Is A Home Equity Loan A Mortgage – The COVID-19 pandemic has been life-changing for everyone. Either you just lost your job and need some last minute help, or you want to update your home to add a home office. In addition, the Index has historically declined and home values increase as demand increases. In this article, we will explain the differences between Home Equity Loans and Lines of Credit and help you choose the best option that suits your needs and goals.

Also known as a second mortgage. A home equity loan is secured by the equity in your home. Your equity is the difference between your current loan balance and the market value of your home. You can generally borrow up to 80% of the value of your home; So you need to earn a lot to qualify. at Palisades Credit Union; Members can qualify for a loan of up to 100% of their home equity.

Is A Home Equity Loan A Mortgage

Home equity loans usually come with a fixed mortgage rate and are term loans; This means that after you close the loan, you will receive a lump sum and pay it in the expected monthly payments on a fixed period. while.

Home Equity Loan Vs. Line Of Credit Vs. Home Improvement Loan

Applying for a home equity loan is similar to the process you went through to get your first loan. Here are the steps:

HELOC in short; A home equity line of credit is a revolving line of credit secured by the equity in your home. HELOCs come with a variable interest rate and work like a credit card: you get a certain amount of credit and can draw from it; Make payments and withdraw as needed. You can link your HELOC to your checking account for easy transfers.

Typically, HELOCs come with a fixed draw period, such as 10 years, and the remaining balance is converted into a loan. A penalty may be imposed for early closure of the account.

At Palisades Credit Union; We offer special introductory rates on our HELOCs. Enjoy 1.99% APR* for the first 6 months.

What Is A Home Equity Loan?

Applying for a HELOC is a slightly different process than applying for a home loan. Here’s what you need to know:

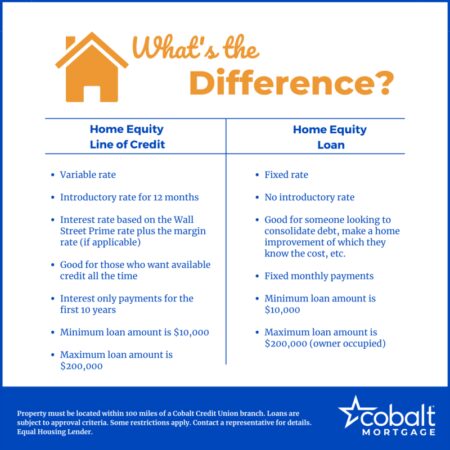

The main difference between a Home Equity Loan and a HELOC is how you get your home equity and how the monthly payments are calculated.

Get the full balance of your loan by making payments at a fixed interest rate. Make monthly payments over several years until the loan is paid off.

Find your perfect fit through the limited edition on our rotating production line. Borrow what you need and make variable monthly payments based on how much you borrow and how interest rates change.

How Much Home Equity Can (and Should) I Borrow?

The biggest question when choosing between a home loan and a home equity line of credit is why you are using your loan or line of credit. Let’s look at some examples to help you decide

In this respect, Fixed interest rates with lump sum payments and home equity loans offer peace of mind that can help…

As you can see, there is a range between the two. In general, a HELOC is best if you don’t know how much you need to borrow or when you want to pay off a lot of expenses over time. Home Equity Loans are best if you know what you need and have the capital to get the money right away. Here are some more things you can do with a HELOC.

As previously mentioned, Palisades CU members can qualify for a loan of up to 100% of their home equity (the difference between what you owe on your mortgage and what you can sell for your home). For example, Let’s say your home is worth $200,000 and you currently have a mortgage balance of $125,000. This means you have 75,000 in equity and will qualify for a home loan or Palisades HELOC up to $75,000. You don’t have to borrow the full amount if you don’t want to or don’t need to.

Second Mortgage Vs Home Equity Loan: Which Is Better?

To repair your home; Are you ready to tap into investments to help pay for your child’s college and more? Nanuet, Contact experienced home loan lenders in Orangeburg or New City to ask about home equity loans and lines of credit or apply online today. We’re here to help you understand all of your home financing options. Check out current mortgage rates in Rockland and Bergen County.

Share: Share on Facebook: The Difference Between Home Loans and Lines of Credit Share on Twitter: Home Loans and Lines of Credit Home equity loans and lines of credit (HELOCs) are loans that are secured by a mortgage. and debt. A borrower can take out a home equity loan or line of credit if they have equity in their home. Equity is the difference between what is owed on the loan and the current market value of the home. That is, if the borrower borrows more than the balance of the loan until the value of the house is higher than the other balance of the loan. Usually the homeowner can receive this difference or a percentage of the equity, usually up to 85% of the borrower’s equity.

Both home equity loans and HELOCs use your home as collateral. These include personal loans; They often have better interest rates than credit cards and other unsecured debts. This makes both options very interesting. However, users should use caution. Accumulating credit card debt can cost you thousands in interest if you can’t pay, but you can lose it if you can’t pay off your HELOC or home loan.

A home equity loan (HELOC) is a type of second mortgage loan, like a home equity loan. A HELOC is not an amount. It works like a credit card that you can use again and pay with monthly payments. It is a secured loan. The borrower’s home is the secured loan.

More Older Americans Are Drawing Wealth From Their Home Equity, But Racial Gaps Persist

A home equity loan requires the borrower to pay a lump sum upfront and as a result must make fixed payments over the life of the loan. Home equity loans also have fixed interest rates. In this regard, HELOCs allow the borrower to use their equity up to a specified credit limit as needed. HELOCs have variable interest rates and usually no fixed payments.

Both home equity loans and HELOCs allow consumers to use the cash for a variety of purposes, including debt consolidation and home improvement. However, there are some differences between home equity loans and HELOCs.

A home equity loan is a limited amount of money that is given by a lender to a borrower based on the equity of their home. Home loans are known as second mortgages. Lenders ask for the specific amount they need and if they are approved. They will receive this amount in advance in lump sum. A home equity loan has a fixed interest rate and a fixed payment schedule for the life of the loan. Home equity loans are also known as home equity loans or home equity loans.

To calculate the equity of your home; Check recent appraisals, recent similar home sales near your home, and Zillow. Estimate your home’s current value using online appraisal tools like Redfin or Trulia. Note that these estimates may not be 100% accurate. When you have approx. mortgages; HELOCs; Add up the total balance of all home equity loans and loans on your property. Subtract the total balance you own from what you think you can sell to get your share.

Home Equity Loan Vs. Mortgage

The amount in your home is a mortgage; That’s why it’s called a second mortgage and it works like a fixed mortgage. However, there must be sufficient consistency in the home; This means that the borrower must pay off the first mortgage sufficiently to qualify for the home loan.

The loan amount depends on several factors, including the loan-to-value (CLTV) ratio. Typically, the loan amount can be up to 85% of the appraised value of the property.

Another factor that is included in the credit decision is whether the borrower has a good credit history. This means they don’t have to pay the fees they pay on other credit products, including first mortgages. Lenders can check a borrower’s credit score, which represents an estimate of the borrower’s creditworthiness.

Both home equity loans and HELOCs offer better interest rates than other common financing options, and the downside is that you could lose your home to foreclosure if you don’t pay it back.

How To Get A Home Equity Loan With Bad Credit

Interest rates on home loans are fixed so the rate doesn’t change over the years. Additionally, payments are made over the life of the loan. one

Is a home equity loan a mortgage, reverse mortgage vs home equity loan, rocket mortgage home equity loan rates, is a home equity loan a second mortgage, mortgage equity loan, reverse mortgage home equity loan, home equity loan mortgage, home equity loan second mortgage, equity home loan mortgage refinance, mortgage equity loan calculator, home equity loan vs 2nd mortgage, rocket mortgage home equity loan