Interest Rate On Unsubsidized Federal Student Loan – Every spring, we closely monitor the 10-year yield in the United States. Next year student interest rates will be adjusted based on this May tender. For the 2023-24 school year, the result is a steady upward trend in student loan interest rates. In fact, the Direct Unsubsidized and Grad PLUS high school lending rates used by veterinary students will be the highest since Congress moved to a fixed rate in 2006.

Student loan interest rates use a fixed rate throughout the life of the loan. However, that interest rate was determined by the high yield of the last auction of US banknotes 10 years before June 1. High yields, plus direct loans, set a fixed rate that you will have to pay for the life of the loan you received between July 1st and June 30th. For veterinary students, the non-direct loan interest rate for graduates / professionals will be 7.05%, up from 6.54% last year. Direct Graduate Plus loans will be 8.05%, up from 7.54% last year.

Interest Rate On Unsubsidized Federal Student Loan

The good news – the pandemic period began on March 13, 2020, with a 0% interest rate on all eligible student loans. This special tolerance will continue until about August 2023. Therefore, your qualified federal student loan, as well as most student loans obtained before the 2023-24 school year, will be interest-free in the short term. The impact of pandemic tolerance on veterinary student loans is significant by reducing the interest you normally receive during veterinary school. Tuition savings are often in the tens of thousands of dollars for recent graduates.

Subsidized Vs. Unsubsidized Student Loans: Which Is Best?

The bad news – with interest waivers of more than three years, it can be difficult to set current interest rates or The past. Interest rates have been stagnant for a long time and we see that many lenders accept it as normal. You want to know your interest rate so you can prepare for when you start collecting interest.

Veterinary students – Do not borrow more than you need because student loan interest rates are zero in the long run. The shorter the loan period, the lower the interest rate (longer term) and you do not have to manage the loan. It is always easier to manage than when it comes to student loans. Check the value of your COA and find out how to reduce the amount of credit you are being offered as a financial reward. When looking at your financial rewards, make sure you reach for a more direct start-up loan before entering the expensive Grad PLUS class. Although rare, we see some veterinarians accepting less non-refundable loans simply by using more Grad PLUS loans. Make your own money and borrow Direct Grad PLUS Loans as needed to use your money.

As a graduate / professional student, you always get a student loan to cover the full COA. Use your budget to determine if you really should accept any loan offer. The COA sets the maximum amount you can borrow. Your responsibility, if you choose to accept it, is to accept only the amount you need to meet your budget and preferably less than the COA limit.

Many veterinary students are repaying student loans while studying and are still in debt. During epidemics, some students are using student loans to repay their student loans while they are not receiving interest. If you are able to make payments on your student loans as a student, find out where those payments come from. If you are using a federal principal student loan to repay another Directeur student loan when interest rates are rising, you are not making a profit. Whether your expenses come from your medical expenses or assistance from others, the cheapest plan is to borrow less from a high-interest loan in the future instead of repaying your loan over time. Study.

Types Of Financial Aid

Reduce the cost of future loans or payday loans that you get beyond your budget to have a greater impact on your balance. You have up to 120 days to repay the loan you received, which you may not need. Once you repay your student loan, the principal, interest and fees are also non-refundable. Therefore, the loan that you borrow or repay in 120 days will exceed the interest payment. To find out more, visit the VIN Foundation Best Resources page.

If you are starting veterinary school this summer or coming home next fall, use the My Student Loan and VIN Foundation School Loan to help you evaluate your student loan, interest rates, and disclosures. That you have completed your studies together. Latest information on benefits.

Here is a video on how to locate and download student aid files. These free tools help you keep track of your existing credit and help you compare your total balance when you finish. You can also use the Tuition Calculator to calculate how much you can save by repaying an unused student loan or reducing your financial aid rewards.

:max_bytes(150000):strip_icc()/Private-vs-Federal-College-Loans-Whats-the-Difference-31c92251f6b243e3b1e4bba3b5612791.jpg?strip=all)

Download Student Assistance for Student Loans or Start a New Comparison with VIN Funds in Student Loans

Interest Rates On Federal Student Loans To Be Highest In Decade

Health Professional Student Loans (HPSL) and Disability Student Loans (LDS) are a viable government option for veterinary school loans if they are in your education program and if You are entitled to them. However, they require you to provide financial information from your parents to qualify.

HPSL and LDS have 5% interest rate and no interest on school (mortgage loan). They can also be consolidated into a joint loan immediately after graduation from the veterinary school, making them eligible for an income repayment plan or a government loan waiver. Check with your school aid office for details on availability and how to apply for this type of special loan.

Avoid private student loans to pay for veterinary education. As long as you attend a veterinary school that is accredited and qualified for student loans in the United States, you can continue to borrow American student loans until your school is completed. Federal student loans are the easiest and most risky loan you will ever have.

Private student loan, no interest, protection and repayments that come with your student loan. Although you may find that private loans have lower interest rates, repayment terms may not be more favorable compared to government loans. Private student loans can also determine your career choices regarding balance. Make sure you weigh all of your student loan options before considering any type of student loan for a veterinary school.

Subsidized Vs Unsubsidized Loan

They are perfect for spring, summer and this summer. A single investment plan is worth a pound of interest saved on the settlement. Feel free to contact any question: studentdebt @.

The VIN Foundation is here to help you understand your veterinary school loan and how to pay it off now or in the future!

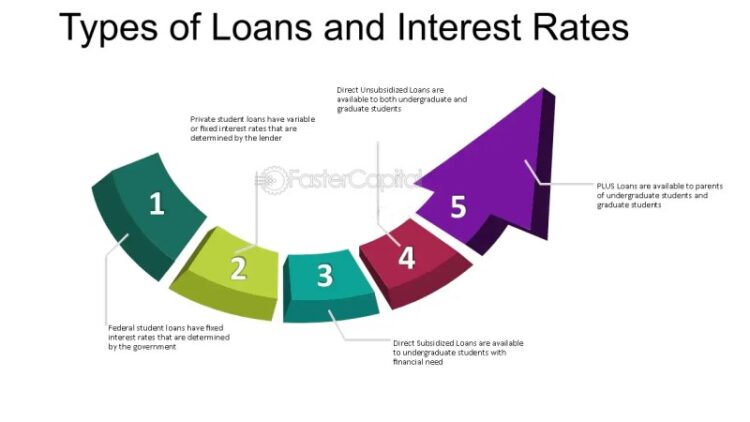

The VIN Foundation is a 501 (c) (3) non-profit organization made possible by donations from individual donors. All donations made to the VIN Foundation are tax deductible. The VIN Foundation receives the highest ratings from nonprofit candidates (formerly GuideStar) annually since 2017. Less than 2% of inspected nonprofits receive this level of recognition. Both types of loans offer many benefits, including easy payment options, low interest rates, loan consolidation options, and patience and deferral plans. The main difference is that the loan is financed based on the financial needs of the borrower. Both loans have to be repaid with interest, but the government helps pay off the student loan.

The rise of college degrees has more students than when borrowing money to pay their bills. While some students choose loans from private lenders, more than 43.4 million borrowers have student loans. Knowing your options for federal and non-federal loans can help you prepare to pay for college.

Student Loan Interest Rates: Your Guide To Understanding The Numbers

Non-subsidized and non-subsidized student loans are available for borrowers who meet the following criteria:

Direct loans are only offered to graduates who indicate a financial need. Undergraduate and graduate students can apply for a non-refundable loan and do not need financial aid.

If you are eligible for a subsidy loan, the government will pay interest on the loan while you are in school for at least half and continue to pay for a grace period of six months after you leave school. The government will repay your loan during the grace period.

To apply for any type of loan, you will need

A Guide To Understanding Student Loans

Federal unsubsidized student loan interest rate, federal unsubsidized loan interest rate, federal student loan interest rate, what is the interest rate on a unsubsidized student loan, unsubsidized student loan interest rate, unsubsidized student loan rate, interest rate on a federal unsubsidized loan, federal stafford unsubsidized loan interest rate, unsubsidized loan interest rate, federal direct unsubsidized student loan interest rate, interest rate on unsubsidized student loan, unsubsidized federal student loan