If You Owe Back Taxes Can You Get A Passport – Taxes are complicated, but if you’re behind on your payments, things can get complicated, fast. If you owe taxes, here are four common options to help you get tax relief, as well as guidance on when to file your return and how to file your return.

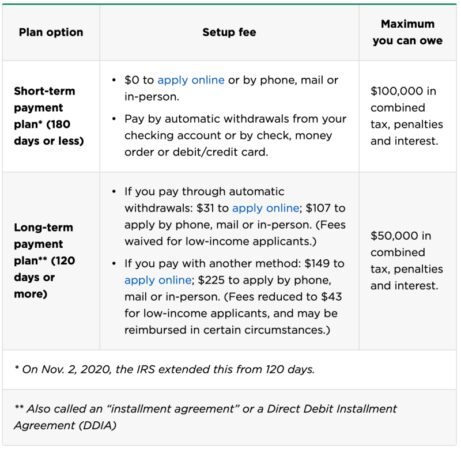

If you need more time to pay your tax bill, the IRS can give you time in the form of a payment plan.

If You Owe Back Taxes Can You Get A Passport

You may also get tax relief through what are called “transfer allowances”. This allows you to pay your tax debt for less than what you owe the IRS. According to the IRS, you have options if you can’t pay unpaid taxes or have financial difficulties.

Reasons You Shouldn’t Talk To The Irs Yourself If You Owe Back Taxes

However, getting the IRS to approve a negotiated offer is more difficult than a payment plan. The IRS accepts less than half of the requests. Before making a deal offer, you should look at other options.

To determine whether you qualify for tax relief through a settlement, the IRS considers your ability to pay, your income and expenses, and the number of assets you own.

Materials and instructions for submitting an offer by consent can be found in IRS Form 656-B. Here’s what you need to know:

If the IRS doesn’t accept your offer, you have 30 days to appeal. The organization has online self-help tools that can guide you through this.

Here’s Why Your Tax Refund May Be Smaller This Year

If you can’t pay your taxes and living expenses for good reason, you can ask the IRS to place your account in “currently uncollectible” status. You will need to request a delay in this collection, and the IRS may ask you to complete a collection information statement to prove that your money is as bad as you say it is. The form requires you to provide information about your monthly income and expenses.

Tax relief companies often offer to help struggling taxpayers. If you are confused about the process or need help filling out a form, some may be able to help. But remember:

Some tax relief companies charge a fee to help the IRS find out how much you owe, set up a payment plan, or determine whether you qualify for a settlement. However, you can do the following for free.

About the Author: Tina Orem is NerdWallet’s tax authority. Her work has been featured in various local and national media about her financial struggles and health issues; Life can be hard too. The situation can be very difficult for tax-paying and vulnerable individuals. But it’s important to know that there are options that can help you lose weight. This article provides a general guide to help you navigate the disability benefits process and manage your tax debt.

Back Taxes And You!

Disability benefits are designed to provide financial assistance to people who are unable to work due to a serious health condition. These benefits can be useful in maintaining a basic standard of living and accessing health care. There are generally two basic types of disability benefits: Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI).

SSDI is a federally funded program that provides financial assistance to people who have worked and contributed to Social Security but are unable to maintain gainful employment because of a disability. To qualify for SSDI, applicants must meet certain criteria set by the Social Security Administration (SSA).

SSI is another federal program that helps people with disabilities who have limited income and resources, regardless of work history. Eligibility for SSI benefits is based on the applicant’s financial need, age, disability status, and citizenship or residency status. To qualify you must:

Paying taxes can ruin your finances, but it often doesn’t prevent you from receiving disability benefits. However, it is important to understand the impact on your benefits.

The Irs Might Owe You $900: But Time Is Running Out To Claim Your Money

If you have unpaid tax debt that includes Social Security taxes, you may not qualify for SSDI. Because you must pay Social Security taxes for at least 5 of the last 10 years to qualify for SSDI. If you don’t pay enough tax, you won’t be able to get these benefits even if you have a serious medical condition. If you’re already receiving SSDI, the IRS can garnish up to 15% of your wages, including SSDI benefits, to pay your taxes.

You can still apply for SSI benefits if you owe taxes. As of October 2015, the IRS will no longer collect SSI benefits.

Getting disability benefits while paying taxes can be a complicated journey. However, it is important to understand that these challenges are not insurmountable. By knowing your rights, seeking professional advice and settling your tax debt early, you can improve your financial situation and focus on your health and well-being. Remember, help is available and with the right approach, you can overcome these obstacles and find stability in difficult times. Optima Tax Relief is the nation’s leading tax resolution firm with over 10 years of experience assisting taxpayers in difficult tax situations. There’s a quick fix for the millions of Americans who haven’t gotten their second coronavirus stimulus check. Ask for the missing amount when you file your 2020 tax return.

But while the IRS promises not to impose economic penalties to cover government debts, some people may not get the full $600 if they owe taxes.

Owe Taxes And Want To Buy A House? Here’s What You Need To Know

The CARES Act passed last March provides cash payments of up to $1,200 for adults ($2,400 for married couples filing joint returns) and up to $500 for children under 17. And the $900 billion coronavirus relief package approved in late December authorized additional payments. Up to $600 for an adult ($1,200 for a couple) and up to $600 for a child under 17.

Under the CARES Act, the IRS can only recover stimulus payments if the individual is delinquent on child support. The latest aid package, 2021, will allow them to get the money they are owed.

However, the problem is that the cash payment is an advance tax credit (recapture credit) for the 2020 tax return that was allowed as two advance payments in 2020 and early 2021. If you receive the credit and your 2020 filing starts on February 12, the IRS will reflect it on your total tax return, including your debt.

For example, if you receive a stimulus check credit for $600 but owe $500, you will receive a $100 fee.

Collection Tools The Irs Or State Can Use When I Owe Taxes

“This is a tax credit on your 2020 income tax return,” the IRS said. “Typically, these tax credits increase the amount of your tax refund or reduce the amount of tax you owe.”

The IRS on Friday launched Free File, free online tax preparation software to help taxpayers with income below $72,000 prepare and file their income tax returns. Americans can use the tool to request a stimulus check.

“Eligible taxpayers who did not receive the full amount in 2021 may apply for a refund when they file their 2020 tax return,” the IRS said. “Use the IRS Free Filer to apply and claim this valuable benefit.” Damage taxes are sliding. This can happen if you don’t pay enough tax, don’t report all of your income, or don’t file a tax return. No matter how much you don’t understand, taking the first step to file your taxes can be costly. Trying to figure out how far you’ve fallen after a fall can be scary. So how do you know when to get tax refund help? What are the red flags that indicate you’ve reached the point where help from a tax return filing expert is your best option?

If any of the following symptoms apply to you, you may need professional tax return help. 1. IRS notices are stored in your mailbox.

Tax Credit: What It Is, How It Works, What Qualifies, 3 Types

If you’ve received several notices from the IRS about back taxes, it’s time to do something about it. Ask for help to stop the endless stream of IRS letters from throwing the next CP14 notice on top of the rest (or worse, throwing it in the trash).

While waiting for the IRS to send you a notice, it may assign your case to a private debt collection agency. We will notify you when we do so. But when this happens, debt collectors call and text the IRS about the debt. As we know, collection agents can be cruel.

Believe it or not, the IRS can withhold, limit or revoke your passport if you are delinquent on your tax credits. Say goodbye to all your travel plans until your back tax problem is resolved. You once

If you owe back taxes, can you file bankruptcy if you owe back taxes, if you owe back taxes can you get a passport, can i get a passport if i owe taxes, can i get a passport if i owe back taxes, if you owe taxes, if you owe state taxes, can you get a passport if you owe federal taxes, if i owe back taxes, can i get a passport if i owe state taxes, can i get a passport if i owe federal taxes, can you get passport if you owe taxes