If I Pay Off Car Loan Early – About seven out of 10 people borrow money to buy their car, and a car loan is one of the biggest financial obligations you have.

If you are one of them, you may have a loan that takes 60 or 72 months to pay off. That’s five to six years! That’s a lot of interest to pay. So we want to help you get out of that debt fast and save money on interest by giving you 6 ways to pay off your car loan early.

If I Pay Off Car Loan Early

It may seem like a stretch, but if your lender lets you do it, you should. With one payment every two weeks, you get 26 half payments per year. This adds up to a total of 13 full payments per year instead of 12.

Pros And Cons Of Paying Off A Car Loan Early

If you have a 60-month loan for $10,000, you’ll only save $35 in interest, but you’ll pay off the loan in 54 months instead of 60. It’s six months out of your life, and it’s easy. be Transfers are easy when you get paid every two weeks.

Instead of just making the suggested payment, round your payments to the nearest $50 to help pay off your car loan faster.

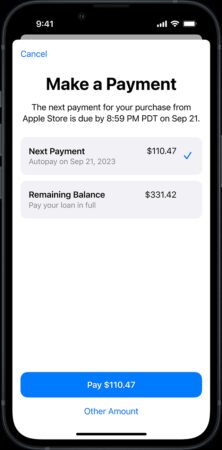

Let’s say you borrow $10,000 for 60 months at 10%, so your monthly payment will be $212.47. With this payment, you will pay off your car loan in 60 months after paying $2,748.23 in interest.

But if you decide to save and pay $250 a month, you’ll pay off your car loan in 47 months after paying just $2,214.69 in interest — a savings of $533.54!

Free Loan Agreement Templates

Let’s say you borrow the same $10,000 over 60 months at 10% interest. If you pay $500 a year, you’ll pay off the loan in 49 months after paying $2,279.35 in interest — saving you $468.88 in interest.

And the savings keep coming. By making at least one extra large payment a year, you’ll save even more on interest. Remember, the sooner you make the down payment, the faster you can pay off your car loan. Early bird gets savings or whatever.

Some lenders will allow you to skip a payment once or even twice a year. Resist the temptation. Skipping payments will extend the term of your loan and cost you more interest.

Here you receive your loan and agree on a new monthly payment and repayment date. Only do this if it gets you a lower monthly payment and/or a faster payment term (repayment).

Save Money With This Auto Loan Hack

Otherwise, refinancing makes little sense. You don’t want to lower your monthly payment and extend the loan term because you’re paying the same principal and more interest.

Even if your car loan balance is high, it is unlikely that your loan will have a high interest rate. That honor goes to credit cards with an average interest rate about three times the average car loan rate.

Before focusing on a car loan, focus on paying off your credit cards to save as much money as possible and improve your credit score.

But if you’re focusing on your car loan, we hope this has helped you get out of debt with a winning strategy and even pocket your car loan fast. Pay! Partner Content: This content was created by a Dow Jones Business Partner and independently researched and written by the editorial staff. Links in this article may lead to us earning a commission. to find out more

How Long Should A Car Loan Be?

If you have cash and poor credit, a car loan pays off early, but it also has downsides, such as a low credit score or down payment fees.

By Daniel Robinson: Daniel Robinson Author Daniel is a staff writer for the Guide team and has written for a number of automotive news sites and marketing companies in the US, UK and Australia, specializing in car finance and the automotive industry. Daniel is The Guide Team for car insurance, loans, warranty options, car service and more. the author

Edited by Rashawn Michner: Rashawn Michner Managing Editor Rashawn Michner is an editorial editor with over 10 years of experience covering personal finance and insurance. Senior manager

There are many reasons to pay off your car loan early, from the satisfaction of getting full ownership of your car to avoiding interest rates. However, this isn’t the best move for all drivers, so you may want to weigh the pros and cons before making a car payment.

Learn How Loans Work Before You Borrow

If you are charged a higher interest rate and have fewer other expenses to worry about, you can pay off your car loan sooner. However, those with more pressing financial needs now may want to look at better auto refinance rates instead.

Car loan refinancing best 72 month car loan interest rates Can I refinance my mortgage and car loan at the same time? Car loan calculator The best car repayment rates How to pay off a car loan quickly Should you pay off a car loan quickly? The Complete Car Loan Glossary: Terms You Should Know (Guide)

$150 Average Monthly Savings Working With Personal Loan Gateway Compare Options A+ BBB Rating

Up To 0% Off Select Cars, Trucks & SUVs Free Online Quotes – Get a real time quote on your cars today. Local dealers compete to offer the best prices on new cars

Amortization Explained: Choosing The Right Loan Term For Financial Success

Peaks save customers an average of 26% per month. Sign and upload documents electronically. Maximum vehicle mileage of 100,000 miles and minimum loan amount of $15,000

Highlights No application fee Loan platform that works with banks Loan approval and conditions based on multiple variables including education and employment

All April invoices last updated on 14/07/2023 – see cover sheet for latest details. Rates may vary based on your credit score, credit history and loan term.

The guide team is dedicated to providing reliable information to help you make the best possible financing decision for your vehicle. Because consumers rely on us to provide objective and accurate information, we’ve developed a comprehensive rating system to rank the best car loan companies. We collected data from dozens of credit providers to rank companies based on a wide range of rating factors. After 300 hours of research, the final result was a composite score for each provider, with the top-scoring companies at the top of the list.

How To Get My Name Off A Joint Car Loan

In general, it’s a good idea to pay off your car loan early if you have strong personal finances or if you want to make a big purchase in the near future. However, this is not always the case and lenders may have barriers to this. Below, in the following sections, we will explain when it is a good year and when it is not.

Unless you have significant debt and plenty of cash on hand, it makes sense to pay off your car loan as soon as possible. The main reason people take out car loans is because they can’t afford a car properly.

If you have a lot of cash to pay for a car, seriously consider a loan balance. That way, you end up paying hundreds or thousands of dollars in interest for borrowing money you already have. There is little reason to keep a car loan if your other debts are paid in full and your finances are strong.

Cars are not exactly cheap, but much cheaper than buying a house. Mortgage rates, or the interest you pay when you borrow money for a home, are much lower for people with higher debt-to-income ratios. You can save a significant amount by paying off your car loan early and eliminating other existing debts.

How To Pay Off A Personal Loan Faster

If you have no other debt, you can get a significantly lower mortgage rate, which can save you thousands over time. It is often worth paying off a car loan before buying a home, because you get a more competitive interest rate for a larger purchase.

If you’re not sure when to finance a car, know that it’s often not a good option if you can’t put a significant amount down on a car loan right now. Also, if your lender has a prepayment penalty on your loan, you could end up paying more than the value of the loan when you make extra payments.

If you’re considering paying off your car loan early, it’s good to be aware of the pros and cons of this decision. Below we break down the most important pros and cons of a car loan advance.

Even taxes aside, owning a car is a great feeling. No one can repossess your car for non-payment of loan payments while it is in your name because it no longer belongs to the lender or the bank.

How Much Does Your Credit Score Increase After Paying Off A Car? — Tally

If you decide to sell it, you also get the full trade-in value of your car. In addition, car owners should choose the limits of their insurance coverage rather than choosing the amount their lender requires them to cover.

When you buy one

What happens if you pay off your car loan early, if i pay my car loan off early, if i pay off car loan early, if we pay loan off early, if i pay my loan off early, if you pay car loan off early, if i want to pay off my car loan early, if i pay a loan off early, what happens if i pay off my car loan early, if you pay off your car loan early, if you pay off a loan early, if you pay off upstart loan early