Interest Rate On A 30 Year Fixed Mortgage – Author: Spencer Lee. CloseText About Spencer Twitter EDT 2 minutes read

The average 30-year fixed-rate mortgage fell for a second week in a row, even as the latest inflation data raised the Treasury Department’s initial yield, causing frustration among industry experts who say a rate hike may not be far off.

Interest Rate On A 30 Year Fixed Mortgage

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg?strip=all)

For the fourth week in a row, the 30-year fixed-rate mortgage remained below 3%, falling to 2.94% in the week ended May 13, from 2.96%

Year Fixed Rates Fall

, according to the latest results of Freddie Mac’s Prime Mortgage Market Survey. A year ago, the average 30-year rate was 3.28%.

At a pace not seen since 2008, while core consumer prices, which do not include food and gas, also rose faster than they have in decades. News can slow a

And lead to higher mortgage rates over the summer, Freddie Mac Chief Economist Sam Khatter said in a press release.

Although the central bank has said that it does not intend to raise interest rates unless inflation remains at or above 2% for a long time, the inflation news – along with

File:federal Funds Rate Vs Treasuries Vs 30 Year Mortgage Interest Rates.png

– puts the Fed in a “difficult position and adds new uncertainty to the path toward mortgage interest rates,” says Zillow economist Matthew Speakman.

“In theory, a sharp rise in inflation would force the central bank to tighten policy by raising interest rates or slowing bond purchases.” But for now, Fed officials downplayed the risks associated with Wednesday’s report, arguing that the big rate hike is temporary. Any deviation from that forecast will put more pressure on mortgage rates,” he said.

When interest rates may rise, the window may close for many borrowers who are not taking advantage of current trends, Khater said.

“Low interest rates offer homeowners an opportunity to lower their monthly payments through refinancing, and our latest research shows that many borrowers, particularly black and Hispanic borrowers, who could benefit from refinancing are still not taking advantage of that opportunity,” he said.

What’s The Latest On Interest Rates?

The averages of the 15-year fixed mortgage and the government’s 5-year fixed hybrid loan with a variable interest rate also decreased from week to week. The 15-year rate fell to 2.26% from 2.3% the previous week. A year ago the average was 2.72%.

The government’s five-year adjustable hybrid mortgage fell to 2.59% from 2.7% a week earlier, compared to a rate of 3.18% in the same week in 2020. Our goal here at Credible Operations, Inc., NMLS Number 1681276, hereafter referred to as “Credible,” is here to give you the tools and confidence you need to improve your finances. While we promote the products of our lenders who compensate us for our services, all opinions are our own.

Based on data compiled by Credible, mortgage refinancing rates have risen in two key terms and have fallen for another term since yesterday.

Prices were last updated on May 3, 2022. These prices are based on the criteria shown here. Actual prices may vary. With 5,000 reviews, Credible maintains an “excellent” Trustpilot rating.

How Are Mortgage Rates Trending?

What it means: After a brief dip yesterday, the 30-year mortgage rate climbed back to nearly 5.4% today. Homeowners who want to refinance can choose between 15 or 10 years.

Based on data compiled by Credible, mortgage rates have risen across the board since yesterday.

Prices were last updated on May 3, 2022. These prices are based on the criteria shown here. Actual prices may vary. Credible, a personal finance marketplace, has 5,000 Trustpilot reviews with an average star rating of 4.7 (out of a possible 5.0).

What it means: Rates for the most popular 20- and 30-year terms are rising today, meaning buyers can look to shorter terms to take advantage of interest savings. But because 20-year rates are rising relative to 30-year rates, buyers who want a longer repayment period should stick with 30-year mortgages.

Singapore Home Loan Rates Hit New High Of 3.08% With Latest Move By Uob

To find great mortgage rates, start using Credible’s secure website, which can show you the latest mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s mortgage calculator to estimate your monthly mortgage payments.

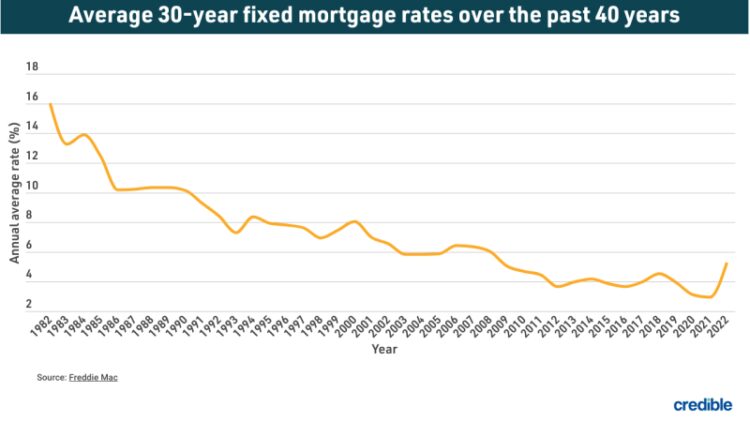

Today’s mortgage rates are well below the highest annual average rate recorded by Freddie Mac – 16.63% in 1981. A year before the COVID-19 pandemic shook economies around the world, the average 30-year fixed mortgage rate for 2019 was 3.94%. The average rate for 2021 was 2.96%, which is the lowest annual average in the last 30 years.

The historic drop in interest rates means that homeowners with mortgages from 2019 and older could save significantly on interest by refinancing at one of today’s low rates. When considering a mortgage or refinance, it is important to consider closing costs such as appraisals, applications, issuances and attorney fees. These factors, in addition to the interest rate and the loan amount, contribute to the cost of the mortgage.

Want to buy a house? Amin can help you compare current rates from multiple mortgages at the same time in a matter of minutes. Use Credible’s online tool to compare rates and restoration today.

Emotions Matter More Than Interest Rates

Changing economic conditions, central bank policy decisions, investor sentiment and other factors affect the movement of mortgages. Credible’s average mortgage rates and average mortgage financing rates listed in this article were calculated based on information provided by partner lenders that distribute Credible.

The award assumes that the borrower has a credit score of 740 and is taking out a conventional loan for a single-family home that will be their primary residence. The price also assumes no discount points (or very low) and a 20% payment.

The reliable mortgage rates listed here only give you an idea of the current average rates. The percentage you actually get can vary depending on a number of factors.

In general, a good mortgage is the lowest you can qualify for based on your personal factors, such as credit, income, other debts, down payment, and more.

Year Fixed Mortgage Tops 8%: Interest Rate Landslide Continues (bats:itb)

A rate that fits your financial situation should result in a manageable monthly mortgage payment, while still leaving enough room in your monthly budget for savings, investments and an emergency fund. And a good price should be competitive with the average price in the geographic area you want to buy.

If you’re trying to find the right mortgage, consider using Credible. You can use Credible’s free online tool to easily compare multiple lenders and see pre-qualified rates in minutes.

Do you have a financial question but don’t know who to ask? Email Credible Money Expert at moneyexpert@credible.com and Credible can answer your question in our Money Expert column.

As a trusted authority on mortgages and personal finance, Chris Jennings has covered topics including mortgages, mortgage refinancing and more. He has been the editor and deputy editor of Personal Finance Online for four years. His work has been featured by MSN, AOL, Yahoo Finance and others. We independently review all recommended products and services. If you click on the links we provide, we may receive compensation. Learn more.

Which Mortgage Is Better? 15 Vs 30 Year Home Loan Comparison Calculator

30-year mortgage rates continue to yo-yo after hitting a 22-year high earlier this month. The 30-year average rose 16 points on Friday, reversing much of the sharp decline seen early last week. As a result, the current average is higher week-over-week, although it is still slightly below the all-time high.

The last fixed average for 30 years is 7.76%. Interest rates vary greatly between lenders, so it’s always a good idea to look for the best home loan option and compare rates regularly, no matter what type of loan you’re looking for.

National average of the lowest interest rates offered by more than 200 of the nation’s top lenders, with a loan-to-value (LTV) ratio of 80%, an applicant with a FICO credit score of 700-760 and no mortgage scores.

Interest rates on new 30-year mortgages rose 16 basis points on Friday to an average of 7.76%. That followed a 17-point four-day decline, effectively retrieving the average at the end of the week where it started the week. The leading average is now just 8 points below the historic September 7 reading of 7.84% – the highest mark since 2001.

Mortgage Rates Pulled Down To Lowest Levels In History

When Freddie Mac released its weekly mortgage average on August 24, it found that the 30-year interest rate had hit a 22-year high. Freddie Mac’s average that week was 7.23%, the highest since June 2001. The current average is slightly lower at 7.18%.

Average plus the interest rate of the previous five days, which may include home equity loans with discount points. The averages show otherwise

Interest rates on 15-year loans rose less than 5 basis points on Friday, erasing the previous day’s decline and bringing the average back to 7.13%. That pulls the 15-year average back a few points from its peak of 7.17%, the 21-year high reached in mid-August.

The 30-year JMA remained steady on Friday, at a high of 7.02%. Although daily averages are not available for 2009, August’s high average of 7.02% was likely the most expensive level reached for large 30-year loans in at least 20 years.

An End To Large Rate Hikes From The Fed?

Average interest rate on a 30 year fixed mortgage, 30 year fixed mortgage interest rate history, interest rate for 30 year fixed mortgage, today's interest rate on a 30 year fixed mortgage, average 30 year fixed mortgage interest rate, mortgage interest rate today 30 year fixed, 30 year fixed rate mortgage interest rate, current interest rate 30 year fixed mortgage, interest rate on a 30 year fixed mortgage, lowest interest rate 30 year fixed mortgage, today's mortgage interest rate 30 year fixed, what is interest rate on 30 year fixed mortgage