Loans For First Time Home Buyers With No Money Down – Since 2003, Dan Green has been a leading mortgage lender and recognized industry expert. Her unwavering commitment to first-time homebuyers and educating homebuyers has made her a trusted voice among her peers, colleagues and the media. Dan decided to extend the American dream of home ownership to all who wanted it. Read more about Dan Green.

Committed to helping you achieve your home ownership dreams. We adhere to our editorial guidelines, including truth and transparency, and may present you with offers from other companies. Read how we make money.

Loans For First Time Home Buyers With No Money Down

Is your trusted guide to home ownership. Since 2003, our team has offered real-world experience and advice to millions of American homebuyers. Our content is based on its integrity: it is factual, impartial and free from external influences. Read more about our operational editorial guidelines.

First Time Home Buyers In Washington Dc May Qualify For The Home Purchase Assistance Program

Is a publisher associated with mortgage companies. We are compensated when you click on specific links on the website or apply for a mortgage with a partner or partners listed in our comparison table. Our partners compensate us differently, so we randomize our tables to protect our readers from manipulation. We may also receive compensation for advertising on the Site, which is clearly stated. Please note that limitations in our software, whether we offer mortgages in your area, and credit factors affect the offers and comparison tables you see on various parts of this site. We do not include offers for every available mortgage product. Someday, we hope, we will.

Your trust is important to us. This article has been thoroughly checked for accuracy on November 10, 2023. This ensures that all information we share reflects the latest mortgage standards. For more information about our commitment to our readers, please see our editorial guidelines.

Gone are the days when you needed thousands of dollars to own a home. You don’t need a 20 percent down payment to buy a home. You may not currently have mortgage loans available.

38 percent of potential buyers say that saving for a down payment is their biggest obstacle to home ownership. Considering the median sales price of $356,700, the average first-time buyer will spend $24,969 on a down payment.

The Tools Available To Canadians Purchasing Their First Home

There are down payment assistance resources that provide a clear path to home ownership. Current legislation awaiting a vote in Congress would offer first-time buyers a $15,000 tax credit and $25,000 in grants.

Even better, if you’re wondering if now is a good time to buy a home without breaking the bank, you don’t have to wait for a new federal law. Here’s how to buy a home today with no money down.

If you could live in your dream home for zero dollars, would you still choose to rent?

You don’t need a big deposit to buy a house. First time buyers report an average of 7%. The chart below shows the median payment for first-time buyers since 1989, based on data from the National Association of Realtors (NAR).

Fha Mortgage Loans With No Overlays Fha Lenders

You can choose a mortgage with no closing costs, which increases your interest rate while keeping money in your pocket.

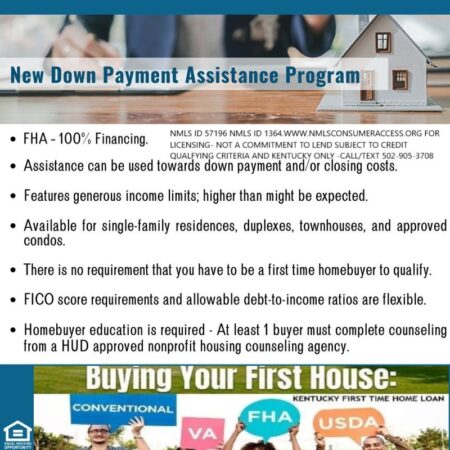

Down payment assistance is also available to help you get a mortgage with no money down. Federal, state and nonprofit agencies—and even mortgage lenders—offer grants and loans to help first-time buyers.

A down payment (DPA) can help you buy a house without outright cash. It includes various federal, state and nonprofit programs for new home buyers.

V, we partner with the Chenoa Fund to make home ownership possible without paying anything out of pocket.

First Time Homebuyer Programs In Delaware

Through our partnerships, DPA provides homebuyers with an FHA loan that provides an affordable and consumer-friendly path to home ownership.

Buyers have two options – a 3.5 percent second loan to cover your down payment or a 5 percent second loan to cover the down payment and closing costs.

If you are on a moderate income or below, the second loan has zero interest and no monthly payments. It is also a forgivable second mortgage. If you pay your housing payments on time, your loan will be forgiven and you will never have to pay it again.

The 5 percent option is waived after 10 years of paying 60 or more days in arrears. If you fall behind, there’s still no interest and no payments—you only have to pay the second lien when you sell or refinance your home.

First Time Home Buyers Incentive Program!

If you belong to people with a high income, the second loan is paid every month. Buyers can choose a 10-year interest-free loan or a 30-year loan with 5 percent interest.

Down payment assistance programs usually have credit history and income requirements. New home buyer programs may require you to complete a mortgage education course. These down payment assistance options are now available.

There are no down payment requirements or minimum credit scores for USDA loans. Designed to encourage increased home ownership in rural areas, these loans offer subsidized interest rates.

Buyers are generally responsible for closing costs, loan fees and mortgage insurance, although there are options for the seller or your lender to cover some of these costs.

Suzanne Steele On Linkedin: #mortgage #interestrates #realestate #realestatevirginia #interestrates…

You can get seller concessions and lender concessions, where the seller and lender will pay some or all of your closing costs.

VA loans provide home purchase options for members of the US military, veterans and their spouses. Like USDA loans, VA loans have no down payment or credit score requirements, although most lenders prefer a credit score of 580 or higher.

You must have a Certificate of Eligibility (COE) to apply for a VA loan. It will verify your service history and current service status to prove your eligibility.

VA guarantees loans against loss with a lien, similar to private mortgage insurance. This allows the lender to offer a zero down payment purchase with less risk and lower rates.

Arvest Bank’s New Product For First Time Homebuyers

Conventional loans from Fannie Mae allow 97 borrowers to secure a classic mortgage with a 3 percent down payment. No personal contribution required. Mortgage gifts, grants and other DPAs can cover your down payment.

Conventional loans are an alternative to 97 FHA loans. It has low initial costs and does not require permanent mortgage insurance.

A conventional 97 loan cannot be used to purchase a manufactured home. Eligible property types include single-family homes with up to four units, apartments and planned developments.

Homeready mortgages from Fannie Mae are another loan option for low-income buyers. Borrowers qualify with a 3 percent down payment and a credit score of 620 or higher.

Most Popular Metros For Gen Z Homebuyers

Home buyer education is required if all borrowers are first time home buyers. All residents can submit their income for verification and improve the chances of approval.

There are also no minimum personal contribution requirements for a down payment. Donations, grants and other DPA programs can cover this investment.

Freddie Mac’s HomePossible Loans offer low down payment mortgages with a minimum down payment of 3 percent. Down payment financing is flexible with no personal cash requirements.

A credit score of 660 or higher is required for approval. The borrower’s income must not exceed 80 percent of the Area Median Income (AMI), which is available on the Freddie Mac website.

Eric Witmer On Linkedin: For All First Time Homebuyers Looking For Improved Rates. Bay Equity Has…

Home mortgages may require mortgage insurance, and buyers can cancel their contract if they reach 20 percent equity.

FHA loans require a minimum down payment of 3.5 percent for borrowers with a credit score of 580 or higher. FHA loans have flexible credit score requirements. Borrowers with scores below 500 are eligible for approval if they put down a down payment of 10 percent or more.

FHA loans also require proof of employment and income. Borrowers must have a debt-to-income ratio of 43 percent or less to qualify under standard guidelines, but the FHA can allow a ratio of up to 56.9 percent with compensation factors.

FHA loans can only be used to purchase a primary residence. District-specific loan limits of $822,375 apply in high-cost areas.

Buy A Home With No Money Down & No First Time Home Buyer Requirement

Conventional loans are the most popular type of loans among buyers. Standard conventional loans require a minimum 3 percent down payment with a credit score of 620 or higher.

Conventional loans are not backed by the government, so the lender’s requirements vary. Compliance with conventional credit limits is governed by FHFA standards. The 2023 mortgage loan limit for single-family homes in most US counties is $726,200.

With the right type of loan, many first-time home buyers can buy a home for free. You don’t have to put down a 20 percent deposit.

When you buy a home with no money down, you can defer your housing payments for longer, protect yourself from rent increases, and you can build wealth with monthly payments equal to the rent.

Araceli Paleo On Linkedin: Let’s Talk About Your Needs

You can buy a home with a credit score as low as 580 and sometimes even lower depending on your lender.

VA and USDA loans have no official minimums, although lenders will approve buyers with a credit score of 580 or higher.

You can still qualify for a loan with a credit score below 580. FHA loans accept credit scores below 500 if you put down a down payment of 10 percent or more.

With the Down Payment Assistance Program, VA and USDA loans, there are no down payment requirements.

Fha Vs Va Loan

Each type of loan has different eligibility requirements

No money down programs for first time home buyers, best loans for first time home buyers with no down payment, programs for first time home buyers with no down payment, no money down home loans for first time buyers, options for first time home buyers with no down payment, home loans for first time buyers with no credit, zero down home loans first time buyers, zero down mortgage loans first time home buyers, no money down for first time home buyers, home loans for first time buyers with no down payment, mortgage loans for first time home buyers with no down payment, home loans no down payment first time buyers