase.

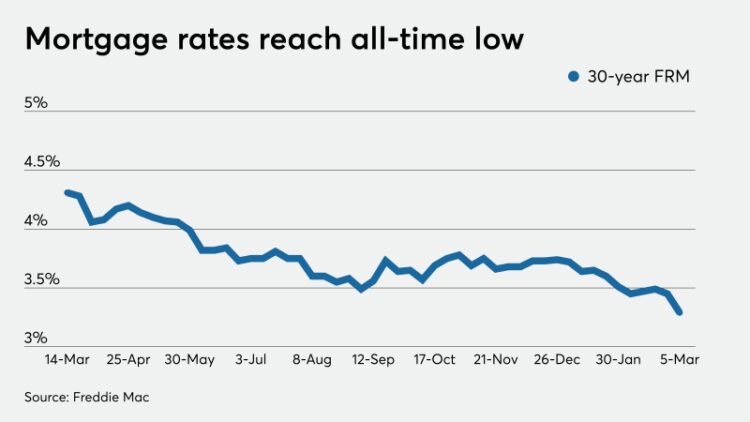

Mortgage Rates Chart

There are many different types of mortgage products. In addition to commercial mortgage products, there are VA, FHA and USDA loans. Each of these shipping products has unique features and specifications. Shipping costs vary from product to product.

Some of these programs are designed for low-income homebuyers. In these cases, you must meet the financial requirements. But with an exchange, you can lock in a lower market interest rate or longer.

If you do not qualify, it is better to get a loan. A loan such as a 30-year FHA mortgage may have more serious fees. For example, an FHA loan pays PMI over the life of the loan. (Many loans are set to eliminate PMI after you put 20 percent down on the home.)

So, looking at all these categories, what should you do to find the best mortgage rates available? Meet the following qualifications:

Housing Market Takes Another Body Blow With Sharp Interest Rate Rise

Not many borrowers will check all these boxes. But in reality, not all of these things are in your hands. But they may not make a positive change, though.

There is no magic formula here. Lenders only want to give loans to low-risk individuals. So make yourself attractive to banks and they will pay you a lower interest rate.

It’s easy. Using online mortgage payments is easy, especially if you use a reliable service.

If you’re looking at your current lender and what they can offer, use credit to get quotes from companies like Citizens Bank, Rocket Mortgage and Stearns Bank.

Mortgage Interest Rates Fall To Lowest Level In Nearly Three Years

It only takes three minutes to complete the basic application. A soft credit request is required to be able to offer a custom rate. This will not affect your credit score. Loan applications fell 3.7% (-36.0% y/y) in the week ending May 26, following a 4.6% decrease (-35.0% y/y) in the week ending May 19. Applications are at their lowest level since late February. . The data comes from the Mortgage Bankers Association’s Weekly Mortgage Application Survey.

Applications for loans to buy a house fell 2.5% (-31.1% y / y) in the new week followed by 4.3% (-29.8% y / y) fell last week. Applications to refinance existing loans fell 6.9% (-45.1% y / y) last week, while 5.4% (-44.3% y / y) fell last week.

The ratio of loans to refinance existing debt in the week ended May 26 fell to 26.7% after remaining constant at 27.4% in the previous two weeks. The ratio of loans with variable rates increased slightly to 6.8% in the week of May 26 from 6.7% the previous week.

The effective interest rate on a 30-year mortgage rose to 7.15% in the week ended May 26, from 6.88% the previous week, and reached a level not seen since early November 2022. The rate is 15 years fixed. Mortgage lending rose to 6.62% last week from 6.33% the previous week, reaching its highest level since early November. The 30-year Jumbo loan rate reached 7.01% in the week of May 26, up from 6.74% the previous week and the highest level since the system began in 2011. For the 5-year ARM loan, this effective rate decreased. . 5.56% in the new week from 6.17% in the previous week.

Average Mortgage Interest Rates: Mortgage Rates By Credit Score, Year, And Loan Type

The average loan size decreased by 0.7%.

30 year fixed rate mortgage interest rate, 30 year mortgage interest rate, today's 30 year mortgage interest rate, lowest interest rate for 30 year mortgage, lowest mortgage interest rate today, lowest interest rate mortgage lenders, lowest interest rate refinance mortgage, lowest interest rate 30 year fixed mortgage, lowest interest rate mortgage, lowest interest rate on a 30 year mortgage, lowest 30 year mortgage interest rate, current interest rate on 30 year mortgage