If I Roll Over 401k To Ira – This can play a role when you’re moving money from one retirement account to another, such as a former employer’s 401(k) to a new employer’s 401(k).

The government treats and taxes retirement accounts differently than savings or checking accounts. This means you cannot invest in retirement savings without taking special precautions.

If I Roll Over 401k To Ira

When you leave, you generally want to keep (some employers let you keep money in the company retirement plan even after you leave). But there may be other reasons to play a role:

Learn The Rules Of Ira Rollover & Transfer Of Funds

In general, you can convert almost any type of retirement account. Here are some possible permutations:

Step 1: Choose the type of account you want to move your money to, whether it’s a new employer-sponsored plan, traditional, or Roth IRA.

Step 2: Call the financial institution that manages your current plan and ask for a direct or indirect role. (A direct debit can reduce the risk of unexpected tax problems.)

Step 3: Wait for the control wheels to turn. (The administrative process generally takes two to three weeks.)

Why Roll Over Your 401(k) Into An Ira

Step 4: Select a new investment portfolio for your funds, as your funds will appear as cash in your new account.

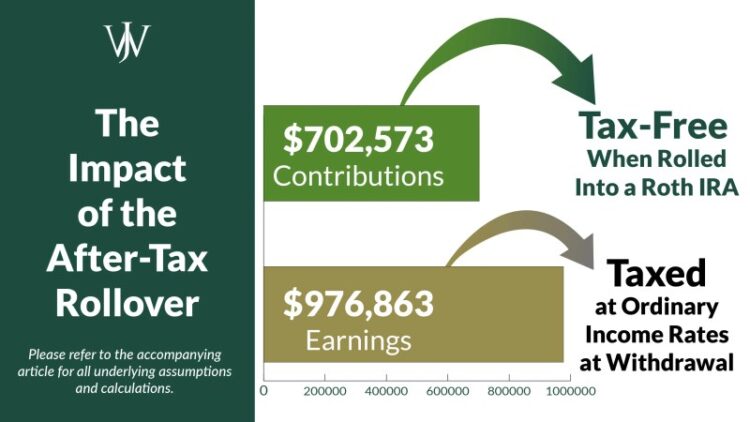

Roth conversions (that is, an IRA or 401(k) to Roth IRA conversion) always incur tax charges because you are taking pre-tax money (IRA or 401(k)) and converting it to cash after tax (Roth). IRA). Although they carry a significant tax liability, these types of cars are popular because they can help you reduce your taxes in retirement. If you do a Roth conversion, you should expect and plan for a significant tax liability for that year.

But failing to play a role can also trigger a tax bill. This can happen if you apply for an indirect role but do not meet the 60-day deadline to transfer funds. The same thing can happen if you are simply given money (instead of requiring formal role play). In this case, you may pay not only income tax, but also significant penalties.

Whatever your role, find out about the tax consequences and the steps to take.

How To Rollover A 401(a), 401(k), 403(b) And 457(b) Account Into An Ira

The tax benefits of retirement plans can be extremely valuable. However, with special treatment comes special responsibilities. If you want to move funds from your retirement account to simplify your finances, access better investments, or for another reason, make sure you don’t withdraw your money and do a formal rollover. Converting an Individual Retirement Account (IRA) or 401(k) plan account is simple and can be done without paying taxes or penalties as long as it is handled according to IRS requirements . In fact, there are two ways to implement role play: by direct transfer or by indirect outsourcing.

As the name suggests, direct transfer is a simpler approach. It is almost entirely controlled by the financial institutions that manage your money. Completing certain forms and providing your consent is a measure of your participation.

By making a qualified withdrawal, you own the retirement funds that have been phased out (in some cases, the IRS automatically withholds 20%). You must then deposit the full amount within 60 days of receiving it to avoid tax issues. As a result, you can get back funds withheld by the IRS when you file your taxes.

There are a variety of reasons to add an IRA or 401(k) to your retirement plan, and they all have to do with strengthening your retirement plan. Given the limited benefits provided by Social Security and the expiration of retirement plans for many workers, this has become an even more important goal for many Americans.

What Is Rollover? Types & How To Do It

The main reason you want to invest is to get guaranteed income. You can use a retirement account to generate income, but this often requires holding highly volatile assets. With such an investment, you eliminate risks and earn predictable returns while protecting yourself from downside risks.

If you save money, chances are it’s more than you save. The payments can last your entire life, or two lifetimes if you are married. This cannot be done with stocks and bonds.

This is another advantage of some reels. If you keep your money in a traditional retirement account, you must take a taxable minimum distribution (RMD) every year starting at age 72, or if you reach age 70½ before January 1, 2020. This will result in a 50% penalty. % of required VaR.

Eligible annuity amounts are exempt from the RMD rules. With a qualified person, you can delay paying your income until age 85. This can help you avoid a higher tax bracket and lower your Medicare payments. Extended deferrals may be more effective if you start working after age 72.

How To Transfer Or Rollover Funds To Your Ira?

This often requires creating a joint living arrangement in which you and your spouse make payments for the rest of your lives. In some cases, a death benefit and/or additional living expense adjustment is required.

As with any financial instrument, the benefits and risks of an investment should be carefully weighed. This can be a solid investment option for someone who is overinvested and concerned about longevity risk. However, this makes little sense for an investor who probably has more than his savings.

Annuities are complicated and the terms and conditions can be confusing to the average person. This can be particularly problematic if unscrupulous sellers offer these products without explaining how their annuity works or taking into account the unique needs of potential buyers.

Annuities offer investors a guaranteed return, but their returns are lower than many financial securities and mutual fund-type instruments that may be held in retirement plans. Before submitting an email, make sure you understand the terms of the exchange.

Pros And Cons Of A 401k To Ira Rollover In Railroad Retirment — Highball Advisors

Annuities are less liquid than pension plans. Once you reach retirement age, you can withdraw your 401(k) or IRA savings at any time. However, your monthly income distributions are determined according to the terms of the contract.

Typically more expensive than annuity accounts. Purchases require a commission. You will then be charged ongoing mortality risk and expense fees, administrative fees and fund management fees associated with your investment choices. Most recurring fees can easily reach 3-4% per year.

If you want to withdraw from an IRA or 401(k), there are a few standard steps.

When considering transferring your retirement savings, make sure you are familiar with the different types of annuities. At the highest level, they can be divided into the following three categories.

Fixing 401(k) Rollover Mistakes

This type offers a guaranteed interest rate for a fixed period, which can be for life. It has very secure and predictable income streams.

This type offers investors higher income potential than fixed annuities because it is based on a market index such as the S&P 500. They do not invest directly in a stock, but they offer downside potential and protection against cuts to pension holders.

Variable annuities offer higher income potential than fixed index annuities, but are subject to downside risks. These instruments constitute the underlying investment portfolio and may exhibit high volatility.

Variable and fixed indexed annuities are not suitable for a turnover strategy. In fact, qualified throws are not allowed. Fixed annuities, on the other hand, can move in any direction and offer what beginners are looking for: guaranteed income and the ability to eliminate longevity risk.

What Is A Gold Ira Rollover?

In addition to understanding the different aspects of email, you need to know a few strategies. The first, surprisingly, is an approach that involves purchasing small amounts of income over several years rather than investing all your money in a single income.

This is an effective way to reduce interest rate risk and makes sense if you anticipate interest rates rising. Delaying your purchases over time will prevent you from entering into a fixed rate and missing the opportunity to earn more in subsequent years.

Another good strategy is to delay your payments as much as possible. Since your life expectancy is part of the calculation used by the provider to determine the amount of monthly payments, the shorter your life, the higher your payments will be. The older you are when you start making payments, the more you’ll pay each month.

The last thing to consider before managing is the turnover in your retirement account. It starts by analyzing your estimated living expenses.

Top 401k Rollover Frequently Asked Questions Answered

Conservative individuals should strive to create a guaranteed monthly income stream that covers 100% of their inflation-adjusted expenses. Common sources of this income are Social Security and pension plans.

How to roll over 401k to roth ira, how to roll over 401k into ira, how to roll over 401k to ira, how to roll over 401k to ira vanguard, can you roll over 401k to ira, can i roll over 401k to ira, roll ira to 401k, how to roll over 401k into roth ira, roll over 401k to roth ira, roll over 401k to ira, roll over 401k into roth ira, if i roll over 401k to ira