Is Fha Loan Good For First Time Home Buyers – Below is a table listing currently available FHA home loan rates in New York. You can use the menu to select a different loan term, change the loan amount, or change your location.

Mortgage rates hit record lows in October 2020 following the global COVID-19 crisis.

Is Fha Loan Good For First Time Home Buyers

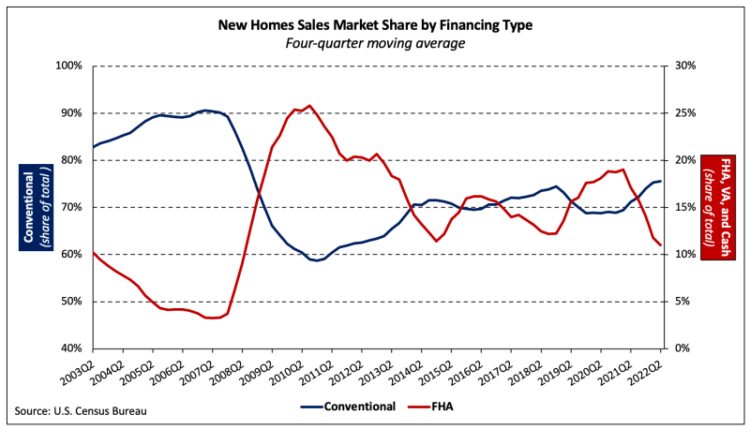

Historically, when the economy is doing well, the share of existing loans increases, and when the economy is in recession, government support programs come into the market.

What Is An Fha Loan? A Complete Guide To Fha Loans

For example, back in November 2009, before the recession, nearly 4 in 10 homebuyers were purchasing a home with the help of a mortgage loan insured by the Federal Housing Administration (FHA).

As of November 6, 2020, the average interest rate for a 30-year fixed mortgage was 2.98%, according to the Mortgage Bankers Association. The average FHA 203(b) loan was 10% higher at 3.28%.

Do you need a mortgage with less stringent credit requirements and cheaper payments? An FHA loan can help. The Federal Housing Administration (FHA) finances residential mortgages primarily for low- and moderate-income consumers. This is also a viable option for many first home buyers.

Our guide explains a brief history of the FHA mortgage program, how it works, and what it takes to qualify for an FHA loan. Let’s discuss the main benefits and some limitations you should consider before choosing this option. It also compares FHA interest rates to conventional loan rates and explains why FHA mortgages can sometimes have lower or higher interest rates. Finally, we provide an overview of the various FHA mortgage programs and how they may meet your specific housing needs.

Fha Minimum Property Requirements And Standards

The National Housing Administration (FHA) was first established under the National Housing Act on June 27, 1934. It was established primarily after the Great Depression to promote and improve housing financing. The FHA wanted to raise housing standards and increase liquidity in the housing market.

Before the Great Depression, mortgage loans were designed with variable interest rates and full payment terms of 11 to 12 years. Homebuyers could only get financing for between 50% and 60% of the home’s price, meaning they would have to take out multiple mortgages to finance their home purchase. . . Commercial banks and life insurance companies also offered five-year balloon mortgages, which included a large lump sum payment at maturity.

Homeowners continued to refinance to extend their mortgage terms when they couldn’t afford large payments. Ultimately, many borrowers were unable to afford the costly lump sum payments, which led to large-scale foreclosures. In 1933, 40 to 50 percent of all mortgages in the United States were foreclosures. The mortgage system was on the verge of total collapse.

However, with the implementation of the FHA, laws were put in place to improve lending practices. The FHA eliminated the need for multiple mortgages by increasing required loan-to-value ratios. Homebuyers were guaranteed 80% financing instead of a 20% down payment. The FHA also proposed a fixed-rate extension that would ultimately feature a 30-year fixed-rate loan. This has made it possible for more Americans to purchase a home and pay it off over a longer, more manageable period of time. FHA’s efforts stabilized the housing market and lifted the U.S. economy out of recession.

Down Payment Assistance Programs & Grants By State 2023

In 1965, FHA became an agency of the U.S. Department of Housing and Urban Development (HUD). Since 1934, FHA has originated more than 40 million home loans. Today, the department continues to help make home buying accessible to more Americans. FHA programs are known for their low down payment options and relaxed loan qualifications.

As the economy continues to grow, many lenders have become overconfident in extending credit. Beginning in the early 2000s, these lenders began offering conventional mortgages to high-risk borrowers with poor credit ratings. Some standard loan programs also offered very low down payment options (100% financing) and mortgages with extended payment terms of 40 to 50 years.

During this time, FHA mortgages still offered down payment options as low as 3 percent of the home’s purchase price. They also imposed mandatory credit requirements. However, because many conventional lenders offered subprime mortgages, more borrowers chose subprime mortgages over FHA loans. FHA loans required mortgage insurance premiums (MIPs) and origination fees that gave borrowers higher interest rates. Interest rates were higher for people who had past credit problems. For this reason, more consumers obtained subprime mortgages from conventional lenders.

The decline in housing prices in the late 2000s led to a housing crisis. This occurred after the housing bubble burst due to the subprime mortgage problem in 2006 and 2007. As lenders extend mortgages to borrowers with unstable credit and high debt, the risk of default becomes greater.

How To Qualify For An Fha Loan

As the real estate bubble burst, large-scale delinquencies, seizures, and devaluations of real estate-related securities occurred. American homeowners took advantage of subprime mortgages. Because the mortgage loan balance was more than the price of the house, even if the house was sold, the loan could not be repaid. A total of 2.8 million U.S. households received foreclosure notices in 2009, according to RealtyTrac.com, an online foreclosure company.

After the subprime mortgage crisis, mortgage lenders became more stringent about credit ratings. Traditional zero down payment loans no longer exist in the real estate market. High lending rates have made it difficult for homebuyers with limited income and poor credit to obtain conventional loans. As a last resort, many borrowers are once again turning to FHA mortgages. In November 2009, nearly 4 in 10 homebuyers purchased their home with an FHA loan. Today, in addition to the down payments offered by FHA, federally backed mortgages such as VA loans and USDA loans offer 100s of financing options.

Due to the COVID-19 outbreak, mortgage interest rates have fallen to historic lows. Despite the recession, the U.S. Census Bureau reported in August 2020 that home sales were up 43% from the previous year. In October 2020, the Washington Post reported that the average 30-year mortgage rate had decreased from 2.87% to 2.81%. At that time, the average interest rate was the lowest since 1971, when Freddie Mac began conducting research. Compared to 2019, the 30-year average interest rate fell below 3.69%.

Seeing the impact of COVID-19 in 2020, the Federal Reserve stepped up to keep interest rates low. They did this to stimulate market activity and help the economy grow. It’s true that many consumers are starting to buy homes, and many homeowners are rushing to refinance their mortgages at lower interest rates. According to Fortune, home sales in 2020 were driven by demand for suburban properties and millennials and first-time homebuyers. Their acquisition comes at a time when work-from-home policies are spreading across many industries.

Indiana First Time Home Buyer Programs Of 2023

Over the past several decades, the FHA program has made mortgages available to many homebuyers. Currently qualified FHA borrowers are guaranteed 96.5% financing. This is possible if your credit score is 580 or higher. Meanwhile, even people with low credit scores between 500 and 578 can get an FHA loan by providing a 10% down payment. The FHA program is intended to promote lending to lower- and middle-class consumers. To protect mortgage lenders, they provide federal insurance protection if borrowers default on their loans.

Despite the 2020 recession, the U.S. homeownership rate increased from 65.1% in 2019 to 65.8% in 2020. About 16% of homebuyers in 2020 had an FHA loan, according to a report from the National Association of Realtors (NAR). . On the other hand, 64% would have taken out a conventional mortgage. It remains the most popular type of home loan purchased in the United States. Meanwhile, 14% of homebuyers chose a VA mortgage. According to the report, 24% of first-time homebuyers chose an FHA loan, while only 11% of repeat buyers chose an FHA loan.

To understand how FHA loans work, let’s look at their requirements compared to conventional mortgages. Mortgage qualifications for FHA programs are generally more relaxed than for conventional loans.

Borrowers with low or poor credit scores may qualify for an FHA loan. If your credit score is 580 or higher, you can afford a down payment of 3.5% based on the home’s purchase price. If your credit score is between 580 and 579, you can still get an FHA loan. However, you will need to pay at least 10% to meet the requirements. This means you can get 90% financing on an FHA loan.

What Are The Fha Loan Requirements 2023?

The FHA program offers one of the most affordable mortgages on the real estate market. If you have a low credit score, you may be able to get a better rate with an FHA loan than with a conventional loan.

For conventional mortgages, lenders typically approve borrowers with a credit score of 680 or higher, while those with a credit score of 620 or lower have a hard time getting a conventional loan. For a conventional mortgage, the higher your credit score, the lower the interest rate you can get. At the same time, if your credit score is low, you may have to qualify for higher interest rates through conventional loans. In some cases, conventional lenders may not approve your application at all.

When it comes to down payment requirements, expect to pay a higher down payment for a conventional loan than an FHA mortgage. Most conventional lenders prefer this.

Fha loans for first-time home buyers, fha first time home buyers, fha first time buyers, is fha loan the same as first time home buyers, fha loan for first time home buyers, fha loan requirements first time home buyers, fha loan only for first time buyers, is fha loan only for first time home buyers, is fha loan for first time home buyers, fha loan for non first time home buyers, fha for first time home buyers, fha loan programs for first time home buyers