If I Am Pre Approved For A Credit Card – Free Printable Templates » Free Pre-Approval Letter Templates [PDF] & Home Loans & Loans Free Printable Pre-Approval Letter Templates [PDF] & Loans & Credits

When it comes to buying a home, a home equity loan is an option for those who cannot pay the full price up front. Home loans allow the borrower to pay off the property over a longer period of time, while still being able to use and enjoy the property.

If I Am Pre Approved For A Credit Card

However, the process of getting a home loan is not as easy as applying for one. Before a borrower receives a pre-approval letter from a loan company, several steps must be taken, including a property inspection and credit check.

How Do You Know If You Have A Pre Approved Card Offer In Your Account?

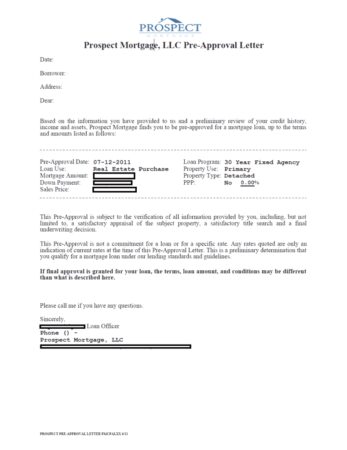

A pre-approval letter is a document issued by a lender to a prospective borrower, indicating that the lender has conducted an initial review of the borrower’s financial information and credit history and is willing to they offer a special loan amount and interest. rate. , depending on the circumstances. the

It is usually valid for a fixed period of time, usually 60-90 days, and may include an expiration date.

Getting a permit early can be beneficial to potential home buyers, as it gives them a better idea of how much they can afford to spend on the property and shows sellers that they are serious and have and financial ability to buy. . However, it is important to note that the pre-approval letter is not a guarantee of the loan and borrowers are still required to complete the entire mortgage application process and meet all the borrower’s requirements before the s-loan is approved and financial support.

Credit card aspiration approval letter better mortgage pre-approval letter capital pre-approval letter cashnetusa pre-approval letter conns pre-approval letter fake mortgage get pre-approval letter get pre-approval letter get pre-approval letter home loan get a pre-authorization how long is the insurance period eligible Pre-Authorization Letter Lender’s Pre-Approval Letter Loan Agreement Loan Pre-Approval Letter Pre-Approval Letter Sample Sample Pre-Approval Letter Financial Loan Agreement Pre-Approval Letter Pre-Approval Letter Pre-Approval Letter-Pre-Approval Letter Sample Home Loan Pre-Approval Letter Pre-Approval Letter Pre-Approval Letter – Pre-Approval Loan Letter Mortgage Pre-Approval Letter Pre-Approval Letter Pre-Approval Letter Pre-Approval Letter Pre-Approval Letter Pre-Approval Letter -Mortgage Approval Pre-Approval Letter Pre-Allroved Letter Pre-Accepted Mortgage Pre-T Qualification Letter Pre-Approval Letters Sample Rocket Mortgage sample pre-authorization letter

What Credit Card Do I Qualify For?

“Loan and Loan Disclosure Letter Templates” are pre-made documents that provide a structured format for lenders or financial institutions to issue pre-approval letters to borrowers seeking mortgages or loans. These templates serve as valuable tools to simplify the pre-approval process, create clear communication, and provide borrowers with an official indication of their eligibility for financing.

A pre-approval letter for a home or loan is a written document that confirms that a person has the first right of the borrower for a certain loan amount based on the borrower’s financial status, eligibility and other relevant factors. Mortgage and loan pre-approval templates provide a standard outline that includes important information such as the borrower’s name, loan amount, terms and conditions and any conditions or contingencies.

By using pre-approval templates for mortgages and loans, lenders can process pre-approvals more efficiently, while ensuring consistency and accuracy of information provided to borrowers. These templates guide lenders to summarize the borrower’s financial qualifications and provide a clear indication of their willingness to proceed with the loan application process.

One of the main benefits of a pre-approval letter is that it helps you determine how much you can afford for a home. This letter will clarify your pre-approved loan amount, give you a clear picture of your budget and allow you to focus your search on properties within your price range.

How To Pick The Best Travel Credit Card In 2023 (+ My Top Cards)

A pre-approval letter shows sellers that you are a serious and committed buyer, which can help you stand out in a competitive real estate market. This shows that you have taken the necessary steps to save money and gives the seller confidence that you can follow through on the purchase.

Getting a pre-approval letter can give you an opportunity to negotiate when you make an offer on the property. If you are competing with other buyers, a pre-authorization letter can help you make a strong proposal and increase the chances of your proposal being accepted.

A pre-approval letter can help streamline the mortgage application process. Since you have provided the lender with your financial information and done a credit check, the lender will be able to process your application quickly and efficiently.

Finally, a pre-approval letter can provide peace of mind to home buyers. This will give you a better idea of how much you can afford and allow you to go into the home buying process with confidence and clarity about your finances.

Tips To Reach Your Homebuying Goals In 2023 [infographic]

Since getting a pre-approval letter involves completing some of the first steps in the loan application process, it can help speed up the process of closing the property deal. Having a permit in place early can help shorten the time it takes to secure financing and help ensure a smooth closing process.

During the pre-approval process, the lender reviews your credit report, income, work history and other financial information to determine if you qualify for a loan. If there are issues or concerns, such as a low credit score or high debt-to-income ratio, the lender will notify you of these issues as soon as possible, giving you the opportunity to solve them before you start buying a house. .

One of the biggest frustrations for a home buyer is falling in love with a property, and then finding out they don’t have the money to pay for it. Getting a pre-approval letter can help you avoid this confusion by giving you a realistic idea of your budget and ensuring that you are only looking at properties that you can afford.

Finally, a first lien can protect you from interest rate fluctuations. Since the letter states the interest rate that you have been approved for, you can be sure that your loan payments will not suddenly increase due to an increase in the interest rate. This can help make the home buying process more predictable and less stressful.

Rbi Expanding Digital Lending With Pre Approved Credit Lines Via Upi || Pay10

Choose a Lender: The first step is to choose a mortgage lender. You can compare lenders by looking at interest rates, fees and customer reviews.

Gather Financial Information: To apply for a pre-approval letter, you must provide information about your income, assets and debts. You may be asked to provide recent pay stubs, tax returns, bank statements and other financial documents.

Fill out a mortgage application: Once you have gathered all the necessary financial information, you will need to fill out a mortgage application with the lender. This may include providing personal information such as your name, address and social security number.

Wait for the lender to review your application: After you submit your application, the lender will review your financial information and credit history to see if you qualify for a loan. This process usually takes a few days.

Amazon Prime Sig Prequalified Offers

Get your pre-approval letter: If you’re approved for a loan, the lender will give you a pre-approval letter detailing the loan amount you’re pre-approved for and the interest rate you’re willing to pay. . This letter is usually valid for 60-90 days, but this can vary depending on the lender.

It is important to remember that a pre-approval letter is not a loan guarantee, and you still have to go through the entire mortgage application process and meet all the lender’s requirements before the loan is approved and funded. financially.

Pre-qualification and pre-approval are two terms that are used interchangeably when considering the home buying process, but they are actually two different things.

Pre-qualification is the first step in the loan application process and is the process of determining whether a borrower qualifies for a mortgage based on their financial information. The process usually involves filling out a short application or providing some basic financial information online, and the lender provides an estimate of the loan amount and interest rate that the borrower can afford. qualified. Getting pre-qualified is usually quick and easy and doesn’t require a credit check or complete financial documents.

Tips To Secure Your First Mortgage

On the other hand, a pre-approval is a more thorough process that includes a complete mortgage application, a credit check, and a full review of the borrower’s financial information. The lender will review the borrower’s income, work history, credit score and other financial information to determine if they qualify for a mortgage and assess the amount and interest rate. The letter of authorization first states a

If you re pre approved for a credit card, what credit cards am i pre approved for, see if pre approved for credit card, see if pre approved credit card, see if i m pre approved for a credit card, pre approved for credit card, if i am pre approved for a credit card, what cards am i pre approved for, if you get pre approved for a credit card, see if i am pre approved for a credit card, if i am pre approved for mortgage, check if pre approved for credit card